The collapse of the dollar, gold and payments in national currencies. Myths and reality

Against the backdrop of the start of the SVO and sanctions policy, the topic of de-dollarization has sharply intensified. Then she calmed down somewhat. But here again are several publications at once, including on VO, on this topic.

While the authors of publications have sound ideas, I would like to point out a number of common myths, which quite often captivate both writers and readers.

So…

Gold

The first and perhaps most popular myth is the use of metallic gold or its equivalent (the gold standard) in international payments as a substitute for the dollar.

It is necessary to immediately disappoint all fans of this genre, but with the exception of certain narrow niche tasks, you can immediately forget about calculations with gold.

There are several reasons for this.

Let's start with why the world generally moved away from payments in gold.

Monetary gold, unlike all modern currencies, which are de facto IOUs, has its own specific commodity value. That is, it is in demand not only as a means of payment, but also as a commodity that has its own use and its own value.

All modern world currencies, unlike gold, have only a nominal value. This is the appeal of gold. It is weakly subject to devaluation, although the world story knows such examples.

But this is also the problem of gold as a means of payment: gold comes into competition with itself.

After all, gold is not only a symbol of wealth, but also an industrial raw material (including jewelry). And the demand for gold as a raw material and gold as a monetary unit may not coincide, which, in fact, constantly happened in the era of monetary gold. And as a result, the price of gold as a raw material and its price as money are different. This is inconvenient to say the least.

Just imagine a scene - “We are selling a shipment of gold. The price per ounce is two ounces.”

A ruble or other paper backed by gold does not solve this problem. It is, in fact, a warrant, that is, a bearer warehouse certificate, according to which you are obliged to give a certain amount of gold, which you can transfer to any person as payment, if that person is ready to accept it as payment. The problem of the duality of gold does not disappear from this. This is precisely one of the reasons that caused the abandonment of the gold standard at one time.

The second reason is political.

Why bother with dedollarization?

The correct answer is to increase the competitiveness of the domestic economy. The subtask of dedollarization is to reduce the impact on financial relations of the main competitor, the United States.

But in order to pay with gold or its equivalents, it is necessary to determine its world value. Let's remember where, in fact, the world price of gold is determined. Hint: these are wonderful cities: New York and London. What is called - they have arrived.

The third reason is purely technical.

The fact is that most international settlements are not payments between state X and state Y. These are settlements between the companies Romashka LLC in State X and Romashka Ltd. from the state of Igrek. Having sold a carload of bananas for gold or the equivalent, they then at least need to pay wages to employees. That is, a relatively simple and accessible mechanism for converting into national currency with minimal commissions for participants should be built.

Such a mechanism could ideally be built as a universal-world or at least local-regional one with the involvement of several (the more, the better) participating states. Otherwise, there will be many bottlenecks and high transaction costs.

However, a problem arises here: we, as a country under sanctions, for example, are interested in creating such a mechanism. But how interested are other participants in the process? Do they need to build such a mechanism if there is already an accessible and functioning one based on the dollar? The sheriff doesn't care about the Indians' problems.

And finally, the last and most important argument.

Let's assume that all the above problems are solved. But even then the gold standard will reach a dead end.

The fact is that over the last hundred years the world has changed somewhat. Globalization and the international division of labor have led to a significant increase in the volume of international payments. For example, the share of imports in the Russian Empire in 1913 was estimated to be about 5% of GDP, while in modern Russia it is from 18 to 21%.

In addition, let us remember that the Global South during the era of the gold standard was overwhelmingly a colonial system, that is, it was not a participant in international payments at all.

And here another interesting question arises: will the physical volume of available gold be enough to ensure international payments?

Currently, according to the Bank for International Settlements (BIS), the daily volume of international foreign exchange transactions in the world is $7,5 trillion. I repeat – this is the volume of transactions in one day. But the volume of gold turnover in the world for the entire 2023 amounted to 4 tons, which is approximately $899 billion. For the whole year. This is true for comparison.

OK. Peace be peace, but what about us?

In the year 1913, beloved by statisticians, the gold reserves of the Russian Empire amounted to 1 tons. For 695, there will be 2023 tons, that is, 2% more. This is despite the fact that the share of imports increased from 332% to almost 37,6%.

In money terms, the current gold reserve at the beginning of 2023 was $136 billion, or approximately 12 billion rubles. The total money supply (the so-called M586,8 monetary aggregate) as of January 2 is 2023 billion rubles. That is, the gold reserve covers 82% of the money supply.

International settlements take up a slightly smaller size. About $2023 billion of goods were imported into Russia in 213. That is, at one time we can pay in gold or its equivalent for only half of the annual import. Despite the fact that the return of gold from Russian exports is unlikely.

Of course, not all imports require settlement in gold warrants - in some cases netting is possible, in others something else is possible. But not the entire gold reserve can be used as a means of payment, since part of it is a safety net and another part is collateral for certain government debt obligations.

You can also estimate the turnover of the gold equivalent or delve into further consideration of all the nuances of this topic, but it will not change the fundamental picture. So the situation, I hope, is clear: the gold standard is already a thing of the past. Moreover, primarily due to the lack of physical volume of gold to support all commodity and financial transactions.

Maybe it will be revived sometime in the future (most likely in the event of a large-scale global catastrophe - God forbid), but not now.

National currencies

With settlements in national currencies, the prospects are much higher, primarily because the number of interested parties is greater than one.

But there are also several but.

Moreover, these but – these are not the machinations of the world hegemon or the European bureaucracy. These are objective economic factors, of which there are actually two.

The first is the absolute size of the national economy.

The second is the volume of foreign trade transactions between the two countries participating in the settlements.

Let's look at both.

However, first let’s rule out one more myth. These are payments in yuan. Let us exclude it for one reason - if the matter does not specifically concern Russian-Chinese relations, then settlements in yuan are not settlements in national currencies. This is replacing one dependency with another.

Having initiated mutual settlements in national currencies, the first problem we will encounter is the assessment of exchange rates. There are two evaluation mechanisms. The first is the stock exchange. But to determine it, there must be a sufficient volume of transactions between quoted currencies, i.e. it is suitable for countries with intensive and fairly large mutual trade turnover. Otherwise, the rate will be determined through the so-called cross rates, that is, through a certain currency that has wide circulation around the world. The clue is the dollar.

In other words, for example, in trade with China the mutual exchange rate can be set relatively independent of the dollar, but in interaction with African countries this is practically not the case.

The second issue that will arise in the course of building bilateral relations is the liquidity of the national currency received as payments.

Let us recall that almost all modern currencies of the world do not have their own commodity value. Only nominal. Essentially, these are depersonalized promissory notes. This means that any of the currencies can be settled for payments exactly as much as established public opinion recognizes a particular currency as legal tender.

Thus, the US dollar is recognized as such almost anywhere in the world. And here is also a dollar, but this time Zimbabwean - interesting only as souvenirs.

The liquidity of a currency is determined in the same way as a debt obligation, by the solidity and solvency of the person who issued it. That is, the absolute size of the economy and its stability.

The three main world currencies - the dollar, euro and yuan - are such because behind them are three economic giants, providing 60% of world GDP. All others are niche or local currencies.

How does this affect mutual settlements in national currencies?

If mutual commodity and financial flows between two countries are approximately comparable, then the transition to settlements in national currencies is generally not very problematic, given other favorable conditions.

However, if there is a noticeable imbalance in favor of one of the parties, then problems arise here.

For example, Russia supplies a certain country X with goods worth conventional 100 units, the return flow of goods is 50 conventional units. When making payments in dollars, this is not a problem; they can be used for any transactions with third countries. But when making payments in national currencies, Russia forms a balance in the currency of country X, which has nowhere to use. Actually, for this reason there was a well-known story with Indian rupees.

Thus, payments in national currencies are limited to the smallest of the counter flows of goods. Moreover, in the extreme case of this situation - when the counter flow is zero, there will be a corresponding result of mutual settlements.

The problem can be partially solved by creating an international clearing infrastructure. That is, if there is a certain third party that has trade relations with both Russia and country X, then perhaps it will be ready to accept the national currency of country X as payment. Moreover, provided that country Y has an imbalance of trade relations in favor of X, otherwise it will not be interested.

As we can see, clearing solves the problem only partially and still leaves many bottlenecks. That is why attempts to discuss ideas for creating similar institutions at the BRICS level at the last summit did not even lead to the adoption of a clear decision on the possibility of developing such a mechanism.

What do we have as a result of all that has been said?

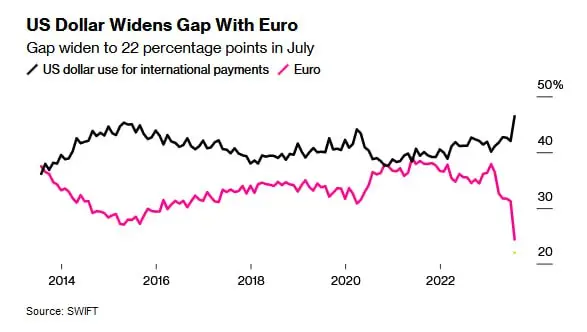

We have a very interesting picture presented on the graph (borrowed from the tadviser.ru resource).

As can be seen in the graph, despite all attempts to reduce the dollar’s share in global payments, it confidently holds its position. And in 2023 it even reached its maximum in the last 10 years. And he will hold his position until a simple and accessible alternative arises.

Perhaps the yuan will become such an alternative if China wants it.

Perhaps an international BRICS quasi-currency will be created for foreign economic settlements. There is already such experience in world practice, for example, the European ECU or the Emvef SDR.

But definitely not a ruble, even if it is gold. The scale simply won't allow it. So, even if Russia suddenly manages to increase its GDP per capita to the US level in the short term, its economy will still be half the size.

It is also necessary to note the popular thesis about the impending collapse of the American financial system, due to the insecurity of dollar emissions.

Firstly, the dollar is secured by its status as a world currency.

Secondly, yes, collapse is possible. But the moment this happens, we will all find ourselves in a slightly different reality, and it is not a fact that we will like it.

Therefore, at the moment there are no world rulers who are really interested in the collapse of the dollar. Quite the contrary, everyone will strive to deflate the bubble as slowly as possible.

Is everything so sad?

Not at all.

The Russian economy, thank God, is not the worst in the world. Although its potential, unfortunately, is far from being fully used.

The Russian ruble has a chance to become a regional currency or a significant component of the world quasi-currency, but this chance will depend on the level of development of domestic production and the level of well-being of the people.

And for this it is necessary to train full-fledged, competent economists (with all the abundance of qualifications we now have almost none of those), to build an economic and industrial policy, a personnel training system, etc. However, this, as they say, is another story.

Information