Ruble or dollar: which currency will collapse first?

Someone does not like a strong ruble ...

Such a low dollar rate, as it is now in Russia, has not been for five years. Financial stability based on tight monetary policy, along with those who do not want to fall in oil prices, support our national currency. At the same time, unprecedented sanctions pressure does not stop at her. It seems that the ruble is held largely due to the fact that even in the fall of 2014, it was lowered so much that it turned out to be just nowhere else.

However, the full potential of such pressure seems to be exhausted. Not even the strongest Russian banks have learned to somehow manage without foreign borrowing. Those who have not learned, or have lost the license of the Central Bank, or are under rehabilitation. It turns out that now it is possible to crush the ruble from abroad only by refusing to buy Russian securities. The West is seriously unable to do anything else.

As a result, America, along with Europe, seems to be trying to follow the path of all sorts of prohibitions and restrictions, but it is not so easy to prohibit buying what brings high and, besides, guaranteed profits. Nevertheless, to say that we do not care at all, is not necessary. Yes, from the high tribunes, we continue to be assured that the Russian economy has managed to adapt to the sanctions, but it still very acutely feels the negative consequences of the contraction of the financial and banking system.

According to estimates by Bloomberg experts, this takes away from our GDP about 0,4-0,6 percent. But still, there are far greater losses in the officially monitored volumes of production and services due to the fact that the shadow and gray sectors of the economy are again growing, as well as the degree of its offshoring. In addition, the position of the ruble, which is already beginning to seem to many to be too entrenched, may well be undermined from the inside.

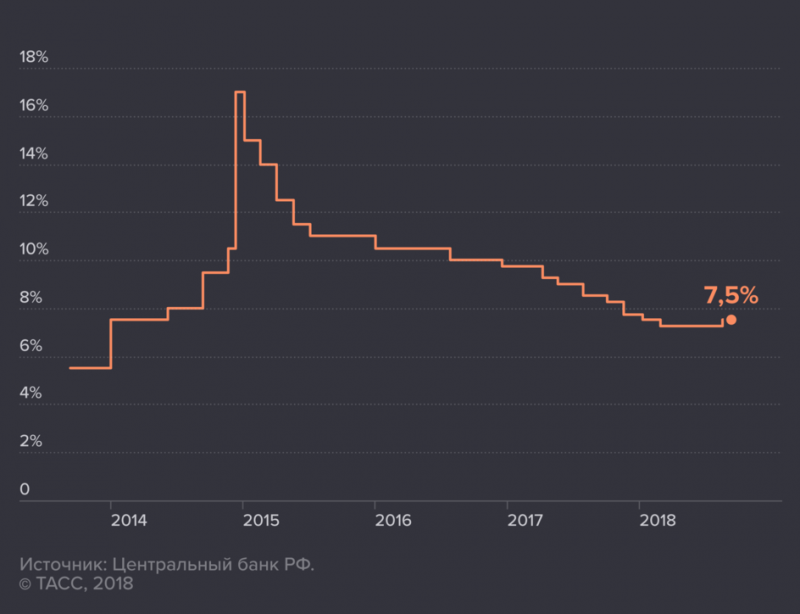

Not long ago, the Bank of Russia announced that it was preparing the most significant reduction in the key rate in recent years. And whatever the officials and experts may say about the fact that the key rate has long defined little in real finance, this will inevitably lead to a sharp reduction in the cost of credit resources in the country. The banking sector may be sad about it all, the OFZ's profitability and attractiveness, of course, will fall, but the real sector of the economy and ordinary citizens will certainly get easier from reducing the cost of credit.

However, with the rate in the Central Bank will be dealt with a little later, but now many are anxiously waiting for the meeting on the monetary policy of the Central Bank of the Russian Federation, which is scheduled for Friday 26 July. A number of experts do not exclude that its results will become a kind of signal that the ruble will turn in the direction of depreciation of the exchange rate. But those who are very actively investing in ruble assets today may be disappointed.

Another serious risk for the Russian currency may be a measure that is often called a technical measure in our financial institutions. It's about the notorious "fiscal rule", which cuts off excess oil and gas revenues. And although in July 26, the cut-off bar is unlikely to be raised, if the Central Bank only hints that this is possible, the ruble can immediately lose not the shares, but whole interest on the exchange rate.

At the same time, active purchases of currency by the Bank of Russia continue to restrain the pace of strengthening against the dollar gained by the ruble. Up to the exchange rate mark in 60 rubles. Further strengthen the ruble is unlikely to succeed. The main thing is that the Central Bank still has a free hand to buy currency for the Ministry of Finance. The Central Bank of the Russian Federation in general is now in fact found itself in a somewhat strange situation, when it is with its own hands that it must refute its own decision to relax foreign exchange controls.

In the opinion of opposition-minded analysts, such a decision would seem to completely deprive the Russian budget of dollar revenues. But inside the country, the ruble will continue to be in demand, otherwise it will be difficult for the same exporters to get the most expensive ruble per dollar.

And yet, there are those who predict our currency by the end of the year to fall to the level of 69 rubles for a dollar. And if someone else had appointed this course to the ruble, and not the best forecaster of the Bloomberg version, Bank Polski’s currency strategist Yaroslav Kosaty, one would not have to worry. But if earlier Kosaty accurately predicted the growth of the ruble exchange rate in the second quarter of 2019, now he has become a pessimist about the prospects for the Russian currency.

Interestingly, the Polish expert connects his poor prognosis with the prospect of a strong reduction in the rate of the Central Bank. Now the high rate of the Central Bank of the Russian Federation (7,50% per annum) supports the interest of foreign investors in Russian securities, and if it is lowered, we should expect an outflow of foreign investments in Russian federal loan bonds (OFZ).

- declared Bloomberg Kosaty.

In June 2019, the volume of investments by foreign investors in Russian bonds reached, according to the data of the Central Bank, 30%. If, under the pressure of new US sanctions, investors begin to massively dump our OFZs, the situation may be such that they simply cannot find buyers. With such a local default, only a concerted purchase of securities at a cheap price from the largest Russian banks, which in such a case are forced to violate all high standards of the Central Bank of the Russian Federation, can save them.

... and someone - a strong dollar!

Generally, while among analysts, those who are optimistic about the ruble remain in the majority. Albeit with a small margin. But with respect to the dollar, the majority are quite pessimistic. Cold reconciliation with China again pushes the US foreign trade to a standstill - it is again unable to cover the negative balance, and the US Federal Reserve simply has no other option than to play against the dollar.

It cannot be ruled out that in the very majority of pessimists there are many who complain about the poor prospects of the American currency quite consciously. And not even free. However, starting the week may not be easy at all, not only for the ruble, but also for the dollar.

Already on Wednesday 24 July, the first data will become known which way the trade balance in the USA is changing. Published figures can be another point for plotting, which will show how much the dollar’s excess appreciation depends on the real prospects for winning Trump’s trade wars.

On Friday there will be preliminary data on US GDP for the second quarter, which will certainly be perceived in the same way. But the most expected information at the end of July is the data of the semi-annual financial statements of the largest corporations, most of which are transnational. They are in the trade wars started by Trump, very calmly located on both sides of the front.

Leaders of the IT-industry and related industries feel particularly comfortable in this regard. Remember the situation with Huawei, seemingly uniquely Chinese. But she was so tied to all the other IT-corporations that, having hit her, the Trump administration fell into the position of the very non-commissioned officer widow who had whipped herself.

Transnational giants successfully operate with all possible currencies with minimal restrictions, and the fact that, by all indications, the dependence of the dollar on other currencies will only increase, they generally care little. Even cryptocurrency, they have long been turned into network surrogates of the same dollar, which can be judged at least by the offers of buying Bitcoin and others like it on the Internet. The minimum margin, the rate, invariably expressed in dollars, the lowest commission, and virtually no bureaucracy. Looking for some more proof?

Nevertheless, the signal to ensure that the exchange correction of the "green" resumed, more precisely, continued, it seems, will be about to be filed. But this will happen only with very bad corporate reporting indicators. With all the other scenarios, and the most likely is now considered moderately negative, nothing will change drastically. And this dollar rollback someone will have to wait again. Perhaps even a very long time.

But in principle, the Trump administration, together with the Fed, seems to be trying to get the dollar to roll back at least once. No wonder that the head of the Federal Reserve, Jerome Powell, with enviable regularity, makes quite “transparent hints” that the US currency is very hot. However, the dollar in any scenario, it seems, will not be able to greatly decrease. Start with the fact that all the threats of Europeans and OPEC to abandon payments for oil and gas in dollars remain threats. And it's not even that you can run into sanctions.

The benefits are too dubious, and claims for some kind of independence are clearly not justified. Well, the costs that may be required to translate such an idea into life can hardly be compared with a ghostly profit, which, moreover, will not be direct, but indirect. It is clear that the numerous buyers of the American weapons, Latin American satellites, and of course, the drug mafia. And most importantly, the first who will be behind the scenes, but purposefully working to ensure that the dollar does not fall, will be China.

The CCP, at its plenary meetings and conferences, will continue to brand the imperialists and replicate the reports of the victory in the trade war with “the wretched Trump and his clique.” Meanwhile, the People’s Bank of China will quietly buy exactly as many dollars as is needed to maintain an acceptable balance in foreign trade and in the budget. And in which case it will be possible to conclude a couple of dozen long-term agreements with OPEC countries and Russia for future deliveries of oil and gas. Of course, not in yuan and rubles, but in dollars. And this, of course, will again support the Russian ruble.

Information