HSBC hosted the dirty money of dictators and arms dealers ("The International Consortium of Investigative Journalists", USA)

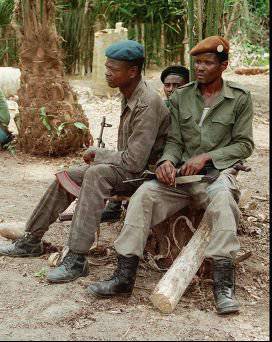

Secret documents indicate that the international banking giant HSBC has profited from a business with merchants weaponswho supplied mortar mines to African child soldiers, with intermediaries of dictators from third world countries, with dealers of bloody diamonds and other international criminals.

Secret documents indicate that the international banking giant HSBC has profited from a business with merchants weaponswho supplied mortar mines to African child soldiers, with intermediaries of dictators from third world countries, with dealers of bloody diamonds and other international criminals.The published data on the internal mechanisms and backstage activities of the Swiss branch of HSBC in servicing private clients refer to invoices totaling more than 100 billions of dollars. They provide a rare opportunity to look inside the top-secret Swiss banking system and find out what the public has not known before.

These documents were obtained by the International Consortium of Investigative Journalists (ICIJ) through the French newspaper Le Monde. They tell about secret bank transactions with customers who were engaged in a wide variety of illegal activities, and first of all, hiding hundreds of millions of dollars from tax authorities. They also feature private accounts of renowned footballers, tennis players, cyclists, rock stars, Hollywood actors, royal families, politicians, corporate executives, and rich dynasties.

These revelations shed light on the intersection of international crime and legitimate business, and also significantly expand our knowledge of the potentially illegal or unethical behavior in recent years of HSBC, one of the largest in the world.

Leakage of information indicates that some customers traveled to Geneva, where they removed large amounts of cash, and sometimes took them with old banknotes. These documents also indicate that the big money in this bank belongs to diamond dealers who work in areas where military operations are conducted, and for the money obtained from the sale of precious stones are financed by insurgent movements and guerrilla groups responsible for the death of a huge number of people.

HSBC, which has its headquarters in London and has branches in 74 countries on six continents, first insisted that ICIJ destroy this information.

At the end of last month, when the bank was fully informed about the information the journalistic team managed to get, it took a more conciliatory position and told the consortium: “We recognize that the culture of conciliation and standards of integrity in Swiss private bank HSBC, as in the industry as a whole was significantly worse than today. ”

The written statement says: “In recent years, the Bank has taken important steps to implement reforms and abandon customers who do not meet the new strict standards of HSBC, including those who have doubts about our compliance with tax laws.”

The Bank further noted that it has made significant changes in this part of its business. “As a result of this repositioning, the Swiss private banking company HSBC has reduced its customer base by almost 2007% since 70,”

The way the offshore banking industry harbors money and keeps secrets has huge implications for the peoples of the whole world. According to very conservative estimates of researchers, 7,6 trillions of dollars are currently hidden in tax havens, because of which the finance ministries lose at least 200 billions of dollars annually.

“The offshore banking industry poses a serious threat to our democratic institutions and our underlying social contract,” said French economist Thomas Piketty, who wrote Capital in the Twenty-First Century (21 century capital), told ICIJ. - Financial opacity is one of the main driving forces of global inequality, which is constantly increasing. It allows a significant portion of people with high incomes and large fortunes to pay negligibly small taxes, while all others are subject to substantial taxes for the public good and services (education, health, infrastructure), which are an essential condition for the development process. ”

HSBC's dubious tax tactics

The secret documents received by ICIJ relate to accounts up to 2007 of the year, and they contain information about more than one hundred thousand individuals and legal entities from more than 200 countries. They are similar to the documents that the French government received in 2010, which shared this data with other countries. Then it led to a whole series of criminal cases and out-of-court settlement with people who evaded paying taxes in several countries. Among the states whose tax authorities received documents from France were the United States, Spain, Italy, Greece, Germany, Britain, Ireland, India, Belgium and Argentina.

In most countries, the law does not prohibit having offshore bank accounts, and if you have an account with the Swiss HSBC Private Bank, this is by no means proof of some kind of wrongdoing. Some of the people mentioned in the documents could have been somehow connected with a bank account in Switzerland, say, a power of attorney, although they themselves were not owners or co-owners of the money in the account. Some of the people of the Swiss bank accounts mentioned in the documents could not be at all.

Hollywood actor John Malkovich, for example, stated through his representative that he did not know anything about the account in which his name appears, but suggests that he could be related to the former stockbroker Bernard Madoff, who was convicted of fraud, and who was a little involved in his finances. British actress spokesperson Joan Collins told ICIJ: “In 1993, my client deposited money in a bank account in London, and later discovered that the money without his instructions was transferred to the Swiss account you are talking about in your letter.” This spokesman stated that no tax evasion n

Musician David Bowie was.

Rock star David Bowie told the ICIJ's media partner, Guardian, that he has been a legal resident of Switzerland since 1976. Tina Turner, considered by many to be a true American singer, has lived in Switzerland for almost 20 for years and in 2013 refused to give up her American citizenship.

Rock star David Bowie told the ICIJ's media partner, Guardian, that he has been a legal resident of Switzerland since 1976. Tina Turner, considered by many to be a true American singer, has lived in Switzerland for almost 20 for years and in 2013 refused to give up her American citizenship.But in many cases, the published documents contain information about highly dubious actions, for example, when bankers advised their clients what measures should be taken to avoid paying taxes in their own country; and clients told bankers that they did not indicate their accounts in tax returns.

ICIJ and the media group from 45 countries more thoroughly investigated the dark side of HSBC's activities than did the participants in the US Senate investigation in 2012, who found out that the Swiss bank has weak control tools, and this allows the Latin American drug cartels to launder hundreds of millions of dollars unjustly extracted funds through its US branches, after which the money can be used.

The detailed report of the Senate’s Permanent Subcommittee on Investigations on HSBC’s activities notes that some of its branches bypassed the US government’s ban on financial transactions with Iran and other countries. And the American branch of HSBC provided cash and banking services to banks in Saudi Arabia and Bangladesh, although they were suspected of being involved in the financing of Al-Qaida and other terrorist organizations.

In 2012, HSBC agreed to pay more than 1,9 a billion dollars to settle criminal and civil investigations in pre-trial proceedings, and concluded a five-year agreement to postpone the criminal prosecution.

A source from the Senate Investigations Subcommittee stated that the investigators had sent a request to HSBC Private Bank with a request to provide them with records on the accounts that the ICIJ managed to get, but the bank’s management refused them. New documents tell about suspicious activity of the bank in many other countries of the world and reveal new names of dubious clients.

On the eve of the revelations, the ICIJ Wall Street Journal reported on a preliminary progress report of an independent audit organization that conducted an audit at this bank. The summary of the report may be published in April, but it is already known that, according to its conclusions, the bank did not improve and did not complete the reforms.

International customers

The documents received by ICIJ are based on data stolen by a former HSBC employee and exposer Herve Falciani, and transferred to the French authorities in 2008 in the year. Le Monde received the investigation materials of the French tax administration, and then shared them with ICIJ on the condition that the consortium assemble a team of journalists from different countries so that they could analyze the data from all sides.

ICIJ has gathered more 140 journalists from 45 countries, including from such publications as Le Monde, BBC, Guardian, 60 Minutes, Süddeutsche Zeitung and 45 more media organizations.

Reporters found the names of former and current politicians from Britain, Russia, Ukraine, Georgia, Kenya, Romania, India, Liechtenstein, Mexico, Tunisia, the Democratic Republic of Congo, Zimbabwe, Rwanda, Paraguay, Djibouti, Senegal, Philippines, Algeria and other countries. They found several names from the current US sanctions list, including the name of Turkish businessman Selim Alguadis, suspected of supplying sophisticated electrical equipment to Libya to create a secret nuclear weapon project, and Russian President Vladimir Putin’s Gennady Timchenko, against which there are sanctions imposed in response to the annexation of the Crimea and the crisis in the east of Ukraine.

There is no information in the documents about exactly what Alguadis and Timchenko have to do with Swiss accounts. A spokesman for Timchenko said that the reasons for the imposition of sanctions were "implausible and absolutely wrong", and that his client "always and fully met all tax requirements."

Alguadis told ICIJ: “For my personal reasons, I have had many accounts in Turkish and foreign banks in my life. Sometimes I thought that it would be prudent to keep a portion of savings offshore. ” American accusations Alguadis called ridiculous.

“All our exports are properly declared at the Turkish customs and are absolutely legal,” said Alguadis, who denies any ties with Libya.

Some clients related to millions and tens of millions of dollars in their accounts are people with political connections. Among them is the former Minister of Commerce of Egypt, Rachid Mohamed Rachid, who left Egypt in February 2011 during the uprising against Hosni Mubarak. Rashid, who according to the published materials has a power of attorney to a bank account on 31 million dollars, was accused in absentia of speculative transactions and squandering public funds. There are other names in the documents. This is the late Franz Merseron (Frantz Merceron), who is also called the financial intermediary of the late former Haitian President Jean-Claude Duvalier, nicknamed Baby Dock, accused of misappropriating millions of dollars before fleeing 900 from the country. This is Rami Makhlouf, whose cousin and president of Syria Bashar al-Assad over the past three years has contributed to the deaths of tens of thousands of his country's citizens during the civil war. Merceron is listed in the lists as an agent for the account of his wife for 1,3 million dollars. Makhluf is the owner of several accounts.

The documents include the names of the people against whom the proceedings are initiated and the proceedings are conducted. For example, this is the former owner of the English Portsmouth football club, Vladimir Antonov, who is being tried in Lithuania for banking fraud in the amount of 500 million euros. This is Kazakhstani banker Margulan Seisembayev, whom Alliance Bank accuses of stealing assets, and the former head of the Maltese state oil company Enemalta Tancred Tabone, accused of extorting bribes.

Taboun's lawyer said in a statement that his client denied all the charges against him, and also said that he “officially authorized the Swiss authorities to provide all available information. ... His financial affairs in this regard are in order. " Antonov under the published documents is the owner of the account on 65 million dollars. Seysembaev according to the same documents passes as the owner of several accounts.

Antonov's spokesman told the Guardian: “Mr. Antonov is not and has never been a tax resident in Britain. He opened the Swiss account you opened for business in 2008, because Swiss banks provide better customer service and are more flexible than British banks. ”

There are a lot of names in this dataset, and among them are the daughter of the former Chinese prime minister and the organizer of the shooting in Tiananmen Square Li Peng Li Xiaolin (Li Xiaolin), Hong Kong High Court Judge Joseph Fok, cousin of Queen Elizabeth II Prince Michael of Kent and his spouse.

The account that may be associated with a prince and a princess was opened in the name of their common company, Cantium Services Limited. A spokesman for the British royal couple said that “no funds have been received on this account”, and that it was closed in 2009. Li Xiaolin and her husband are listed as account holders on 2,5 million dollars. Fok is listed as the owner of an account closed in 2002. They did not respond to requests for comments.

In the published data there are a lot of names from royal families. This is the King of Morocco, Mohammed VI, and the Crown Prince of Bahrain Salman ibn Hamad ibn Isa al-Khalifa, and dozens of members of the ruling family of Saudi Arabia. Many are either full owners or co-owners of accounts. The role of the king of Morocco in these documents is not specified.

In the published data there are a lot of names from royal families. This is the King of Morocco, Mohammed VI, and the Crown Prince of Bahrain Salman ibn Hamad ibn Isa al-Khalifa, and dozens of members of the ruling family of Saudi Arabia. Many are either full owners or co-owners of accounts. The role of the king of Morocco in these documents is not specified.A representative of the Crown Prince said: “The Crown Prince of Bahrain has invested in a regional mutual fund that he does not own. He gained no tax benefits from this. ”

Among businessmen and political sponsors from the United States, there is a financier and philanthropist S. Donald Sussman (S. Donald Sussman), who opened his own account even before marrying Congressman from the Democratic Party of Maine, Chellie Pingree; Millionaire and owner of lingerie company Victoria's Secret Les Wexner, who in 2012 allocated 250 thousands of dollars in support of former Republican presidential candidate Mitt Romney; and the Israeli family of diamond dealers, Steinmetz. The Wall Street Journal in 2007 reported that Sage Capital Growth, a venture capital firm at Stein Man, paid generously for performances and other services to the former mayor of New York, Rudy Giuliani, who was widely advertised as an implacable fighter against organized crime and corruption, and who later unsuccessfully tried to become a GOP presidential candidate.

A spokesman for Sassman said that this was not his account, and added that the businessman made a passive contribution to the technology venture capital fund. He further said that the account belonged to this fund, and that Sassman first found out about his existence when ICIJ addressed him with questions. “Mr. Sassman has a lot of minority deposits,” said his representative, “and he has nothing to do with the management of funds, investment decisions and other activities.” Wexner and the Steinme family did not respond to requests for comments.

An analysis of the documents collected by ICIJ shows that many people associated with the accounts hid their names in every way, taking extraordinary precautions for this, although the HSBC staff constantly assured their clients that they were reliably protected by strict secrecy rules of Swiss banks.

Many of the accounts belonged to companies from offshore tax havens such as the British Virgin Islands, Panama and the distant Pacific island of Niue, but not the owners of the funds. Thousands more accounts are impersonal and numbered.

In the documents, the HSBC employee calls on the initials of one of the most famous Australian businessmen, Charles Barrington Goode:

“The accountant БGG would like to be called Mr. Shaw. Therefore, during the entire discussion, we talked about Mr. Shaw, ”this employee wrote in one of the documents. Hood's account was called SHAW99.

At the time, Goode was chairman of ANZ Bank, one of the largest in Australia. As for Hood’s participation in politics, one of the senators during the debate in the Australian parliament in 2001 called him the “money bag, fundraiser for the Liberal Party” of the current Prime Minister Tony Abbott.

In Australia, there are two funds that are associated with Hood. These are The Cormack Foundation and Valpold Pty Ltd. Between 1998 and 2013, they transferred more than 30 million Australian dollars to the Liberal Party in Victoria, as reported by the Australian Election Commission.

Goode told ICIJ that he opened this account 30 years ago, and that the bank insisted on using a pseudonym. “A bank employee told me that in the interests of security I need some other name or number to identify the account, and that I will have to use it in correspondence with the bank. I chose the name Show. According to Goode, “this account was inactive for about 25 years,” and before closing it five years ago, he reported it to the Australian tax authorities and paid taxes on the profits.

Banking policy violations

These documents raise new questions about HSBC's previous public statements that its employees are not helping clients evade taxes. So, in July, 2008, Chris Mears (Chris Meares), who led HSBC's private banking business at the time, said at a hearing in the British Parliament: "We prohibit our bankers from participating in tax evasion and encourage such activities."

Three years earlier, one wealthy British client named Keith Humphreys, who worked as director of the Stoke City football club in the English Premier League, told his HSBC manager that one of his family’s Swiss accounts was not declared in the British tax administration. The documents indicate that at that time there were more than 450 thousand dollars in this account.

Humphreys told the ICIJ Guardian media partner that this bank account was registered not in his name, but in the name of his father, and that they later voluntarily reported him to the authorities. This account, he said, "was opened in accordance with the financial recommendations," given to him at that time. It was reported to the tax authorities in 2011 year, having agreed to pay pounds sterling within the framework of a settlement agreement 147 165.

In another case, an HSBC employee made the following entry in the folder of Irish businessman John Cashell (John Cashell), who was later convicted of tax fraud in his home country: “The nature of his activities carries the risk of exposure by the Irish authorities. Once again, I tried to calm him down, saying that no danger threatens him. ” Cashelle did not respond to a request for comment on this entry.

The bank was worried about the cash transaction of a Serbian businessman on 20 million euros. However, bank employees confined themselves to asking him to act not so openly. “He was told that today the bank does not interfere with its money transfer operations,” the relevant document says, “but prefers that such operations be conducted on a smaller scale. He acknowledged our concern, and will continue to operate with smaller amounts. ”

Employees of HSBC, it seems, are not very worried about their characteristic for Canadian physician Irwin Rodier. “This customer is a little confused; for example, whenever he arrives in Zurich, he first flies to Paris, and then rents a car to get to Zurich, trying to keep the final destination of the trip secret, etc. ”

Rodier told ICIJ CBC / Radio-Canada's media partner that he settled all tax matters with the Canadian authorities.

In a statement to ICIJ, HSBC noted: “In the past, Swiss private customer service banks acted differently from today. Such banks, including those owned by HSBC, assumed that the responsibility for paying taxes lies with private clients, and not with the banks with which they deal. ”

How to circumvent the new law

The released documents show that some European customers received recommendations on how to avoid tax withholdings from their bank savings, which entered into force in the EU in 2005. Switzerland has agreed to implement the new tax law, called the European Savings Directive, or ESD.

However, this law applied only to individuals, and not to corporations. Documents show that HSBC Private Bank took advantage of this loophole and began to offer such a service, in which individuals turned into legal entities in order to declare income.

Documents show that the entire 2005 year, customers came to Switzerland day after day to withdraw cash in British pounds, euros, Swiss francs, US dollars and even Danish kroner. Sometimes they were asked to give them money with old and small banknotes.

One of those who came for dollars and euros was construction entrepreneur Arturo del Tiempo Marquez (Arturo del Tiempo Marques), who was sentenced to seven years in prison in Spain for smuggling cocaine in 2013. He owned HSBC with up to 19 bank accounts totaling more than three million dollars. He did not respond to the request for comments.

During one of the transactions, a British businessman and tycoon Richard Kering (Richard Caring) arrived in September 2005, accompanied by a security guard, to collect more than five million Swiss francs in cash.

Employees of HSBC, explaining Kering’s actions to withdraw such a huge amount of money, said that he intended to put them in another Swiss bank, but did not want the two banks to know about each other. They wrote: “RK is trying hard to be careful.”

A spokesman for Kering told the Guardian that he did not evade taxes, and offshore funds were used in accordance with generally accepted and widely used tax principles.

The documents show how Kering, a major sponsor in British politics, transferred one million dollars to the Clinton Foundation, which is a non-profit organization created by former US President Bill Clinton to "strengthen the capabilities of the people of the United States and the people of the whole world to solve problems of global interdependence."

The request for donation to the Clinton Foundation was received in December 2005 of the year. A month earlier, Karing sponsored a chic corporate party with caviar and champagne, which took place in the Winter Palace of Catherine the Great in St. Petersburg, Russia. 450 guests flocked there and were entertained by Sir Elton John and Tina Turner. Bill Clinton addressed the guests. During this evening, it was possible to collect more than 11 million pounds for a children's charity.

Other Clinton Sponsors

Documents released by ICIJ also report on many other high-ranking donors to the Clinton Foundation, including Canadian businessman Frank Giustra (Frank Giustra) and German superstar Michael Schumacher, seven times become the champion of Formula 1. The representative of Schumacher, who is listed as the owner and beneficiary of the account closed in 2002, told ICIJ that the driver has long been a resident of Switzerland.

Records show that Jostra is the only person on HSBC lists who had more than 2006 million dollars in 2007 / 10 in the year. True, his role in this account is not specified.

The New York Times reported in 2008 that Justra made a donation to the Clinton Foundation account shortly after Bill Clinton traveled to Kazakhstan with him in 2005. Upon the arrival of the guests, Nursultan Nazarbayev, who has been the president of this country for several decades? met with them at a chic late banquet.

As noted by the New York Times, Clinton publicly expressed support for Nazarbayev, which contradicted the position of the American government and his wife Hillary Clinton, who was then a senator and criticized Kazakhstan for human rights violations. As shown in the records in corporate reports, two days later, the company Just got the right to buy in Kazakhstan three state-owned uranium deposits.

As noted by the New York Times, Clinton publicly expressed support for Nazarbayev, which contradicted the position of the American government and his wife Hillary Clinton, who was then a senator and criticized Kazakhstan for human rights violations. As shown in the records in corporate reports, two days later, the company Just got the right to buy in Kazakhstan three state-owned uranium deposits.According to Clinton and Giustra, they went to Kazakhstan in order to see with their own eyes the charitable activities of the foundation. A Clinton spokesperson told the New York Times that the former president was generally aware of Justra’s business interests in Kazakhstan, but did not help him in any way.

The representative of Justra denied history The New York Times said that Jostra is acting "in full compliance with the disclosure requirements for all of his bank accounts." A representative of the Clinton Foundation told the Guardian that the foundation follows "strict principles of sponsorship integrity and transparency in its operations, going far beyond what is required of American charities, including full disclosure of information about all of our philanthropists."

The disappearance of data in Greece

The data that the French authorities provided to other states became the basis for launching official investigations in a number of countries. French magistrates are trying to find out if the bank has helped some of its clients avoid paying taxes for 2006 and 2007 years. French authorities have demanded that HSBC provide a guarantee guarantee in the amount of 50 million euros. The Belgian prosecutor’s office last year accused the bank of tax fraud.

In August 2014, an Argentine tax inspectorate searched the HSBC office in Buenos Aires. The Buenos Aires Herald newspaper reported that the head of the country's tax administration, Ricardo Echegaray, accused the bank of “creating a fraudulent scheme as a maneuver to hide bank account information from tax authorities”.

In its statement, HSBC ICIJ noted that it “fully fulfills its obligations to exchange information with the competent authorities” and “actively implements measures that ensure the tax transparency of its customers, doing this even ahead of regulatory and legal requirements”. “We also cooperate with the competent authorities investigating these issues,” the bank said.

The documents raise questions about why in some countries there were investigations, and others didn’t, and how thorough the investigations were.

For example, the most detailed material is related to the British customers of HSBC. During the preliminary investigation, the French tax authorities identified more than 5 thousands of British customers related to HSBC accounts for 61 billion dollars. By the number of clients and by the amount of money, Britain has overtaken all other countries.

It is possible that initially the French investigators could overestimate the real amounts in clients' accounts, but the British tax authorities concluded that 3 600 out of 5 thousands of people, about whom she received information from the French in 2010, “potentially did not fulfill the requirements”. A report submitted to the House of Commons Committee in September 2014 states that the tax service revealed tax arrears of people from the submitted list for the total of 135 million pounds, while Spain recovered 220 million pounds from its violators and France 188 million Lord Stephen Green (Stephen Green) who headed the HSBC bank in the period for which documents were made public, later became Minister of Commerce in the Cameron government in Britain and held this position until 2013.

Apart from several disparate court cases in the American federal courts, it should be noted that the US Federal Tax Service also showed little diligence in its work, although French investigators from the tax authorities found 1 400 people associated with the United States who had accounts on them 16 billion dollars. Again, this figure is higher than the amount that ICIJ calculated.

In a statement to the ICIJ 60 Minutes media partner, the US Federal Tax Service noted that since American taxpayers in 2009 had initially called for voluntary reporting of their offshore accounts, "there were more than 50 thousands of disclosures, and we collected taxes in the framework of this initiative alone for more than seven billion dollars. " US tax officials refused to say how many statements of this kind came from people with deposits at HSBC.

What happened after France sent the list of 2 names to more than thousands of Greek HSBC clients caused such a scandal that the former finance minister of this country was now on trial.

Greece received this list in 2010, but until October 2012 did nothing. At that time, the Greek magazine Hot Doc made public these names and noted that the authorities are not investigating and are not trying to find out whether or not the rich Greeks evaded taxes when austerity measures were in place in the country, including salary cuts and tax increases for those paid them.

Unlike the reluctance that the Greek authorities showed in investigating possible cases of tax evasion, they showed tremendous speed in another matter by arresting Hot Doc editor Kostas Vaxevanis and accusing him of violating privacy laws. He was quickly acquitted, and this trial provoked outrage in society when two former heads of the financial police showed in court that neither the former Minister of Finance Georgis Papakonstantinou (Giorgos Papakonstantinou) nor his predecessor had given orders to conduct an investigation on this list. Papaconstantinou stated that he was lost.

When the list finally surfaced again, the names of the three relatives of the ex-minister were missing. Now he is charged with abuse of trust, forging official documents and neglecting his official duties, because he removed the names of his relatives from the list, and also did not take any measures to obtain this document.

Serving weapons dealers

In the documents received by the ICIJ, information constantly appears that indicates an arms trade.

HSBC retained Aziza Kulsum and her family as clients even after the UN put it on its blacklist for funding the bloody civil war in Burundi in the 1990s.

The UN report from 2001 also states that Kulsum in the Democratic Republic of the Congo was actively involved in the illegal trade in the important strategic mineral coltan, which is used in the manufacture of electronic devices. Much of the world's reserves of coltan are located in conflict zones in central Africa, where various armed groups control numerous mines, extort money from mining companies and profit from the illegal sale of ore.

The two Kulsum accounts were closed before 2001, and the third, for 3,2 million dollars, was frozen (although not closed) at an unknown time for unspecified reasons “related to non-compliance with the requirements.” Kulsum's husband had some connection with another account that was not closed, and on which 2006 million dollars lay on 2007 / 1,6. In HSBC, Kulsum is listed as an “entrepreneur (stones and precious metals)” and the owner of a tobacco factory.

The documents featured another questionable account, registered at Katex Mines Guinee. According to the UN report for 2003, Katex Mines was a fake company that the Guinean Defense Ministry used to supply weapons to the rebel soldiers of Liberia during the fighting in 2003. Then inexperienced child soldiers fought for both sides, hundreds of people died during the fighting, and more than 2 thousands were injured. Three years after the publication of the UN report on Katex Mines, 7,14 million dollars were on this account.

Other recordings show that HSBC employees in 2005 met their client, Shailesh Vithlani, in the capital of Tanzania, Dar es Salaam, where they advised him on how best to invest money. The Guardian newspaper in 2007 reported that Vitlani, listed as the owner of one of the accounts, is allegedly an intermediary who helped the British weapons company BAE secretly transfer millions of dollars to an unspecified price in the military of the Tanzanian government in an unspecified account in the Swiss bank 12. We were unable to contact Vitlani for comments, but in 2007, he told the Guardian that he had not paid any money from a Swiss account to Tanzanian officials.

Another HSBC client related to HSA was the South African political consultant and businessman Fana Hlongwane. In 2008, the British Service for Combating Large-Scale Financial Frauds filed a statement with the South African Prosecutor’s Office stating that Khlongwan received money from VAE through a secret network of offshore brokers, and in return contributed to the promotion of arms supply transactions.

Attorneys of Khlongwan did not respond to repeated requests to comment on this matter.

In his affidavit during the 2014 arms supply contract, Hlongwane denied that “there is at least some evidence that incriminates me and / or my companies of corruption and abuse.”

In banking documents, Hlongwane is listed as a beneficiary for the account of Leynier Finance SA, on which there were 880 thousand dollars. For two other accounts where 2006 millions were in 2007 / 12, his role was not specified.

In banking documents, Hlongwane is listed as a beneficiary for the account of Leynier Finance SA, on which there were 880 thousand dollars. For two other accounts where 2006 millions were in 2007 / 12, his role was not specified.The owner of the other account seems to have been involved in the Angolagate scandal.

In 2008, the French Prosecutor’s Office began the trial of the 40 case with more than people involved in corrupt arms transfers to Angola in the 1990s. The prosecution argued that under the corruption scheme, bribes worth 50 million dollars were transferred in exchange for contracts worth almost 800 million dollars. Famous Frenchmen appeared in the case, including the son of former French President Francois Mitterrand.

The account associated with Angolagate in the name of Micheline Arlette Manuel and codenamed Corday was opened from 1994 to 1999 year. The exact role of Manuel in this account is not specified.

The code name Corday was assigned to several accounts in HSBC and other banks, which were officially related to her husband, Manuel Eve. He also had an account with HSBC. He died after being convicted of involvement in this scandal. A French court ruling from October 2011 says that Yves Manuel received and hid 2,59 a million dollars, knowing that these funds came from a company that gave bribes to officials from France and Angola. Michelin Arlette Manuel did not respond to the request for comment.

Another account was found in the name of Wang Chia-Hsing, the son of the alleged intermediary in the scandalous arms deal to Taiwan Andrew Wang Chuan-pu.

Wang Chuangpu fled from Taiwan, where he is wanted on charges of involvement in the assassination of the first rank of the Taiwanese Navy, Yin Ching-feng, as well as in a series of kickback deals and corruption scandals involving Taiwan, France and China.

The South China Morning Post reported that Wang Chuangpu left China shortly after Yin Chinfeng's body was found at the northern coast of the island in December 1993, which was about to expose and report on rollbacks and corruption in buying six Taiwanese Navy french frigates. Although Wang Chuanpu recently died, his Swiss attorney told 30 in January, the lawsuit against him continues in both Switzerland and Taiwan.

In HSBC documents, Van Chuanpu is named interior decorator. They also indicate his address in a prestigious area of London. It reported on conversations between Wang Chuangpu and the bank’s employees at a time when, by order of the court, his account on 38 with more than million dollars was blocked. From the documents it is not completely clear what exactly Wang Chuangpu had to do with this bill. However, the documents indicate that he asked the bank to recognize his status as a temporary resident without permanent residence in Britain. This status has foreigners living in the United Kingdom and not paying income tax and tax on income from capital abroad. In general, this status is considered a form of legal tax evasion.

A spokesman for Wang Chuanpu said that his client "regularly paid all the necessary taxes and did not commit any inappropriate and illegal actions."

Diamond traders

ICIJ analysis shows that almost 2 of thousands of HSBC clients are associated with diamond trading. Among them is Emmanuel Shallop, who was later convicted of trading in blood diamonds.

Blood diamonds are gems that are mined in war zones, and then sold, receiving funds to continue the war. This name was given to diamonds mined during the recent civil wars in Angola, Côte d'Ivoire, Sierra Leone and other countries.

“Diamonds have long been associated with conflict and violence,” said Michael Gibb of Global Witness, an international human rights organization. “The ease and simplicity with which diamonds turn into weapons of war with irresponsible treatment is simply amazing.”

The documents show that HSBC was aware of the investigation that was conducted by Belgian law enforcement agencies against Shellop during the period when the bank provided him with services. “We opened for him a corporate account registered for a company based in Dubai. ... The client is now extremely cautious because the Belgian tax authorities are putting pressure on him to investigate his financial fraud in the field of diamonds, ”says bank documents.

Shellop’s lawyer told ICIJ: “We don’t want to make any comments on this issue. My client, for reasons of confidentiality, does not want his name to be mentioned in any articles. ”

Other account holders at HSBC could have been associated with Omega Diamonds, which resolved a tax dispute in Belgium in 2013 by paying 195 million dollars, but did not admit its guilt. The Belgian authorities in their civil lawsuit claimed that Omega Diamonds transferred its revenue to Dubai and traded diamonds from Congo and Angola. At the time when the alleged trading was carried out, the managers of the company Ehud Arye Laniado and Sylvain Goldberg had their accounts in HSBC. Omega’s third shareholder, Robert Liling, is featured in the documents as the owner of several accounts.

The trustee of this troika said that none of his clients were charged with tax violations. “The tax dispute between Omega Diamonds and the Belgian tax authorities applies only to Omega Diamonds, but neither Mr. Laniado, nor Mr. Goldberg, nor Mr. Liling are involved in it. The Omega Diamonds tax dispute was settled to the satisfaction of all parties. ”

Links to al Qaeda?

For the first time, the communication of HSBC's customers with al-Qaida was openly talked about in July of 2012. The report of the US Senate referred to the proposed al-Qaida internal list, which listed its financial sponsors. The report's authors noted that information on this list appeared after a search in the Bosnian branch of the Saudi non-profit organization Benevolence International Foundation, which the US Treasury department called terrorist.

Osama bin Laden, who organized the September 11 attacks, referred to a handwritten list of 20 names, calling it the Golden Chain.

Osama bin Laden, who organized the September 11 attacks, referred to a handwritten list of 20 names, calling it the Golden Chain.From the moment when the news In the spring of 2003, the Gold Chain names were announced and a Senate subcommittee made a speech that HSBC should have known these powerful business people were risky clients.

Although the significance of the “Golden Chain” list was repeatedly questioned, ICIJ, in all likelihood, found the names of three people from this list who, after 2003, had Swiss HSBC accounts.

These documents tell us very dark stories, but there is at least one there that makes you smile.

Among HSBC account holders were diamond dealers Mozes Victor Konig and Kenneth Lee Akselrod, included in Interpol's search lists. But there was also Elias Murr (Elias Murr), who is the chairman of the board of the Secure World Foundation, operating under the auspices of Interpol. This organization has the goal of combating terrorism and organized crime. Before joining politics, Murr was a famous businessman. In 2004, when he served as the Minister of the Interior of Lebanon, he had an account with HSBC registered to Callorford Investments Limited. By the 2006-2007 years, 42 million dollars accumulated in the account.

The representative Murra said that the condition of the client and his family is well known, and that the family Murra had accounts in Switzerland before his birth. The specified account is in no way connected with his political activities. “If a Lebanese citizen opens bank accounts somewhere, it’s not illegal and should not be suspicious,” he said.

Information