How to raise a couple trillion out of thin air or the financial pyramid of the millennium

The legendary digital "gold" - bitcoin - from a toy of crypto-banks and anarchists, back in 2010, suitable only for buying pizza (at the then rate of a couple of pizzas - 10.000 BTC), by 2013 had become a standard means of payment for a variety of goods disapproved by the state on all kinds of darknets. sites. By 2019 - into an instrument of speculation and accumulation.

By now, it has become a full-fledged and respected investment vehicle in the world of Wall Street and expensive suits, and its turnover exceeds the revenues of Amazon and Apple. In a word, bitcoin has become a tool in which even states are not ashamed to invest.

This article is not aimed at a technical analysis of its protocols and a description of the cryptocurrency economy in general. Equally, the goal is not to study its merits and demerits - there is a huge amount of such materials on the network. It offers a controversial point of view on the sharp and unexplained colossal jump in its value over the past year.

Photo source: profinance.ru

As we can see from the charts, the starting point is the end of autumn - the beginning of winter of 2020, when bitcoin began to grow sharply and inexplicably in price. The downturn in January 2021 is quite understandable (more on that below), then bitcoin (like ether and a couple of other cryptocurrencies) breaks through all imaginable ceilings, capitalizing on stratospheric amounts of trillions of dollars.

This is a very interesting fact, which is equally interestingly superimposed on the coronavirus epidemic and panic that has swept the world. All traditional means of investing money for this year have considerably sagged (I think everyone remembers that even oil for a short time acquired a negative value, and companies were almost ready to pay for its export), but useless zeros and ones of hashes on disks jumped like this as even Apple did not grow in the golden days of Steve Jobs.

Additionally, interest is fueled by the fact that bitcoin is a 100% intangible asset. It is not backed by anything at all and in any way - this is its difference from any traditional currency, which is provided at least by the economic growth of the issuing state. This can be clearly seen in the example of Russia and the United States: depending on the growth of the economy, the currency of a country becomes harder and more expensive - and this is logical.

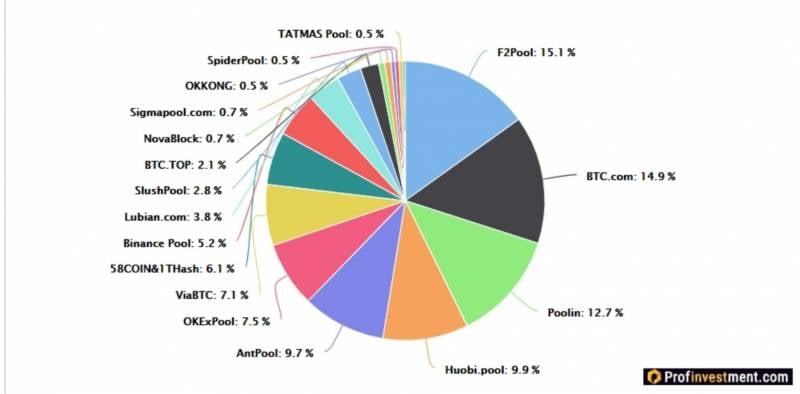

Bitcoin, on the other hand, does not have an issuer as such (we will keep silent for now that more than half of the mining capacities are concentrated in China, this is a topic for a separate article) - and no one is responsible for it.

Basically, Bitcoin is backed by only one factor - the fact that it is being bought. And they buy it because it grows - and it grows because they buy it.

We've already seen this somewhere, haven't we? ..

But to pull oneself out of the swamp in the style of Baron Munchausen like this, an initial impetus was needed - the market had to spin up the scheme so that it could generate the money supply on its own.

So how did Bitcoin get such a huge boost in the worst investment year since the Great Depression? How from a "dark horse" for illegal money transactions, it became a legalized means of payment, under which they want to put ATMs in New York?

For a possible answer to this question, we need to turn to US monetary policy.

If you do not delve into the topic, the dominant economic ideology of the West since the early 1980s is the so-called "Chicago school", the most prominent thinker of which is considered to be the notorious Milton Friedman. It is the ideology of the Chicago school that underlies the practical strategy of overcoming the economic crises of the US Federal Reserve System.

What is its essence?

In short: any economic crisis arises from a growing imbalance between goods and money. It develops either into deflation (a textbook example is the crisis of overproduction and a massive drop in prices during the Great Depression), or into inflation (and that can develop into hyperinflation, a typical example is Weimar Germany, but the inhabitants of Russia will also remember the more familiar and close 90s ). There is also a third option - a monstrous mutant of stagflation (also familiar to us firsthand), combining an economic recession and a depressive state of the economy (stagnation and rising unemployment) with rising prices - inflation, but in general it can also be described in terms of an imbalance in production and money supply in handling.

A huge number of methods of dealing with such situations have been invented - from the socialism of President Roosevelt's "New Deal" to the release of prices and Gaidar's "shock therapy". However, not all of them ended with at least partial success ...

The Chicago school (again omitting numerous details) briefly offers this option: we see a crisis caused by a lack of finance - we pour more money into the economy, and everything is getting better thanks to the "invisible hand of the market" - you just need to push it a little. How does it look in practice?

For example, if such a method was used during the beginning of the Great Depression (the Fed was organized shortly before that in 1911 - it was later recalled for a long time that she had failed her first aptitude test in dealing with crises), then as soon as the people ran banks to cash out their stocks, bonds and all kinds of securities (in banks, of course, there was not enough money - this caused panic growing like a snowball, and the market collapsed completely, like a house of cards), the Fed had to immediately pour megatons of liquidity into the banks ( there are different ways for this, more on that below).

Then the banks would have resisted - and the market followed them.

We will not touch on the question of the rationality of such a strategy here (it is presented in a very simplified manner, and many generations of economists have broken so many copies here that it will be enough to ensure chivalry for the entire Hundred Years War) - we will only touch on how this can be done.

If we just turn on the printing press, then we will follow the path of Germany, Zimbabwe and Russia in the early 90s, when the currency, instead of injecting new forces into the economy, simply adds ballast to it. It just depreciates faster than it gets printed.

The Chicago school did not think so primitively - instead of the vulgar printing of money, they did much more subtle.

The process was launched - the affected banks began to receive loans, which poured liquidity into them through the sale of government bonds.

It is worth saying that this method can work brilliantly only in a situation where the state itself is world-famous as reliable and secured, paying on debts with interest (albeit tiny) and stable during crises. With Russia, this, alas, will not work - it publicly declared a default in 1998 and refused to pay all the bills - accordingly, we no longer have faith here.

But in the United States, this focus has been successfully working for a hundred years.

As a result, the Fed approached 2008 fully armed: it saved almost all precious banks and hedge funds that tried to play with the objective laws of supply and demand (using a massive mortgage pyramid) and lost to them to smithereens.

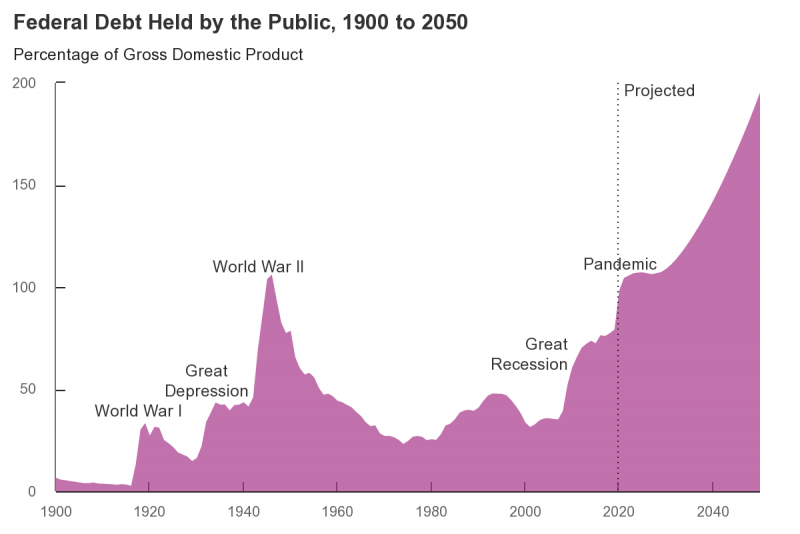

After that, the US economy was poisoned by millions of various derivatives, not backed by anything but word of honor, faith and hope of top managers for billions of dollars. However, the second Great Depression was averted. How? By stamping several trillion dollar public debt bonds (on the chart this is the point of the Great Recession in 2008) and, accordingly, injecting liquidity into the economy.

Then everything is simple - the bonds were thrown into the international market (in fairness, the United States has indeed been gradually paying interest on these bonds for a century now, so they are considered super reliable and are being actively bought) and, in general, the plan worked. The United States ran into even greater debts to the whole world, but saved its economy.

And then 2020 came. It turned out to be even more crisis - and again for man-made reasons, and mostly of a political nature.

The meaning of life of any politician in any country, which determines his modus operandi, is to be elected again and again.

For the United States, this is especially important - any elections they have, due to the peculiarities of the system, turn into real battles. A particularly luxurious titanomachy happened before our eyes just a few months ago: the unpopular populist Trump lost to the popular populist Biden - and this happened largely because of COVID-19.

Faced with a pandemic of the next version of SARS, several strategies could be chosen. It was possible to save the economy, like Sweden and Belarus, by abandoning quarantine measures. The economy could have been sacrificed in favor of populism.

At first, Trump tried to push through the first path, but the United States is not Scandinavia (where the people are generally apolitical and calm, and extremely trust the government) and not Belarus (where you can't mess with the president). In the United States, it is impossible to stay in power by swimming against the tide and pushing a point of view that is not held by the majority. As a result, in many ways, it was Trump's attempts to sit on two chairs - to save the economy and his chair, cost him both the loss of his chair and the failure in the economy.

Biden, on the other hand, gained popularity due to the fact that he immediately promised not socialist, but communist payments to all those affected by the epidemic - and mainly to the most marginalized segments of the population.

And then the main question arose - where to get the money?

Stamping dollars is not an option (hello 1920s Germany!). Stamping bonds like 2008? It will not work - bonds can only be sold during a growth period, and the economy of the whole world collapsed in 2020, and did not show any progress.

But the United States urgently needed trillions of liquid dollars, and then bitcoin enters the scene - finally we got to the main hero of the occasion ...

In 2016-2019, Bitcoin was still looked at very suspiciously: they were paid for drugs and weapon, speculated, sanctioned Iran, some muddy people from China and North Korea withdrew money in bitcoin ... In a word, it was quite problematic to trade it legally.

But a holy place is never empty: in the wake of cryptocurrency problems, the Bitfinex exchange platform (which at first denied everything, but you can't hide an sewn in a sack - this history unearthed in an array of materials related to the activities of companies registered in exotic offshore zones, published in early November 2017 following an investigation organized by the Suddeutsche Zeitung newspaper) quickly organized Tether Limited in 2015.

It was registered, of course, offshore.

The company stamped a bunch of its own USDT (US Dollar Tether) tokens, each of which, by a willful decision of Tether, was equated in value to the dollar. Naturally, the company claimed that the tokens were secured and liquid, but there was no confirmation of this.

Affiliated with it, Bitfinex immediately began trading cryptocurrency for the above-mentioned tethers, taking all the difficulties of withdrawing bitcoin upon itself (tether was not a cryptocurrency, but a token of an officially registered company - it could be bought 100% legally and without any problems).

This is associated with the first jump in the value of bitcoin in 2017-2018: the cryptocurrency first became mass, it began to be actively traded, demand went up, and the price also went up. For this business, more and more teters were minted - and other exchanges, seeing the monstrous benefits of the process, poured into the game.

As a result, by 2019, 80% of cryptocurrencies were backed, but not by the dollar, but by an incomprehensible little thing in the form of the Tether token (which, of course, is equal to the dollar and is provided by the word of honor of the Caribbean offshore!).

By 2020, the pyramid scheme has reached its highest point: the voices of common sense began to be heard louder and louder. Serious crypto investors began to withdraw from bitcoin (despite the continuous hype and growth of the exchange rate), because they understood that no Tether Limited would have enough reserves to cover at least 10% of the current cryptocurrency capitalization in teters.

It was clear that everything was based on parole and could collapse at any moment. Note that in the summer of 2020, the United States covered Gram - the tokens of the famous Pavel Durov, because of which he got into debt for a couple of billion dollars and was even forced to make peace with Russia. So the situation with cryptocurrencies and tokens of private companies was very, very tense in autumn 2020 ...

As a result (this is where our little conspiracy thesis begins) the two loneliness found each other.

On the one hand, there was bitcoin with a capitalization of half a trillion dollars - monstrously overheated, unsecured, but not yet collapsed and in dire need of moral support from serious people who would guarantee it liquidity. And the Biden government, badly in need of an injection of a trillion or two (in any form!) Into a half-dead economy, in order to finally announce the long-awaited economic growth to the whole world.

And then close the year with a profit, in the best traditions of Friedman, issuing bonds for this business (and paying the promised money to his African American electorate, becoming famous as the saviors of America) ...

The culmination of the Bitcoin adventure was a US investigation that uncovered a monstrous financial pyramid around tethers.

- M. Petkov. “Is Tether a dummy? History and results of the investigation ”.

As a result, the New York prosecutor's office, thanks to its conscientiousness (and the fact that they started it back in 2018, when no one thought that bitcoin would be useful), almost broke the financial scheme of the century for respected people.

This is the reason for the strange dip in the value of bitcoin in January 2021, when the results of the investigation were made public, which, in censorship terms, can be formulated as follows: Tether is not provided with anything, and Tether Limited is a pyramid.

But respected people quickly came to their senses, and now the verdict has already been announced - the Caribbean Mavrodi receive a monstrous fine in the form of ... $ 18,5 million and are required to provide quarterly reports on the degree of provision of tokens with US dollars over the past two years.

A report to them was instantly made by a neighboring firm from the Cayman Islands - respected offshore auditors Moore Cayman (which no one had ever heard of before). It said - we have all the money, we can give it our word of honor, we saw it ourselves. The failed bitcoin rate gets accelerated enough to go beyond the atmosphere, and its capitalization begins to grow.

And then the cherry on the cake - Elon Musk and Tesla begin to invest in cryptocurrencies with terrible force! And not only Musk - all the top companies, hedge funds and banks suddenly wake up and start pouring liquidity into bitcoin by tankers. Musk and company are not muddy Tether, since they take a couple of billions, it means that it is good business. Investors are catching up, and, finally, the coveted summit is taken.

Now, the total value of the mined bitcoins can be used to redeem "Apple" - and there will still be a piece of "Google" left.

Everyone wins: bitcoin gets the longed-for liquidity with the guarantee of respected people, respected people recursively receive a guarantee of economic growth through investments in a product that is growing by leaps and bounds. The economy is growing, bonds are being printed, the population is receiving payments, the throne is not shaken - everyone is happy.

The only problem is that this growth is still fictitious, and still lags behind the growth of commodity production. And we are beginning to see the fruits of the so-called latent inflation - an increase in prices for microelectronics by 2-3 times (including even the cheapest Chinese penny chips based on antediluvian technical processes), a shortage of high-tech components (and no, it is due to the fact that “miners bought all the cards ! ”- only partially) and even a wild rise in US cheese futures!

Given the unprecedented volume of money supply over the past year, we should expect wild commodity inflation that is not reflected in official statistics - but this, however, is a topic for a separate article.

Information