Returning to the future of the Fed

Since 1999, the congressman has consistently submitted bills for the removal of the Fed to Congress. The Federal Reserve Act states that “the term of the charter is set by the maximum legal limit” (it says, "It says:" is a well established legal order: 99.

Alan Greenspan's financial system reform

Most Viewed News American media is amazed at the presence of stock tickers, whether it is the bottom line of the TV screen or the left side of the computer monitor. Tickers are such electronic tracks on which real-time quotes of securities run. Those Americans who are specifically hooked on the needle of stock market speculation usually spend their free time behind a computer monitor, frantically clutching a mouse in one hand, ready to send a request to the broker with a quick “click”. How many suicides have happened across the country due to unsuccessful games and huge debts on a brokerage account - stories probably never to clarify, but the money was lost is not measured.

This is not surprising - in the US, the younger generation sleeps and sees itself as programmers and stock traders. The unbreakable friendship of new technologies with exchange trading has a logical connection: the financial condition and well-being of 99,9% of all software and computer companies took place overnight precisely because of exchange trading. And the whole life of these companies was built according to a well-knit pattern: the “advanced company” is created with the sole purpose - to go through the “go public” procedure as soon as possible and find yourself on the stock exchange. In a matter of months, companies sometimes manage to “raise” up to a billion dollars, if not more. At the end of 90, some companies' shares overnight increased in price by 200 times! To keep within reasonable cost limits, it was necessary to constantly carry out the so-called price split.

The period from 1999 to spring 2000 of the year was the high point of the entire American “new economy”. Thousands of nameless dot-coms (dot.coms), companies whose business was directly connected to the Internet, have sprung up in the sky. The solid “tsekhoviki”, like our “Emulex” or the legendary “Cisco”, providing the “iron” component of the Internet, did not stand aside. The capitalization of these monsters instantly exceeded tens of billions of dollars. Alas, a year later everything was back to square one: the soap "Internet bubble" burst with a bang.

In 2000-ies, it became clear that the rapid introduction of information technologies in the field of cash payments sharply accelerated the circulation of non-cash means of payment, i.e. reduced total volume requirements for such means of payment. As a result, there was a huge mass of free money, but there was no inflationary threat!

The main activity of the Fed in the period of the Clinton administration is usually considered to be a successful fight against inflation - this “Achilles heel” of almost all post-war democratic administrations in the United States.

Why, with the huge, growing mass of free money in the US, there was no inflation in the 90s, and the Fed chief, Alan Greenspan, noticed the American economy overheated only in the middle of 1999? We have no answer. Most likely inflation occurred in the area of non-cash circulation, i.e. was hidden (as in the time in the USSR), and therefore it simply did not count. More precisely, they did not take into account the huge expenses of Americans for financial games in the stock market, where speculation with shares of IT companies was going on.

And the point is not only that it has always been very difficult to calculate inflation using the maximum monetary aggregate that takes into account the value of commercial securities (L). The rapid spread of information technology in the financial and credit and banking sector, the emergence of Internet banking and so on. led to the creation of new electronic means of payment, the turnover of which by the state (Fed) has become more difficult. Moreover, the dollar supply of such payment instruments could grow significantly regardless of the Fed's efforts, which was largely due to the reform of the US financial system blessed by Greenspan.

We are talking about the Gramma-Lich-Blilley Act (Gramm - Leach - Bliley Act, PL 1999 - 106, 102 USC 12.) Adopted in the autumn of 1811. The modernization of the financial system, which has become the largest gift for the "new information economy" of the United States. With this major economic decision, Congress overturned those introduced in 1932. The Glas-Stigall Law provides fundamental restrictions on holding associations of banks, guarantee funds (working with securities) of insurance and other companies providing financial services.

Adopted during the reform of the American banking system 1932. The famous Glas-Stigalla law prohibited banks from engaging in speculative insurance of securities and underwriting (that is, to guarantee their placement among investors). In accordance with this law, the price of securities could not be arbitrarily declared by the issuer or the bank supporting it, but was determined on the stock exchange during trading. Thus, banks were deprived of the opportunity to “inflate bubbles”, guaranteeing the nominal liquidity of shares and other obligations of private companies (such operations were very risky at the beginning of 30). It can be said that it was the Glass-Stigalla law that provided the real sector of the US economy with investments and played a huge role in its recovery from the worst 1929-1930 crisis.

In today's competitive economy, non-working people (who receive wages), not capitalists (organizer of the production of marketable goods), who do not play well on the stock exchange (securities speculation), and not even rentiers (who receive interest on bank deposits or rent on their property ), and the issuer of bills, i.e. the one who was able to convince (or compel) a sufficiently large number of market participants to use their obligations (issue of payment instruments). The income of such an issuer is called “seigniorage”, and its main recipient is the US Treasury.

The Gramma-Lich-Blily law unwittingly created a situation in which the United States began to share “seigniorage” on a large scale with IT companies pursuing a policy of rapid capitalization, while the prices of their shares were guided by the predicted (hypothetical) synergistic effect and supported by government spending. Those financial companies that placed the shares issued by them (by crook sold them for real money) at an inflated price, also received such a “seigniorage”.

The Fed chief, following his monetarist tradition of curbing inflation, using Gramma-Lich-Blily law stimulated the transfer of a huge amount of free money from the money market to the stock market, and thus almost the entire "inflation overhang" fell on the dollars on which shares were purchased IT companies. The depreciated huge amount of money invested in the extremely expensive capitalization of IT companies did not show demand in the domestic consumer market, where inflation is usually measured by price dynamics.

In fact, at 1999, President Clinton lifted the ban on financial speculation and helped reduce state control over the issue of shares, as well as the continued growth of stock prices of US companies much higher than their value. Armed with the Gramma-Lich-Bliley law, financial companies in the 21 century acquired the right to offer their customers not only banking services, but also insurance of their assets (stocks and bonds).

Grabbing these information and communication technologies, American investors turned away from industry (the real sector), and began to "inflate bubbles", large-scale operations with electronic money substitutes. This activity has undermined the development of not only American industry, but also the American economy.

What the Fed is doing and why

The US Federal Reserve is best known for its influence on the reduction or increase in the amount of money freely circulating in the economy, i.e. on the money offer. The content of this concept is reduced to the (real) amount of funds circulating in the economy that are available for a specific period of time in the US financial system.

Accordingly, if the number of payment instruments that circulate in the economy is more or less, the Fed gets a false picture of what is happening.

The Fed, based on real data, conducts a current analysis (monitoring) of the state of the national economy, on the basis of which measures of state macroeconomic policy are determined:

- rate on loans from federal funds;

- discount rate.

These rates represent benchmarks for interbank loans, as well as loans provided by federal funds to commercial banks. Using these most flexible and popular monetary policy tools, the Fed has an effect on the money supply.

If the money supply lags behind the needs of the economy (that is, the rates at which banks lend to customers are high because there is little money), the Fed turns on the heater — at the FOMC meeting, reduces the base interest rate and buys out government bonds (US Treasury bonds) from banks way throwing in additional payment instruments. Cash from banks becomes more, it eases the conditions under which banks can lend money, there are new opportunities for business and consumers. It stimulates the economy as a whole.

On the contrary, if the money supply is excessive and the economy does not have time to “digest” them, there is an overflow of money circulation channels, which is a threat to inflation (when prices are constantly increasing). In this case, the Fed’s actions resemble a refrigerator — the basic discount rate of interest rises, and government obligations are thrown into the free market. These measures reduce the cash reserves of banks, banks tighten the conditions for obtaining commercial and investment loans, the money supply is reduced, business activity of entrepreneurs is slowed down, but the economy as a whole is saved from inflation.

In all this, the main thing is the following: in modern USA, cash is only 5-6% of the total volume of calculations. The main part of settlements (95%) is carried out by banks in a cashless way, through the electronic payment system.

From this it follows that as a result of toughening global competition, a state can collect the effect on the demand of means of payment only when it has the opportunity to increase its debts, for which it is not going to pay. One of the most common methods of such borrowing is to compensate for budget losses by forcibly diluting the money supply (issuing unsecured money or bonds). This method is called the “sovereign (senor) method,” and the additional revenues generated by the state from this activity are called emission tax, or “seigniorage”.

Exploring the history of "seignion", economists saw the following trends:

- in 1970-2000-s - payment instruments serving the global economy, for the most part from cash turned into non-cash (and essentially electronic). The main part of the cash expenditures of the population and companies of the USA began to be serviced by electronic means of payment (the most important place here is occupied by electronic trading, salary on cards, playing on the stock market (buying and selling shares));

- after 2000, the sphere of payments serviced by electronic means has expanded dramatically, non-transparent transfer schemes have emerged (here the emigrants tried - sending billions of dollars to poor countries). Developed countries are not in a position to limit this financial traffic, since tightening control over this channel can cause tremendous damage to their economy and cause the opposite effect. Therefore, many private issuers emerged (they were before, but with the advent of the Internet they found a “second wind”). Another important shift: if the dollar used to attract the competitiveness of American goods and services, in the 21 century, the competitiveness of the issuer system almost completely depends on the image (authority) of the issuer. In other words, both the Fed's dollar and the funds of exchange of other private issuers are based primarily on the financial image of their issuer, and then on the issuer's organizational resources. The 21 century paradox is that in our time of black and white PR, it is much easier to increase the authority of an issuer, and therefore the main efforts are made not so much to improve the real component of issuers' means of payment (a powerful economic base in its traditional sense), but rather to unwind these means.

Who are these issuers? This is Internet banking, issuers of anonymous electronic cards and virtual accounts, with which you can pay anonymously in real and virtual stores. The difference between the cards of one or another issuer and the “cash” money of the electronic payment system is huge. A regular credit card (or debit card) is issued by one or another bank, giving access to those who opened an account with the bank. Payments on this card are tied to a specific person. Do not discount the fantastic possibilities of the very existence of your own “cash holding” of cash, which can be manipulated virtually online in different ways. All this contributes to the fact that, sooner or later, private settlement systems will be forced out of the market unsecured state money "sovereign senor".

And private business leaders who are carrying out plans for further liberalization of the money circulation system are focused on ousting state-controlled money by private electronic means of payment, and it will be even harder for the government to perform macroeconomic regulation functions and ensure the sustainability of the market economy. In such conditions, we can speak not about the stability of the national economy, but about the sustainable development of a corporation that has its own monetary system.

The consequences of reducing the macroeconomic regulation of the US Federal Reserve.

In the era of the spread of information-banking technologies, there are fair doubts about the self-sufficiency of traditional methods of macroeconomic regulation of money circulation. In fact, is it possible to focus on inflation rates in the United States if they no longer reflect the dynamics of the purchasing power of the overwhelming part of dollars earned in personal (5%) and non-cash (95%) circulation.

Key macroeconomic indicators tracked by the Fed:

- the amount of money in circulation - the wide distribution of electronic money has sharply accelerated their turnover and led to a clear redundancy of the means of payment in circulation;

- inflation - the proliferation of competing private payment systems makes macroeconomic estimates of inflation in the US economy too inaccurate;

- and the unemployment rate - the spread of "financial robots” and similar programs will soon lead to massive uncontrolled commercial activity, which makes the estimate of the unemployment rate untrue.

It turns out that the politically motivated intuition of its chairman, which undermines the credibility of the dollar as a reserve currency, is almost the main reason for the decisions taken by the Fed.

You can't say “stop” to the internet!

In fact, the Fed has currently lost its “monopoly” on a qualitative analysis of the economy. Using the same computers as the Fed, large companies, downloading these supercomputers with economic “software”, the purpose of which is to search for the initial statistical data of national and international information and a virtually unlimited range of business monitoring indicators. Such a company is oriented in economic matters not worse than the government.

A robot of this company that uses the computational power of a supercomputer, minisupercomputer or cluster of computers (and the usual 4 nuclear core, which is a trifle :);) trained in automated search for profitable (speculative) investment opportunities (for example, playing on the difference between the profitability of acquired shares and the rate interest on a loan taken to buy them) can, round the clock, be absolutely legal to scan the global financial system in search of cheap loans and profitable financial instruments (gambling experience). Locating anywhere in the world, opening a special bank account and using a cheap and reliable electronic transfer system to get loans from some financial systems, at the same time putting this money into the game at other sites, millions of robots whose performance is provided by multi-core Intel or AMD processors , carry out large-scale speculation with the US currency and the US stock market, contribute to the destruction of the mechanism for regulating money circulation and macroeconomic regulation of the market economy. Onomics in general, undermines the world’s confidence in the reserve currency, further aggravating the imbalances that have arisen in connection with the abolition of the gold equivalent of the dollar.

As a result of the widespread use of “financial robots”, all global competition is degenerating to the level of a fight between them (a virtual game between computer softphones).

It is not obvious, but something inside suggests that the winner in such a market game of "pure knowledge" will be the program in which the interests of a person, country or society are considered the least.

“Bulls make money. Bears make money. Boars go under the knife. (popular saying on Wall Street)

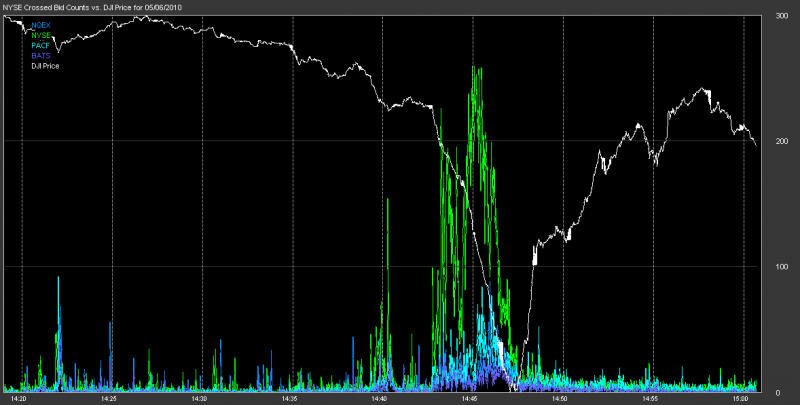

6 May 2010, from the US stock market, 20 billion dollars disappeared from 862 in minutes. The fall of the Dow Jones index (990 points) was the most dizzying in all the years of the stock exchange. The fall continued in just ... 5 minutes (from 14: 42 to 14: 47), after which the market, like a scalded one, won back 90 index points in 543 seconds. Such a performance on the US stock exchange has not yet been observed!

The catastrophe comes to life only in detail: in the 14 hours of 47 minutes, the securities of about 200 companies have completely lost their value. In the literal sense of the word: their current quotes ranged from 1 to 3 cents! Since an exchange is by definition a “zero-sum game,” the billions earned by some exchange members mean the same money lost by others.

After such arithmetic, talk about the unique capabilities of the era of wild privatization in the CIS is not impressive. At least because the performances played in 2010 on the American stock exchanges make it possible to overcome the distance from non-existence to fabulous wealth in minutes!

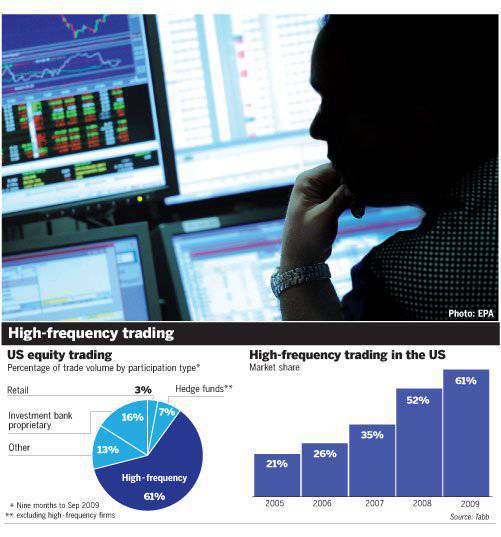

Found guilty in May: enraged SEC jabbed a finger at HFT (high-frequency trading) - “high frequency trading”. HFT technologies allow traders to instantly analyze huge amounts of market information and implement investment strategies. High-frequency trading is characterized by an enormous number of transactions within a single trading day, opening positions only for a short time (up to a few seconds), fixing profits at the first minor changes in securities quotes - computerized trading algorithms, which nowadays provide more than 70% of stock exchange turnover .

The formal binding of High Frequency Trading (HFT, High Frequency Trading) to the collapse took place by mid-May. The 16 numbers The New York Times published a pretty, whether promotional or protective article (Speedy New Traders Make Waves Far From Wall Street) about how young people aged 20 to 40 sit across different cities and villages of America. years, dressed in T-shirts, jeans and baseball caps, and trade almost from their own bedrooms on the stock exchange, using sophisticated scientific algorithms. According to the New York Times journalist Julia Creswell, the tweeters, desperate at some point to analyze the scientific market, took and turned off their supercomputers. “At noon 6 in May, when the stock market began to plunge into a lightning collapse, someone (at Tradeworx) went to the computer and typed HF STOP on the keyboard: sell everything and disconnect. What followed is what made the entire financial world shudder. ”

The basis of HFT - the so-called flash orders, high-speed exchange orders, the meaning of which is as follows. For a specific bribe, exchanges provide “select” customers with the opportunity to see the bidders' applications arriving at the common terminal before anyone else. The gap is usually 30 milliseconds. For super powerful computers with which high-frequency traders are equipped, this time is more than enough to analyze the applications and place your own - proactive. Their effectiveness will directly depend on the applications that will go to the market in the next instant.

The culprit of the market collapse - HFT, then his little patted on the sidelines of Congress and the Senate, intimidating almost a legislative ban, and betrayed public oblivion.

Why betrayed is clear: the main figures of high-frequency trading in America are Goldman Sachs, Morgan Stanley and a dozen of the largest banks - they provide 70% HFT of daily exchange turnover.

Former senior Goldman Sachs executive Greg Smith.

Immediately after the “failure of the stock exchange” (this is the official name of the performance from 6 in May), the general public had an overwhelming desire to glance at the mysterious lucky people, for whom the collapse of the market turned into a golden rain.

Nanex experts show that similar cases, albeit on a smaller scale, have already occurred on the October 30 2009 of the year and January 28 of the 2010 of the year.

Knockout for 9 seconds!

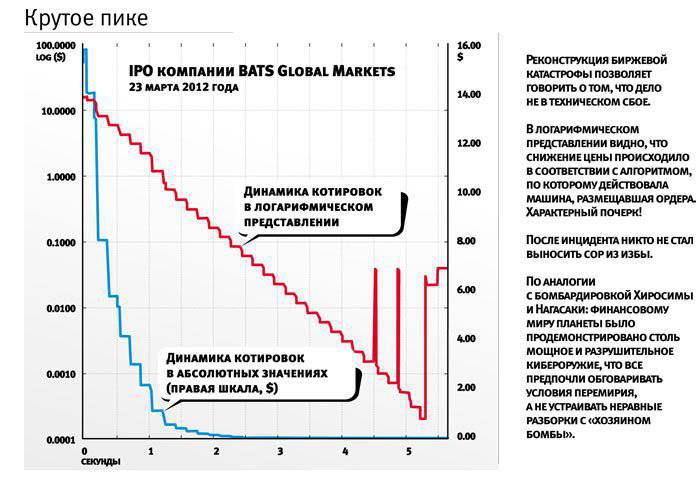

For almost two years no one remembered HFT, and the events of 6 in March of 2010 were preserved in collective memory as an annoying technical error or someone's mistake. And recently, 23 March 2012, an event occurred that clearly demonstrated: “technical error” quietly evolved into weapon such a destructive power that it seems to have been borrowed from the arsenals of the fantastic "Star Wars" of the future.

The event in question did not have impressive texture (lightning collapse of the market by a thousand points!), So only narrow professionals of exchange trading noticed it. And in vain the public paid him so little attention! By far-reaching consequences and potential, the 23 March incident of 2012 was an order of magnitude better than the HFT pranks two years ago.

This is a failed attempt by the American company BATS Global Markets to hold an IPO. Attempts to bring the shares to the stock exchange continued exactly ... 9 seconds, during which the company's securities literally depreciated to almost zero, trading on them was suspended, and after some time the company management confusedly declared its full refusal to go to the stock exchange in the foreseeable future .

The blame, like two years earlier, was officially laid on the “software failure”, but the accident of the SEC and all the structures involved in the drama was found to be a casual witness who not only recorded the incident down to a millisecond, but also analyzed each of the 567 stock transactions made in 9 seconds with securities BATS. From the analysis it appeared that there was no “software failure” at all, and the collapse of the IPO was the result of the work of a hidden malignant computer algorithm running from the terminals of an unidentified company that has direct access to the NASDAQ electronic exchange. The algorithm that purposefully carried out the clear task set for him: to destroy the IPO BATS!

The BATS IPO incident demonstrated that, in addition to passive “disconnecting”, HFT algorithms can still “turn on” and act at the right time and place in such a way that any security can be destroyed in seconds! But how many IPOs are being held in America every year by unknown companies? One more, one less ... The fact of the matter is that BATS is not at all an ordinary business in itself, but what is there to be modest about! - the third largest trading exchange in the USA! The main investors of BATS were Lehman Brothers, Getco, Wedbush, Lime and Deutsche Bank. The names are all sonorous - what are only the late Leman brothers worth! - however, and the combined sad stigma: losers! The absence of genuine favorites — companies that really determine global financial policy — is striking.

January 27 2006 of the year BATS opened for the realization of “high-speed, high-volume, anonymous algorithmic trading” and thanks to dumping commission in just a few months, 10% of the total American stock exchange volume (more than 50 million deals daily) took over! Trades on BATS moved more than 270 brokerage and dealer offices, not only from the US, but also from Europe and Asia.

In 2008, BATS Global Markets, which by then had already managed three sites (two for shares and one for options), made a net profit. At 2012, the commercial success of an alternative high-frequency trading platform ultimately predetermined the decision of the founding fathers to make the company public. The highlight of the BATS IPO was that the underwriters decided to send the company’s shares to a large navigation through its own trading platform! Not through the traditional NYSE and NASDAQ ...

When BATS shares were listed on the stock exchange, Citibank, Credit Suisse, Morgan Stanley and JPMorgan joined the main underwriters, but even in the extended list the list lacks at least one name, which in itself completely outweighs the rest: Goldman Sachs.

In light of what has been said, the 23 March events of 2012 look more improbable than the most unscientific fantasy. In the meantime, the fact remains: the placement of BATS papers began in 11 hours 14 minutes 18 seconds and ended in 11 hours 14 minutes 27 seconds. 9 seconds of trading - and a complete failure!

Nanex (the most casual witness!), The largest supplier of ultra-accurate stock information in the USA, helped to reconstruct the dramatic events. Nanex tracks, captures, and then sells the entire chronography of America’s stock market life to traders to the nearest hundredth and thousandths of a second. The analysts of the company, within days after the incident, conducted their own investigation, which showed that there was no “software failure”!

In the first transaction conducted at the site of BATS itself, the lion's share of the shares passed - 1 million 200 thousand shares. Further events developed as follows:

- in the first thousandths of a second, starting from the second, the quote rises to 15,75 - 800 shares are exchanged, which is already carried out on the NASDAQ;

- further in the range of a second, a chain of successive drops follows: $ 14 - $ 13 - $ 10,23 - $ 8,03 - $ 5,79 - $ 4,17 - $ 3,01. All transactions are conducted on NASDAQ;

- in the second second of life IPO BATS continued falling: $ 2,17 - $ 1,15 - $ 0,76 - $ 0,0002 (two hundredths of one cent!). A total of 444 trading was done on 100 dollars each, and all transactions were made on NASDAQ;

- pause for a second, then in 11 hours 14 minutes 21 a second passes the fixing transaction for 3 cent per share BATS;

-in 11 hours 14 minutes 27 seconds the price rises to 4 cents ,.

-in 11 hours 14 minutes 33 seconds the message “Halted” lights up on all the boards: the exchange breakers are turned on, which automatically stop trading on the stock if its quote changes above the allowed limit.

- BATS management announces the withdrawal of IPO from the auction.

After a startling embarrassment, CEO and president of the company, Joe Rutterman, made a public appeal to investors, in which he apologized for the catastrophe and fully blamed the software glitch (software glitch): “This is a terrible shame. We feel terrible. All responsibility lies with our company. We take responsibility. There were no external influences from the side. ”

The last phrase looks very piquant, because if a stranger Nanex easily found the killer orders from NASDAQ terminals, BATS engineers could do it even faster by analyzing the internal traffic for transactions with shares of their own company. And definitely discovered. However, BATS chose not to inflate the scandal.

Unprecedented situation

Weakening US public money is being supplanted by private financial instruments in the bulk of payment and settlement transactions. And, in our opinion, that level of speed and capacity of computer memory, as well as the capacity of communication channels, will not be reached soon enough for private settlement systems to ensure the collection of high-quality primary information on financial flows, transactions and other low places using them subjects.

The Fed was powerless in front of those who want to make money on the Internet, and therefore it simply cannot protect the dollar. If you will, the Fed is now in the situation of an old master of the early twentieth century, playing with a modern supergross-level chess program. To save face, the master can only hope to change the rules of the game ...

http://hotair.com/archives/2012/07/25/house-votes-to-audit-the-federal-reserve/

http://www.spiegel.de/international/world/west-wing-the-shrinking-influence-of-the-us-federal-reserve-a-562291.html

http://www.washingtonpost.com/wp-dyn/content/article/2010/11/17/AR2010111705316.html

http://offline.business-magazine.ru/2012/194/344703/ freedomworks.org/blog/jborowski/top-10-reasons-to-end-the-federal-reserve

http://www.infowars.com/the-audit-the-fed-bill-gets-passed-by-the-house-but-obama-and-the-democrats-are-going-to-kill-it/

http://habrahabr.ru/post/97515/

Information