Banks and tanks. War loans to Britain during the First World War

War is a dear thing

The Sarajevo assassination on June 28, 1914 of Archduke Franz Ferdinand, heir to the Austro-Hungarian throne, and his wife Duchess Sophia Hohenberg in Sarajevo by a Serbian high school student Gavrila Princip had almost no effect on the state of the financial markets in Europe, let alone London.

However, the Austrian ultimatum to Serbia on July 23 changed everything. European stock markets experienced a collapse, and investors, as always in unstable times, began to look for a "safe haven" in the form of bank gold.

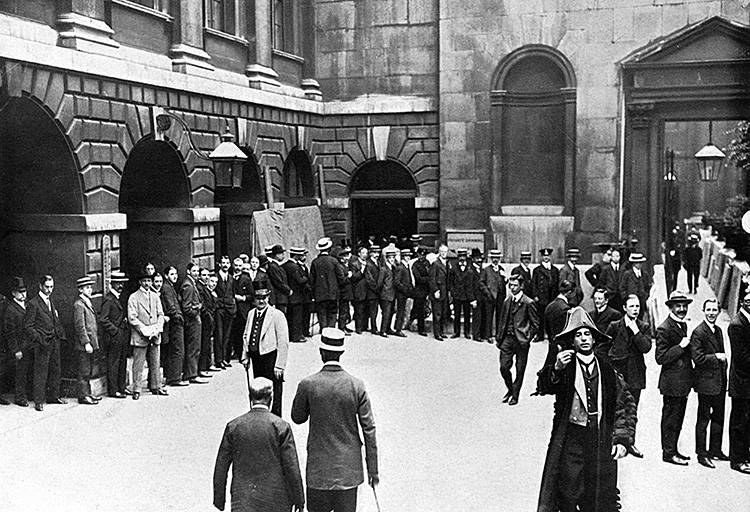

By July 27, London was in panic, and the Bank of England was literally besieged by crowds of people trying to exchange their paper money for gold.

People line up outside the Bank of England in July 1914 to exchange notes for gold.

The securities market and the foreign exchange market crashed on the same day. It is unthinkable, but the complete collapse of the British financial system took place right in front of the bankers, who were unable to do something on their own ...

On July 30, the Bank of England reacted with a single weapons in his arsenal: he raised the interest rate from three to four percent and from four to eight percent the next day.

On July 31, the London Stock Exchange closed for the first time in its 113-year-old historyand on August 1, the bank again raised the bank rate to a record high of 10 percent.

Such a scenario was not planned, but neither the Treasury nor the Bank of England had any other contingency plans. Further rate hikes were now considered impossible.

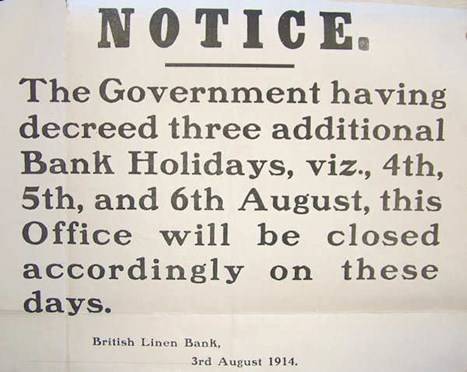

Friday, July 31st, was supposed to bring relief to the besieged banks. The planned weekend day in August meant they didn't have to open their doors until Tuesday morning, however, the escalating crisis this weekend has led to an extension of bank holidays. On Monday, August 3, the government announced an unprecedented four-day bank holiday to give the Treasury and the bank time to take a series of measures to bail out the financial markets.

During these holidays, David Lloyd George, who was then Treasury Secretary, drafted and passed an Act in Parliament - the Currency and Banknotes Act, according to which Great Britain abandoned the gold standard.

Pursuant to this law, the Treasury issued £ 300 million worth of paper notes (equivalent to more than £ 30 billion today) without gold backing.

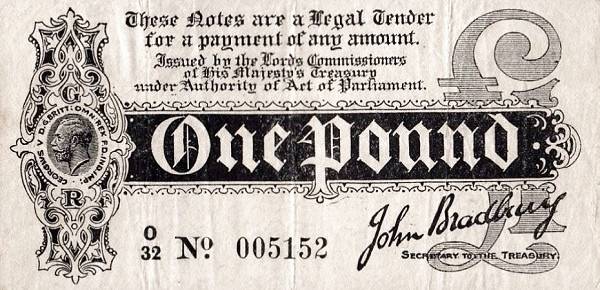

The introduction of hastily printed small denomination banknotes issued by the Treasury (not the Bank of England) and the government's general moratorium on contract payments (which allowed banks to refuse to pay deposits) prevented people from running around banks when they were later opened.

The Treasury issued notes signed by Sir John Bradbury, Permanent Secretary of the Treasury. They were immediately nicknamed "Bradbury" by the people.

A couple of months later, this sample of the early 1914 banknote was replaced by a more elegant version.

Calls for patriotism and the government's appeal to citizens to stop trying to exchange paper money for gold were successful. When the banks reopened on Friday, August 7, the first Bradbury's had already been printed and delivered to the banks.

By removing gold from domestic circulation, this law effectively suspended the gold standard and in practice allowed an inflationary increase in the money supply, which enabled the government to print banknotes to cover its obligations. Consequently, the law gave the government, acting through the Bank of England, greater authority to issue banknotes in excess of the previously authorized limit.

So the first battle of World War I was won by the Bank of England before the British even fired a single shot.

The government quickly realized that the war would be very costly and that it would need to take steps to raise funds to pay for the necessary weapons and ammunition. In the first weeks of the war, the government financed its military spending with loans from the Bank of England, but by the late autumn of 1914 it needed new funds.

On November 7, Treasury Secretary Lloyd George presented the first military budget to the House of Commons, which indicated a deficit of £ 339 million, on the assumption that the war would last until the end of March 1915. Against this background, plans were implemented for what would be the first in a series of war loans.

The loan should have been much larger than any previous government bond, something in the region of £ 350 million (equivalent to £ 35 billion today).

This was six times the previous largest loan received (£ 60 million raised in 1901 to fund the Boer War). The loan was promised to pay interest at a rate of 3,5% and was to be repaid by the government between 1925 and 1928.

This first war loan was issued at a 5% discount, which meant that investors could buy £ 100 shares for just £ 95 - so they could look forward to just over 4% annual return over the expected life of the loan - an attractive return for investments supported by the state.

The first war loan targeted wealthy individuals and institutions who could afford a minimum subscription of £ 100 (equivalent to over £ 10 today). The support of UK commercial banks was essential to attract these potential investors.

Funding for World War I required the UK government to borrow the equivalent of annual GDP. But his first attempt to raise capital in the bond market ended in failure. The 1914 war loan raised less than a third of the planned £ 350 million and attracted only a very small group of investors (a fact that was hidden from the public for decades).

This setback influenced all other fundraising efforts. While the slogan "business as usual" characterized Britain's initial approach to war, the country gradually abandoned the consistent long-accepted principles of free trade, taxation and liberal capitalism.

In the fall of 1915, Britain sharply raised taxes, expanding incentives for the middle class, but raising rates for the wealthier in order to attract more capital. Higher taxation was also supposed to slow down private consumption, which led to higher inflation.

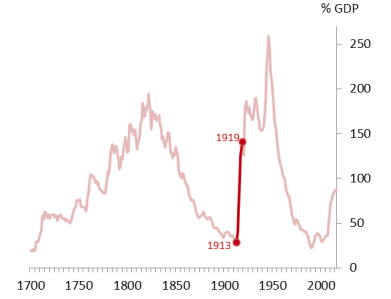

Between 1913/14 and 1918/19, government spending increased more than 12 times to £ 2,37 billion. Although tax revenues quadrupled over the same period, war loans were required to finance the remainder. As a result, UK government debt has increased from roughly 25% of GDP to 125% of GDP in four years, requiring the issuance of bonds and a buildup of debt at a pace not previously seen in peacetime.

UK national debt

These unprecedented costs meant that the war posed both a military and a financial challenge.

Capital raising was not a secondary element of Britain's military strategy - as the richest economy among the Entente countries and the financial center of its time - it was at its core.

As Lloyd George formulated in 1914, Britain's plan was to use its trade and naval forces to ensure the ability to provide an army to support French forces on the continent and raise capital to provide its allies with weapons and supplies.

In short, whatever one may say, but war is an expensive thing.

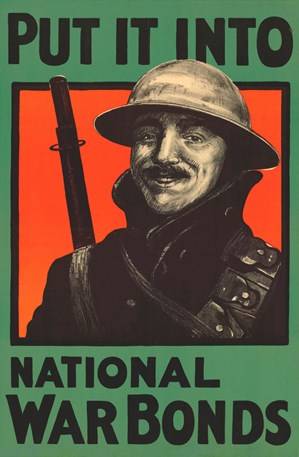

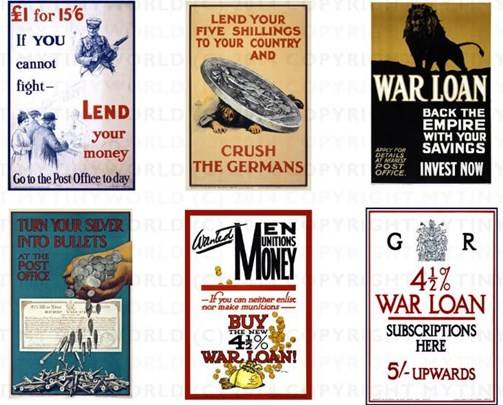

This will be followed by several more military loans, which will attract not only large investors, but also ordinary citizens. The publicity has risen several steps higher. The result was the release of a number of eye-catching posters, often from well-known artists, encouraging people to buy bonds.

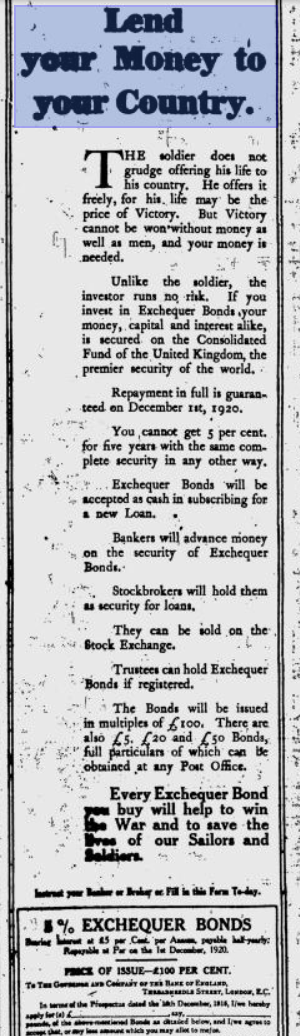

This April 1916 advertisement for 5% Treasury bonds was typical of the time:

(Translated by the author. I do not pretend to be particularly accurate, but the meaning, I hope, is clear).

Tank banks

In 1917, the war bonds advertising campaign took on a new lease of life. A completely unusual marketing move was used for that time. It was decided to use the people's interest in the miracle weapon - tanks.

Six real veteran tanks, brought directly from European battlefields, toured the cities and towns of England, Scotland and Wales. Their main purpose was to facilitate the sale of government war bonds.

These were British Mark IV heavy tanks of the male modification - with mixed cannon and machine-gun armament (as opposed to the female modification - which had only machine-gun armament). Each of them, in addition to the tail number, according to the tradition of that time, had its own name:

• No. 113 Julian,

• No. 119 Old Bill,

• No. 130 Nelson,

• No. 137 Drake,

• No. 141 Egbert,

• No. 142 Iron Ration.

The participation of the tanks in the Battle of the Somme and their recent participation in the Battle of Cambrai have sparked the public's imagination: their appearance on the show proved to be very popular with viewers fascinated by this new wonder weapon.

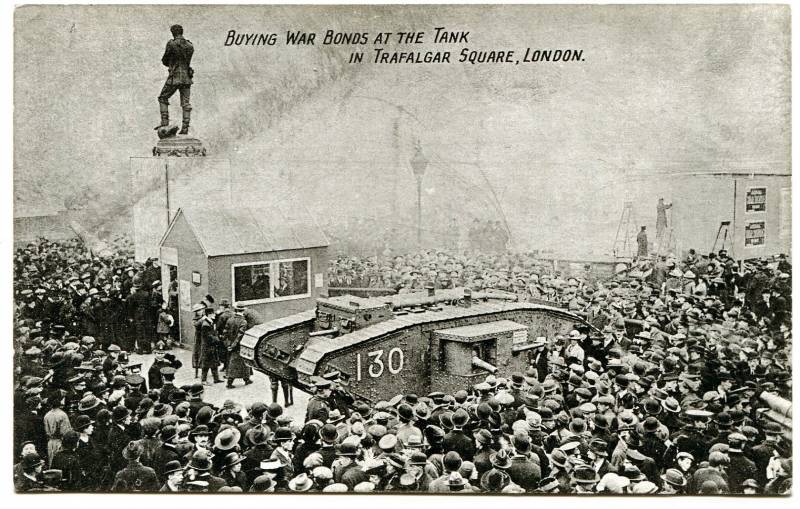

On November 26, 1917, tank No. 141 "Egbert", wounded in battles, took part in the Lord Mayor Show in London at Trafalgar Square. In December, tank # 130 Nelson replaced it for two weeks.

Soon the campaign spread throughout the country: traveling tanks spent a week in every city on their way, and two girls sold war bonds from a table set inside the tank. They began to call this - "tank banks".

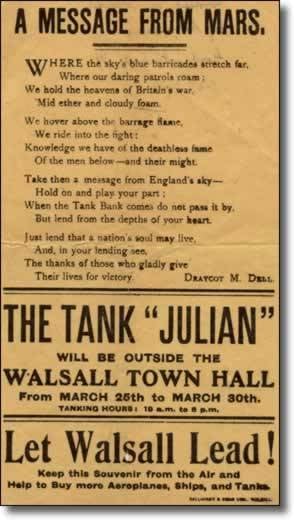

The tank arrived in the city with great fanfare. It was greeted by high-ranking civilians and local celebrities, and speeches were delivered frequently. The tank was accompanied by soldiers and artillery pieces; sometimes, before the appearance of tanks, the plane dropped brochures and booklets over the city with calls for investing in bonds.

Leaflet dropped on Walsall ahead of Tank 113 Julian's visit.

Tank used to put on shows for the public to demonstrate his capabilities.

Several black and white silent videos illustrating tanks visiting different cities:

The amount received in each city was announced in the national press, which provided an element of competition, especially between large industrial cities.

General deposits in "tank banks" for cities where the amount was over £ 2 million:

• Glasgow - £ 14,

• Birmingham - 6 pounds sterling,

• Edinburgh - 4 pounds sterling,

• Manchester - £ 4,

• Bradford - £ 4,

• London (for 2 weeks) £ 3,

• Newcastle - £ 3,

• Swansea - 2 pounds sterling,

• Hull - 2 pounds sterling,

• Leicester - £ 2,

• Liverpool - £ 2,

• West Hartlepool - £ 2 (£ 367 per capita),

• Sunderland - £ 2,

• Aberystwyth - £ 682 - £ 448 per capita, later confirmed as the highest in the empire.

The sums are really huge when you consider that the average worker was earning £ 2 a week at the time.

In 1919, the Treasury agreed to transfer 264 tanks to various townships in gratitude for their financial efforts. The National Committee for War Savings (a public organization to promote wartime loans and savings certificates) decided which cities would receive one of these tanks. Once received, the tanks were usually stationed in parks or public places. But due to lack of funds or general indifference, they subsequently simply stood and rusted.

All but one of these tanks were eventually sold for scrap or otherwise destroyed before World War II. Only a tank in the city of Ashford, Kent has survived to this day, largely due to the installation of an electrical substation in it in 1929. The tank is now a registered war memorial.

A short video with a story about this tank:

In fact, Mark IV tanks have survived in a number of museums in England, Australia and the United States. I met this one at the Aberdeen Artillery Museum.

And this one is in Brussels, in the Royal Museum of the Army and Military History of Belgium.

PS

I was almost finishing work on this article when it suddenly got an amusing continuation.

I received a message from a fund to which I have contributed for many years and which now pays me a pension. They congratulated me on my official retirement (I recently turned 67, and this is the retirement age in our area), indicated the exact amount of monthly payments, said that their organization, as before, is guarding my interests, that my savings are safe and sound, and even slowly growing, since they are invested in solid bank funds of various countries (names are listed). Among others, I found a mention of British debt obligations (!).

Having rummaged through the net, I found interesting information.

It turns out that World War I war bonds are currently in the hands of 120 investors.

But since 2014, for the centenary, Great Britain began to pay off its debts during the First World War to depositors!

Until that time, bonds also did not lie dead, they were regularly paid interest.

Since 1917, the government has paid out £ 5,5bn ($ 8,64bn) in interest alone on perpetual 5% and 3,5% war bonds, according to Britain's Debt Management Department.

The British government also says it will consider redeeming a number of other antique Treasuries.

Some of these commitments date back to the XNUMXth (!) Century.

Thus, in 1853, British Prime Minister William Gladstone issued bonds to consolidate the authorized capital of the South Sea Company, founded in 1711. The company crashed in 1720, leaving huge debts.

The British government at one time promised her a monopoly on all trade with the Spanish colonies in South America. Expecting a repeat of the success of the East India Company, which provided England with a thriving trade with India, investors bought up shares in the company.

As its directors spread fables about the unimaginable riches of the South Seas (modern-day South America), the company's stock surged more than eightfold in 1720, from £ 128 in January to £ 1 in June, before plummeting to end of the year.

However, on the British stock market, these bonds also have their own, albeit not very high, quotation.

What's the South Sea Company! On this market, war debt bonds are quoted for the wars with Napoleon and even for the Crimean War of 1853-1856! Under them, the owners may well get loans today on very convenient terms.

Of course, to me, who launched pigeons from the balcony from such bonds back in 1959, such a formulation of the question seems completely unusual.

When a decree was issued, according to which the circulation of the winnings of previously issued loans was stopped and the repayment of bonds was postponed for 20 years, they were lying in a bundle in grandfather's box in a box completely useless. Citizens did not believe that someday the state would pay at least something on the bonds, and then there were many families where children were allowed to play with beautiful pieces of paper. Well, I was glad to try.

Sources:

Michael Anson, Norma Cohen, Alastair Owens and Daniel Todman. Your country needs funds: The extraordinary story of Britain's early efforts to finance the First World War

Norma Cohen. How Britain paid for war: bond holders in the Great War 1914-32.

Daunton, M. (2002) Just Taxes: The Politics of Taxation in Britain 1914-1979, Cambridge

Sayers, RS (1975) The Bank of England 1891-1944, Vol. I.

Wikipedia articles, etc.

All images in this article are taken from the Wikipedia media warehouse, the Flikr free images resource and the like, unless expressly stated otherwise.

Information