The clash of economies. The power of money. Money and power

Great Britain in the 19th century, the empire, over which the sun did not set, reached the pinnacle of its power, and then slowly and irrevocably began to lose it. The process is as objective as it is inevitable. Which was the main cause of the outbreak of the First World War, designed to tame rapidly developing Germany, capable of extrapolating the time, uniting Europe under its leadership, to challenge the power of the British Empire. The latter, traditionally playing on the contradictions of the continental states, had no such impudence (that is, even the likelihood of Germany’s possible withdrawal to a position with which she could challenge). Well, pick up, or, in extreme cases, adjust, casus belli for Anglo-Saxon geopolitics has never been difficult.

And if for London, the First World War was in favor of maintaining its leading position, then for the USA and Germany it was a war of succession to the British Empire (however, in a certain way, like the Second), the fall of which was predetermined. But after the end of the war, the United States, having actually intercepted the role of world leader, formally remained in a catching position. British well-being, like the main European countries, was actually supported by loans from the United States, which became the largest holder of monetary gold after the war, possessing about 40% of world reserves. Also, the strategic alliance of the elite of the Anglo-Saxon states, both financially and politically-military, also played a huge role in the existence of the empire.

The essence of it was that England could hold its gold reserves not in gold, but in dollars, secured by gold, located in the United States, and the rest of the European countries were able to keep their reserves in pounds sterling, secured by dollars, which were secured by gold, based in the USA. This meant that, apart from the United States, no one remained on the direct gold standard, and the United Kingdom acted as a world banker only at the expense of supporting the dollar.

The ongoing policy of winners (first of all, of London and Washington), the format of which later became known as neo-colonial, in relation to the Weimar Republic not only brought the latter to doom, but also made it hopelessly dependent. The Dawes Plan, according to which Germany was to pay reparations in the future, was the prototype of the neoliberal policy of the second half of the 20th century, and its forms were exactly reproduced with the policy of economic seizure by the International Monetary Fund of Third World markets. The bottom line was that in order to help Germany in its reparation payments, she was given loans from those Western countries, to which they returned. By the end of the twenties, the Weimar Republic was supposed to owe more than before the start of the plan, despite the fact that all this time it had been paying its debts consistently. And this wobbly construction was doomed to failure.

The fact that this whole financial pyramid is over is well known. The global financial crisis. Which was the result of such risky lending to the US war-torn European economies. Risky in terms of guarantees timely payment of arrears. Increasing lending at the expense of low interest rates in the “roaring 20s” created the appearance of an increase in well-being, in fact, only inflating consumer debt and financial manipulations with stocks on the stock exchanges.

In those days, only France was skeptical of the gold exchange standard created by New York and London. And she was particularly annoyed by the fact that only the pound sterling and the dollar actually turned out to be top-notch currencies, while the franc stood aside. Such an incredulous approach strengthened the national monetary policy, which was based on the desire to strengthen the franc by returning the gold reserves stored in the British currency. Which, as the French were convinced, could depreciate at any moment.

And when in 1927, Paris demanded that London return gold worth about 30 million pounds, the UK was forced to ask the Fed to lower the interest rate even more, which would have been a stimulus for the British currency. But also a lowering of the rate was reflected in an even greater growth of the financial bubble, so already greatly inflated. And as soon as the Federal Reserve raised its stakes in the hope of limiting its further inflation, the entire world financial system began to crumble, crashing down on the head of the real sector of production.

Quite a lot is known about what started after the market crash, but also much remains hidden, like the underwater part of an iceberg, from the public eye. For example, the fact that the number of victims among US residents during the period of economic depression exceeded the number of victims of the Holodomor in the USSR. As well as the number of the dispossessed, it turned out to be comparable to those affected by the "defarming" of the US residents engaged in agriculture.

Anyway, all this only reveals the global processes inherent in that period. But pulling out certain events from the context and presenting them, only as the cruelty of the tyrant Stalin, who is hungry for blood, is at least an intentional propaganda insinuation.

Out of the global depression came out with the help of world war. This, of course, does not mean that the purpose of the war was in this. This only means that with the maturing of World War II and the growing contradictions in Europe, mobilization preparation for war, including production, it was possible to get out of the abyss of the Great Depression. By and large, it is thanks to the intensification of defense orders and the work of the military-industrial complex. What the representatives of the US economic elite are already recalling, such as the Nobel Prize winner in economics, columnist of The New York Times, Paul Krugman, who is not referring to this option to get out of the global financial crisis raging the past few years.

Realizing the inevitability of world war, the clash of communism and Nazism, as ideologies, or socialism and capitalism, as economic systems, respectively, the Soviet leadership prepared for it thoroughly, increasing the size of gold reserves to 2800 tons, unsurpassed either before or after magnitude. Due to which the Great Patriotic War was conducted in many respects, and also the half-ruined country was restored.

By the end of World War II, Great Britain had finally lost its influence, and in the capitalist part of the world the United States of America became the only leader. Fort Knox, the banks on Wall Street and other vaults in the United States have already settled around 80% of all the world's gold reserves. This provided tremendous benefits that it was impossible not to use. As a result, the Bretton Woods agreement established the hegemonic role of the dollar in the trade and financial sphere of most of the world. Which already by the beginning of the Cold War was used as one of the methods of conducting contactless confrontation. For example, by squeezing and banning the communist parties from the parliaments of Western European countries under the terms of the assistance of the Marshall Plan.

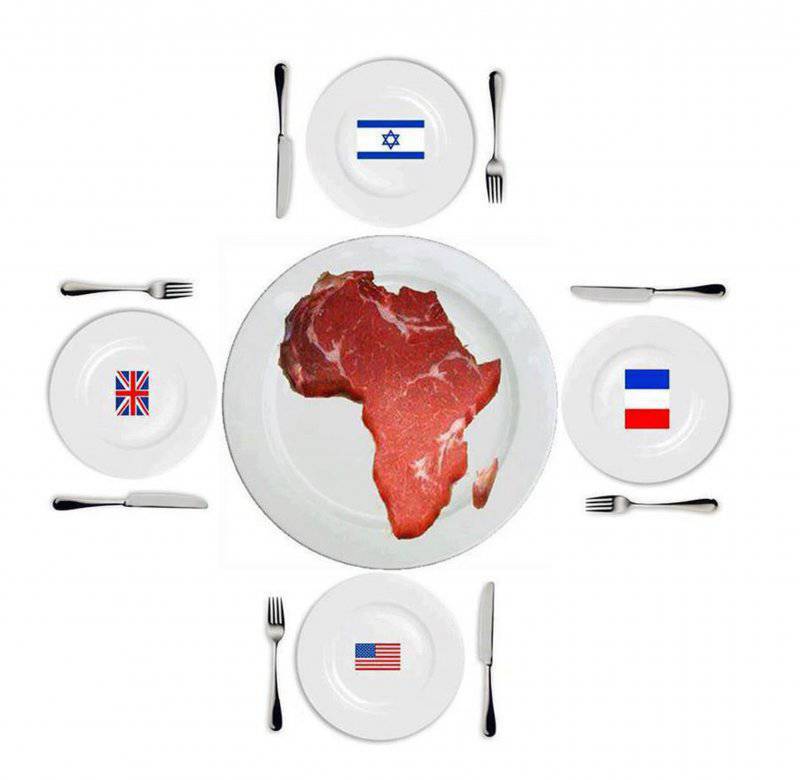

The end of the Second World War marked a massive change in the current world order. The era of classical colonialism was completed as a result of this great war, but was replaced by an already more elegant economic neo-colonialism, which left unnoticed the gross subordination of the Third World to capitalist imperialism. Geopolitics, in fact, has been supplanted by geoeconomics. What was expressed in the transition from the concept, concentrated in the expression of Halford Mackinder:

Who owns Eastern Europe, he controls the "Heart of the World"; who owns the "Heart of the World" controls the "World Island"; who owns the "World Island" rules the world

to a concept centered on the expression of Henry Kissinger, the only person who held the post of Secretary of State and National Security Advisor to the US President:

If you control oil, you control whole countries; if you control food, you control people. If you control money, you control the whole world.

.

That is, shifting priorities from capturing and controlling living space (what the Nazis called lebensraum) by military-political methods to capturing markets where oppression and exploitation took place at a lower level of public relations, allowing the use of rhetoric about democracy and the invisible hand of the market. At the same time pursuing an anti-human policy and slipping into the abyss of liberal fascism.

But with the gradual restoration of Europe, the United States began to lose its former unshakable "golden" economic power. With a steady increase in lending, the amount of dollars substantially exceeded the level of the end of the war. Despite the fact that gold prices remained the same, set at the peak of the Great Depression 1933 of the year. Many European countries had a negative attitude towards this state of affairs, and, as it had already happened before, France initiated the return of its gold reserves from the US repositories. Having demanded the exchange of accumulated dollars at a fixed rate set at Bretton Wood, the Fifth Republic actually sent Washington a knockdown. But before the knockout was still far away. Forced to make an exchange, they received a pile of paper, which they themselves could at any time use for printing, waving a pen to the gold going to the other side of the Atlantic. By the way, de Gaulle was forced to withdraw France from the North Atlantic Alliance under pressure from the United States, dissatisfied with such unprecedented rudeness: the state demanded what it had every right to do. Democracy, constructed on the basis of the Washington Consensus, worked differently.

And in order not to completely lose "everything that it has accumulated with difficulty," the United States simply refused to convert dollars into gold. Having devalued the dollar and switching to floating exchange rates after the Jamaican international conference at the beginning of 70x, the demand for green currency would inevitably decrease. But by linking the dollar to world oil sales of OPEC, the United States provided the unlimited need of industrialized countries in dollars.

With the arrival of Margaret Thatcher as prime minister of Great Britain and the victory in the US presidential election of Ronald Reagan, a new stage in the development of the economic spread of influence and at the same time de-industrialization of the "first world" countries began. With the increase in interest rates from 1980 to 1982, any long-term contributions to industrial facilities became meaningless, especially when taking into account crisis 70x, which led to a gradual degradation of production in the once industrially advanced countries and the export of all technical and production facilities outside the Western world, - most often to Southeast Asia. Later, the concept of neoliberalism, designed by Milton Friedman, entered the arena of economic expansion.

The essence of which, like the whole of capitalist development, is the constant expansion of accessible markets, for which international organizations such as the WTO (GATT), the IMF and the World Bank are used. The struggle between the two economic systems, capitalism and socialism, which ended with the collapse of the USSR, was the last opportunity for the Western world to accomplish what was necessary for the continued development of capitalism and the growth of economic indicators. Grab those markets that were behind the Iron Curtain during the Cold War.

All this was accompanied by a constant smooth decrease in interest rates, which stimulated demand through cheap loans. The global economy has completely shifted to the credit rails, laid across the thin ice of trust, holding back the enormous risks on which it was built. And all this was only one side of the coin.

The second part of the financial game was the constant swelling of markets, securities markets, stock trading, etc. That is, the constant self-growth of the cost of capital, the boundaries of which, as Marx said, does not exist, because of its abstract essence. And what Warren Buffett repeated already in relation to its modern manifestation:

The limits in which derivatives can be varied are limited only by the imagination of the person - or, as it sometimes seems, mad people.

This increase is quite simple. Banks after issuing a loan and receiving papers confirming it, put them in a pile. It guarantees a refund in the future or the right to collect property (that is, the theoretical repayment of debt). But since the bank cannot sit and wait for years to repay loans, it must put its assets into circulation. And then these piles of mortgages were combined, packaged in one financial document, evaluated and put up for sale. In other words, the bank sold those who wished to buy them, income from future returns of debts of its clients. But moreover, all this could be repeated again and again, each time increasing the price of such a pool of securities. No one bothered to check the possibility of returning each individual mortgage paper, and they themselves so spread throughout the market that it became almost impossible to do so. How to figure out who actually owns the primary financial document, because it could simultaneously enter into a number of syndicated pools of securities. This was supplemented by reciprocal exchange default swaps (CDS) to protect each other from the non-payment crisis and a high proportion of leverage, that is, the ratio of borrowed funds to its own, in the course of trading in derivative financial documents. All this together created the much-desired illusion of growth in the trade balance (which seemed to be forever), the redistribution of risks of non-payment, the ability to get rid of illiquid securities by combining them and assigning high ratings to a derivative financial document.

All this was possible only thanks to the abolition of the Glass-Stigoll Act, adopted under Roosevelt, at the peak of the Great Depression, which was a reaction to the growth of financial speculation in the preceding period of the roaring twenties, which provoked the biggest crisis of the 20th century. And only after it was completely abolished by the Gramma-Lich-Bliley Law in 1999, did all this money orgy get a second life. Selling risks, banks already became absolutely indifferent whether the debt would be repaid. Their main goal was to lend as many loans as possible, regardless of the solvency of the person to whom they provided loans. Even knowing that the client will not be able to repay the debt, the bank was interested in imposing a loan on him.

Such a financial funnel was dragging into the credit trap more and more people who really did not understand how it all worked. In most cases, customers simply pecked at the interest rate-bait, which was exhibited specifically for this, but after a planned increase in which, payments became increasingly unaffordable for them. The bank was even prepared to go for negative depreciation, that is, the growth of debt (due to the small portion of loan payments) was higher than the market value of the goods purchased for debt, which accompanied the loan agreement at the first time of reimbursement at the initial rate.

And a possible dawn of the work of "organized financial groups" became possible only thanks to the abolition of the already mentioned Glass-Stigoll law, which, among other things, prohibited at the same time traditional banking and investment activities. Immediately after its annulment, the merging of the types of activities divided until then, mergers and acquisitions, syndicization and monopolization of various financial spheres began. Due to this, a deliberately flawed system was designed in which all players played along with each other. The banks that sell securities, consulting firms recommending their purchase, insurers who hedge these assets, and rating agencies that evaluate them, all belong to the same team, which allowed them to gain points without any adversary. The only thing they did not take into account was that they had an opponent. And it was a risk, the tangle of which, instead of carefully unwinding it, as they wanted it, turned out to be completely confusing.

Once in 2007, due to an increase in interest rates on payments, a mortgage non-payment crisis broke out, the whole pyramid scheme began to shake feverishly. It became clear that who, what and to whom should - it is not clear. Insurers began to burn, columns of trust pour in, and bank accounts deflate. The bubble burst. The music stopped playing, and there were not enough chairs for everyone. After the bankruptcy of Lehman Brothers, one of the strongest players in the credit default swap market, in September 2008, the entire global economy was shaken. From the mortgage securitization crisis, it developed into a global financial crisis, where no bank trusted its yesterday’s partners anymore.

This state of affairs turned out to be rather pitiable for everyone. And former opponents of state intervention in the economy were forced to ask him about this intervention. By launching a quantitative easing program in September 2008, the Federal Reserve for the month of 3 increased the balance (read, printed paper) more than all its previous existence (since 1913 of the year). Starting to repurchase securities, the Fed, we can say, saved the banks already approaching bankruptcy. The same thing is happening now, under the auspices of the third round of the quantitative easing program "QE 3", only by a more sophisticated scheme.

The collective fear of total economic chaos still forces today's players to enjoy the system created on the hegemony of the dollar. But at the same time, each of them now understands that she is doomed, and is trying to find a way to avoid, or at least minimize, her losses. The contradictions of such a buffer regime are constantly growing, as everyone is trying to use the available time to organize their own "airbag" in case of a dollar fall.

For many, it suddenly became obvious that currency reserves held by central banks may cost a little more tomorrow than the paper on which they are printed. The only thing that can save is real assets and ... gold. The hunt for which is already open. And in view of the developing economic crisis, the end of which is not yet visible, the buildup of gold reserves is becoming a matter of national importance. The dollar monopoly of the reserve currency will gradually (and perhaps not really) come to naught, which only stimulates the governments of countries holding their financial reserves in the tickets of the US Federal Reserve System to refuse them and look for guarantees in more reliable means of savings. And as for the uncertainty of the future financial system, gold is the best guarantor, as always. That extrapolation can lead to the birth of a new gold standard. And then the winners will be the one who will have it.

And in connection with the rush of the yellow devil that arose in the market, its price in accordance with the primary laws of supply and demand has crept upwards. Everyone wants to have time to get a really worthwhile product. And since the level of trust has fallen due to the crisis, no one else is sure that he has, if he does not own it directly.

In this regard, Germany, the second country in terms of gold reserves, saving its reserves in foreign vaults (since it became dependent on the countries of the victors of the Second World War), decided to reclaim its gold. Germany conceived a full repatriation of stocks from Paris (after the announcement of which France launched an operation in Mali), but at the same time did not dare to swing as widely into ingots stored in the US, trying to stammer about returning only a small part. Moreover, it turned out that the gold that had been saved at the Fed had never been inspected, which caused a negative public reaction. And even the small share that the Bundesbank decided to return, the United States was not able to provide, stating the need to stretch this one for seven years.

And this is not counting the fact that over the past twenty years about 930 tons of gold have been transported to Germany from England. Especially if you pay attention to the fact that this process took place in complete silence. That at the time of publicity also caused quite a lot of conspiracy theories.

And this is only Germany. But the same desire to acquire gold swept all. Russia, overtaking China, has become the largest buyer of gold in the last ten years. At the same time, Beijing, like Moscow, is constantly increasing purchases, as well as production. To date, the share of gold reserves of the Russian Federation is about 10%, which is very small compared to the ratios of gold to gold reserves of other developed countries, in which it is about 70%. But in China, the situation is even more critical. With foreign exchange reserves of three trillion, the share of gold is only 2%. The global players are clearly not interested in losing all their savings at one moment in the event of a dollar crash, but they are definitely interested in reducing its role and moving to a multipolar economic order.

But today, buying and selling gold is a rather specific process. Just as with credit swaps, no one can be sure that he bought. Since the purchase receives only a wrapper for a certain amount, the guarantee of receipt of which is as dubious as the above-described credit insurance. The above-mentioned attempt by the Fed to delay the return of gold reserves owned by Germany, as well as other indirect signs indicate that the amount of gold stored in the Federal Reserve Bank of New York is much less than that stated. Also, the attempts to pass tungsten for gold as gold have not yet cooled in their memory, which makes them even more skeptical about the Fed's reserves.

And while the global financial crisis, part of which is the European crisis, creates unprecedented precedents, such as lawsuits over rating agencies or the Cyprus tax, it becomes obvious that the players have no easy solutions left, and there are no constructive proposals within the framework of the existing concept. foreseen. The financial system objectively seeks transformation, which will undoubtedly change the configuration of the entire world order.

And finally:

Wealth is very good when it serves us, and very bad when it commands us. F. Bacon

Information