Spring aggravation of the sense of duty. National debt

They counted and didn’t shed tears

The collective West has not been surprised for a long time how the United States manages to live beyond its means, but now unfriendly countries seem to be much more concerned about why they cannot drive Russia into debt. It is no coincidence that the foreign press completely ignores information about our national debt that comes from us.

Moreover, a certain vow of silence extended to the so-called “unofficial” sources. Complete silence reigns, even if the information is presented by the main controllers of the country - from the Accounts Chamber of the Russian Federation.

But it was from the SP of the Russian Federation, which has recently clearly gone into the shadows without an approved chairman, with all due respect to the acting Galina Izotova, who recently recalled that the volume of Russia’s national debt at the end of 2023 increased by 2,7 trillion rubles and reached 25,6, 15 trillion rubles. This amounts to XNUMX% of GDP.

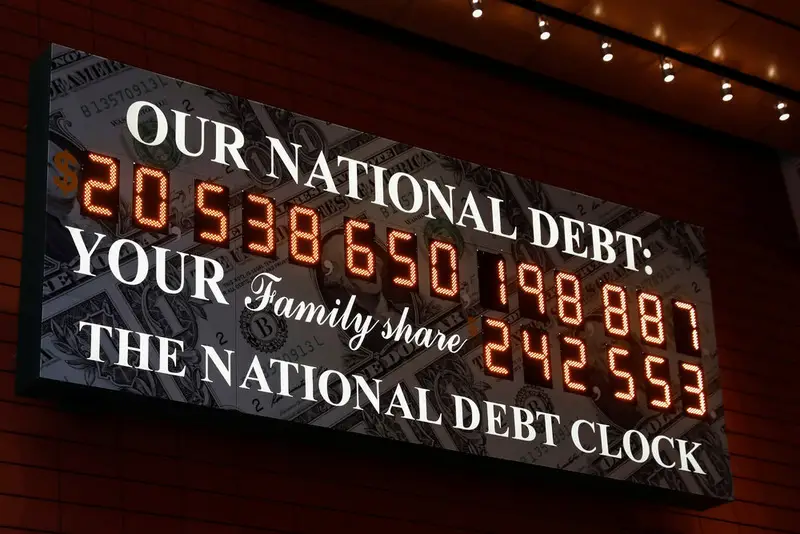

In comparison with the United States, where the entire country has to pay off its long-overwhelming national debt for more than a year, one might say, almost nothing. For Russia, which, according to European and American politicians and the press, “spends trillions on SVO,” which no one argues with, is a truly unique achievement.

And no manipulation of statistics, mind you. Commenting on the results of the analysis of the government debt of the Russian Federation, the office of auditor Alexei Savatyugin rightly noted that “one must be able to not only pay debts, but also delegate them.”

Who, to whom and how much?

The point, as you can understand, is that the right and obligation to “borrow” is increasingly transferred to regions, banks and companies, including those with state participation in capital. At the same time, no one is canceling the very trend of reducing, first of all, external debts.

It is not by chance that calculations by SP RF specialists from an analytical note on annual budget execution showed that the main increase in the debt burden on the Russian budget comes from internal debt. At the end of 2023, it grew by 10,8% (2,03 trillion rubles) and amounted to 20,8 trillion rubles.

At the same time, there is no need to talk about a significant reduction in the external debt burden, although Russia now owes $4,09 billion less in foreign currency. Currently, the external debt of the Russian Federation is $53,3 billion.

Nevertheless, the budget indicator of external debt still increased, and quite significantly. What this is connected with is not so difficult to explain - the devaluation of the ruble, which can already be called “another”, is to blame.

In our opinion, this is exactly the case, since the country’s financial system, like its citizens, adapted to the rise in the dollar and euro exchange rates from around 70 and 80 rubles to 90–100 without any shocks or, worse, panic.

So, in ruble equivalent, Russia’s external debt did not decrease, but increased by 743,9 billion rubles – to 4 billion rubles.

Not “parallel” export – someone else’s debt

From the point of view of manipulations with debts, from which it is necessary to rid the federal treasury whenever possible, operations with investments in the US national debt seem to us to be very indicative, although miniscule in volume. The volume of such investments fell most noticeably last fall.

In October, Russia more than halved its investment in American government bonds to $31 million. This was noted after an increase to $73 million was recorded in September due to purchases of securities by individuals and companies.

It seems that someone had insider information about the upcoming devaluation of the ruble, promptly investing in foreign exchange instruments. At the same time, the Central Bank of the Russian Federation stated with enviable regularity that the Bank of Russia does not have US government bonds. No one, not even the auditors of the RF SP, can prove the opposite due to the complete lack of open information.

At the moment, investments in long-term and short-term US government bonds remain approximately at the October level with a significant predominance of long-term ones.

Against the background of the amount of investments of $4,5 billion, which appeared in the data of the American Ministry of Finance at the beginning of 2022, it is quite possible to say that we can forget about Russian assistance in the Fed’s work with the American national debt. Seriously and for a long time.

Is it too early to rejoice?

It remains to be noted with some concern that companies, banks and regions, unlike the Ministry of Finance and the Central Bank, today cannot boast of a weakening of the debt burden. The Ministry of Finance managed to report an increase in the total public debt of Russian regions by the end of 2023 by 14%.

Not much, but given that GDP growth rates lag behind the debt indicator by more than three times, the trend is not encouraging. However, in total the regions owe significantly less than the country as a whole – 3,192 trillion rubles. But we should not forget that the regional budgets in total are also significantly, even very much smaller than the federal budget.

In this regard, the proposal of Russian President Vladimir Putin, made in his address to the Federal Assembly, to write off two-thirds of the regions’ debt on budget loans, except for infrastructure, cannot but inspire optimism.

Apparently, in parallel with this, the practice of mandatory placement of federal loan bonds will be minimized, which, in fact, due to rising rates, are becoming very attractive.

However, a flexible policy of floating rates, tied not to the rate of the Central Bank of the Russian Federation, but to real inflation indicators, can bring down any demand, even close to the rush. And again, despite the fact that big problems with debts, as well as with finances in general, are not visible even on the horizon, the idea of new “Stalinist” bonds or a large war loan literally suggests itself.

Information