Mysteries of the “Great Depression”: why was the crisis so severe and prolonged?

Milton Friedman.

It is clear that the root cause of the depression was the stock market crash in the fall of 1929, and before that, the economic boom of the “roaring” 1920s against the backdrop of the “soft” policy of the Federal Reserve. But what happened in the fall of 1930, causing an economic catastrophe in the United States that lasted almost the entire 30s? After all, the previous severe recession, according to the National Bureau of Economic Research, lasted only 18 months - from January 1920 to July 1921.

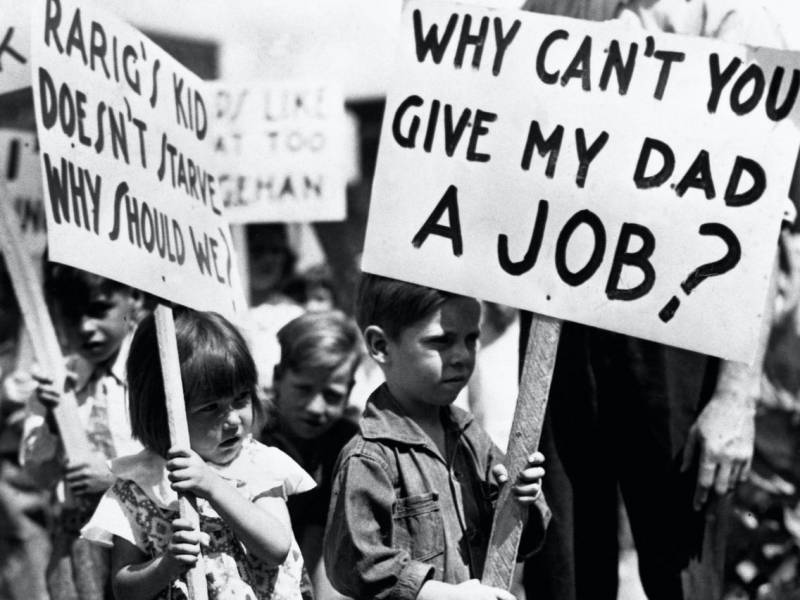

The Great Depression is one of the most acute crises in modern times. stories, in which America, riding on all the achievements of industry, technology and science, was thrown back deeply, and its people, in search of any work and piece of bread, were deprived of all hope. It’s hard to imagine a greater humiliation for the proud Americans who believed that if you have a head and hands, you can solve any problem.

Government response to the onset of the crisis: be patient

Everyone understood perfectly well that the stock market crash that occurred in the fall of 1929 would not pass without a trace. But the American establishment, which professed the doctrine of state non-interference in market affairs, believed that everything would recover on its own in about 2 months.

Hoover and Treasury Secretary Andrew Mellon urged the public to be patient - promising that an economic recovery was about to begin.

Herbert Hoover

Mellon believed that shock therapy would be the best response to the crisis:

Andrew Mellon

When the failure was realized, some essentially correct measures (government purchases of agricultural products, bailouts for banks and companies) were taken, but they were carried out half-heartedly and inconsistently.

As a result, the crisis continued. A number of liberal critics still believe that F. D. Roosevelt was just using Hoover's legacy: but this is not true.

Let us give an example.

Amid the collapse of the financial system, Herbert Hoover formed the RFC (Reconstruction Finance Corporation) on January 22, 1932. As part of its work, $1,62 billion was spent on purely protective measures: providing assistance to the banking system, repurchasing bonds of railway companies - the largest asset in the banks' portfolio. However, these measures did not produce results; the money seemed to go into the sand.

Any government intervention required increased spending and deficit financing of the budget, which was strongly contrary to the economic traditions of the time.

Banking crisis: point of no return

In 1929, there were approximately 25 banks in the United States. With assets of $568 billion, the banks' equity was $72,3 billion and their debt was $9,8 billion.

Before the panic began, more than 8 commercial banks were owned by the Federal Reserve, but nearly 000 were not. A significant part of the banks' assets consisted of securities, loans secured by securities, urban real estate and rural land.

After the stock exchange crash, most of the securities and real estate sharply depreciated, and a significant part of the loans became non-repayable, while there was a sharp reduction in the resource base of banks due to the massive withdrawal of household deposits and a decrease in the balances of enterprises. Banks' assets and liabilities began to dry up. As a result, bank failures became widespread.

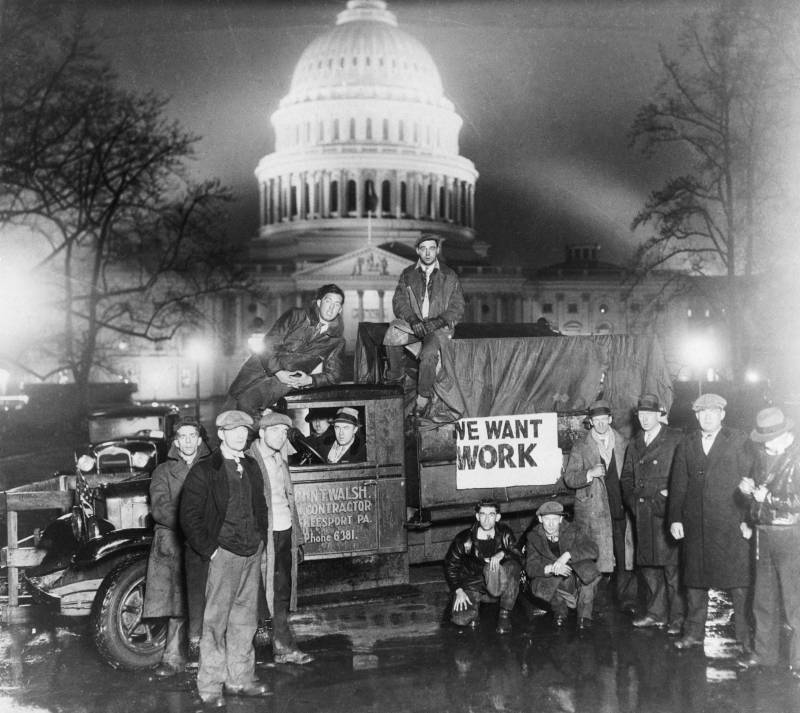

"Invasion of Investors", 1930s

In the fall of 1930, the first banking crisis began. The process began with the collapse of Caldwell and Company, the largest financial holding structure in the southern United States. The parent company's assets suffered after the 1929 stock market crash. The population sought to withdraw money - the lack of deposit insurance made such a measure the most reliable protection.

As Gary Richardson writes in his study:

The panic began to subside in early December. But on December 11, New York's fourth largest bank, the Bank of United States, went out of business. The bank was negotiating a merger with another institution. The New York Fed helped with the search for a merger partner. When negotiations broke down, depositors rushed to withdraw funds, and New York's Superintendent of Banking closed the institution.

This event, like Caldwell's collapse, generated headlines across the United States, stoking fears of financial Armageddon and prompting nervous depositors to withdraw funds from other banks."

The crisis began in the Sixth District, headquartered in Atlanta. However, Atlanta Fed officials provided active support to local banks, encouraged Fed member banks to extend credit to their nonmember respondents, and directed funds to cities stricken by banking panics.

At the same time, the St. Louis Fed (Eighth District) limited concessional lending and refused to help non-Fed institutions. As a result, in the sixth district the economic decline slowed, and in the eighth district hundreds of banks went bankrupt, lending decreased, and unemployment increased.

The first national banking crisis coincided with the financial crisis in Europe and reached its peak after Great Britain abandoned the gold standard in the fall of 1931.

In 1932, a significant part of the banks tried to limit the issuance of cash to their depositors. The first precedent was set by the state of Nevada, which closed all state banks in October 1932.

The second national crisis began in the winter of 1933, in February 1933, when one of the major banks collapsed in Detroit. A banking panic began in Michigan, and on February 14, the governor closed all banks to protect them from bankruptcy. A wave of bank closures swept across many states.

In 1921, the total number of commercial banks was 29, in 788 - 1929. But already in 25, the number of banks was 568, having decreased by about 1933.

Thus, during the period from 1929 to 1933, about 40% of all banks ceased operations. This caused a “enlargement effect” of the system.

As Ben Bernanke candidly writes:

Many Fed officials were willing to subscribe to the notorious “liquidationist” thesis of Treasury Secretary Andrew Mellon, who argued that weeding out “weak” banks was a harsh but necessary condition for restoring the banking system.

Moreover, most of the troubled banks were relatively small and not members of the Federal Reserve System, making their fate less interesting to Fed policymakers. In the end, Fed officials decided not to intervene in the banking crisis, thereby once again contributing to a sharp contraction in the money supply.”

Economic disaster

The Great Depression led to impoverishment and enormous suffering of tens of millions of people, significantly changed their psychology, worldview, and revalued their moral guidelines. This is reflected in the following comparison:

The scale of the crisis is evidenced by the following data: the volume of US GNP for 1929–1933. fell 1,85 times from 104,6 to 57,2 billion dollars, the volume of investments - by 85%.

Per capita income fell 45%, from $847 to $465. Unemployment grew rapidly, increasing from 3% to 25%; in March 1933, its volume amounted to about 17 million people. About 2,5 million people were left homeless. More than 110 companies went bankrupt.

The volume of automobile production decreased by 80%, steel production by 76%, rolled steel production by 74%, and coal mining by 42%. The production volume of the metallurgical industry was at the level of 1900.

"Business card" of the 30s

The greatest damage was in the agricultural sector - wheat production decreased by 36%, corn - by 45%, the fall in prices for grain was about 2,7 times, for cotton - more than 3 times. There was a sharp drop in real estate prices.

Farm real estate fell in value many times over - a farm that was worth about $1929 in 100 went into debt for about $5. The massive ruin of farmers unable to repay loans began: about 1 million farms went bankrupt. Due to the fall in demand, deflation began - a general decrease in the price index for 1929–1933. amounted to about 25%. The wage reduction was more than 30%.

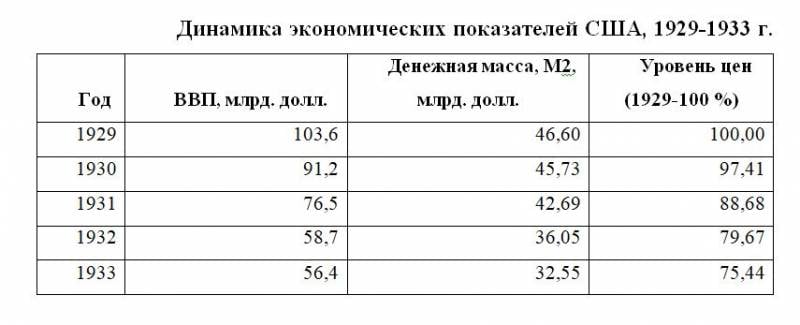

Here are the main economic indicators (according to bea.gov and data from M. Friedman and A. Schwartz).

Due to the decline in solvency, farmers lost their land and homeownership, and the affected citizens settled on the outskirts of cities in slums built from containers and waste, aptly named “canvilles” (“Hoover villages”).

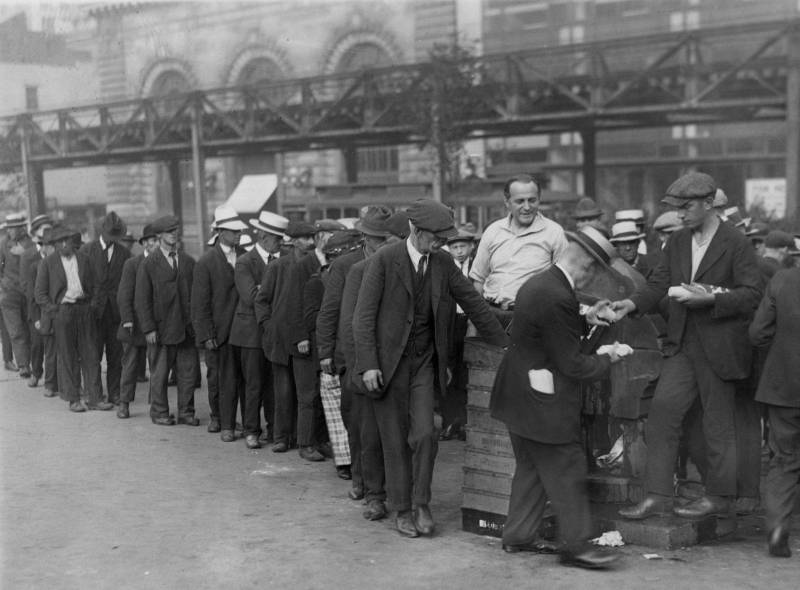

"Beadonvilles" ("Hoover Townships"), 1930s

Those who had a business found themselves on the labor exchange, everyone grabbed any, even the most menial job, and queues lined up in the cities for free soup.

Queue for free food, 1930s

The people began to understand that the previous ideals of a “free” economy did not work in a crisis - many previously successful people were unable to change anything, they lost hope, and many gave up. Vagrancy and homelessness became widespread, and abandoned cities began to appear. America was moving to the left, social protests were expanding.

As a result of the collapse of the American economy, the Republicans lost power for a long time - F. D. Roosevelt was elected 4 times in a row, and after him the Democrat G. Truman also became president.

Children's picket: work for parents, 1930s

Since the world economy was strongly connected, following the United States, the entire world economy fell into the abyss of the Great Depression.

Now we are often reproached from abroad for the Holodomor, for the misfortunes of the revolution. But the United States had something similar, but there was no civil war and large-scale repression.

How money shortages caused economic collapse

The economy and financial system had to be saved through cash injections, and banks from depositor runs. But the US government and the Federal Reserve hesitated, and the crisis grew.

During 1930, from February to June, the Fed consistently lowered the rate from 4% to 2,5%, but these measures could not stop the crisis. The collapse of the US banking system caused a contraction in the money supply.

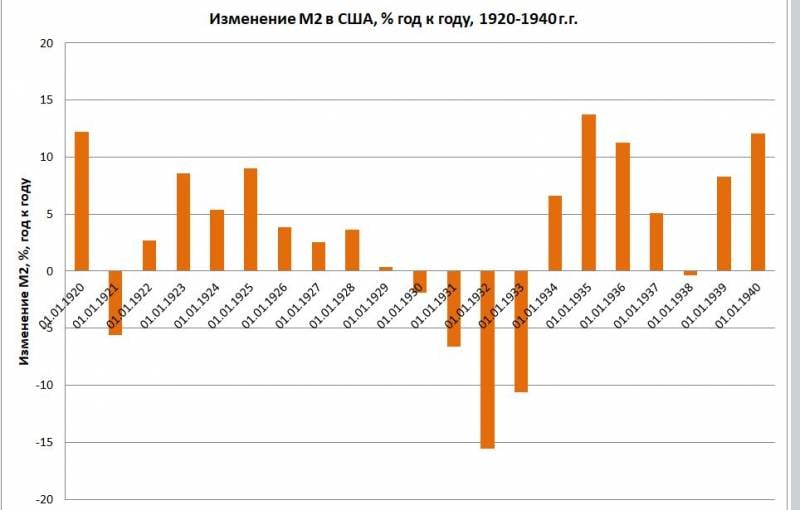

If in 1929 the volume of M2 was $46,6 billion, then in 1930 it was $45,73 billion; in 1931 – 42,69 billion dollars. But already in 1932 the volume of M2 fell to 36,05 (by 15,5%), in 1933 M2 reached a value of 32,22 billion dollars, having decreased by 10,6% over the year. For the period 1929–1933 The money supply fell by 30% (!).

According to M. Friedman and A. Schwartz

The reduction in money supply hit aggregate demand, deflation began, which outwardly looked like a crisis of overproduction, goods were piled on store shelves, but could not find buyers.

It was this dynamic that served as the basis for the diagnosis of M. Friedman, Ben Bernanke and a number of politicians and researchers who accused the Fed of ineffectiveness in resolving the crisis, as well as various interesting conspiracy theories of the tragedy.

The banking system has the property of expanding the money supply by creating money through monetary multiplication, simplified: a bank issues a loan, part of the money goes through the client to the next bank, this bank also receives money to issue a loan, etc. An indicator characterizing “monetary expansion » – money multiplier.

But when clients take their money, the processes go in the opposite direction. The same effect causes a reduction in the volume of investments and lending, when banks are afraid to lend, and clients are afraid to invest in business due to an assessment of increased risks, expecting the situation to worsen.

The primary compression gives rise to a drop in demand, which in turn reduces the demand for lending, a complex process arises that leads to a deflationary funnel and a debt crisis.

First of all, during a crisis, the interbank market stagnates, affected by a “crisis of confidence” and depreciation of collateral instruments. The domino effect then creates a chain reaction of non-payments throughout the economy.

According to M. Friedman and A. Schwartz

In his work, Sergei Blinov estimates that the money multiplier in the United States fell by 46% during the Great Depression from 6,6 to 3,5. If the Fed had injected the necessary liquidity into the banking system and promptly passed a deposit insurance law, the consequences of the crisis would have been much mitigated, although unemployment would still have been high.

In 2002, Ben Bernanke, then a member of the Federal Reserve Board, publicly admitted what economists had long believed. Mistakes by the Federal Reserve contributed to

On November 8, 2002, in a speech given at a conference in honor of Milton Friedman... on the occasion of his 90th birthday:

The Great Depression: Fed Miscalculations and the Gold Standard

Many people at one time wondered how the Fed led the United States to the Great Depression?

As M. Friedman, the founder of the theory of monetarism and neoliberalism, states:

People at the Federal Reserve Bank of New York and other banks kept pleading with the Fed's board of governors to step in and do what needed to be done. In Congress, someone constantly insisted on changing the Fed's course. Outside commentators... have also pointed out that the Fed's restrictive policies are having a detrimental effect on the American economy..."

Many modern economists, politicians and businessmen today also reproach the Bank of Russia, saying that it, in fact, makes similar mistakes. But this is a separate topic.

Ben Bernanke, as chairman of the Federal Reserve, pointed out:

In his article "Money, Gold and the Great Depression", Bernanke discusses the causes of the depression and states that in September 1931, after a period of financial turmoil in Europe, speculators attacked the British pound, presenting pounds to the Bank of England in exchange for gold, which led to the depletion of gold reserves. The UK abandoned the peg, allowing the pound to float freely.

Then came the depletion of the Fed's gold reserves as central banks and private investors converted large amounts of dollar assets into gold in September and October 1931. Withdrawals by foreign and domestic depositors from the US banking system also contributed to the monetary contraction.

Describing the situation after the First World War, which preceded the Great Depression, Z. Moshensky writes:

This gave rise to a steady trend towards deflation, which in the post-war years increasingly hampered the growth of financial and securities markets in European countries. Deflationary ideology, born of a desperate attempt to cling to the gold standard, was the worst possible cure for the world economy."

As the greatest economist of all time, J.M. Keynes, believed:

He was negative about the idea of a gold standard, since the main supply of gold was in the United States:

But this is precisely the option that has now been implemented in the world.

According to Bernanke, countries that left the gold standard earlier should have avoided the worst case of the Depression and begun the recovery process earlier. Thus, Great Britain and the Scandinavian countries, which left the gold standard in 1931, recovered much earlier than France and Belgium, which stubbornly adhered to the gold standard. Countries like China that used the silver standard instead of the gold standard avoided the Depression almost entirely.

Crisis: who wins and who loses

During a crisis, the winners are the most experienced and informed players who sell their assets in advance and gain liquidity. Those investors who did not manage to exit stocks before the crisis, and those who managed to start new projects implemented through loans, are doomed to the most serious problems.

The situation for all borrowers is difficult. The crisis of 1929 was deflationary and had a long period - the economy recovered only by 1940. Deflation causes the value of money to rise sharply.

Any crisis creates a mechanism for the redistribution of property, clearing the economy not only of ineffective owners, but contributing to its monopolization. The lucky owners of liquidity after the crisis can buy back assets at a much lower (sometimes several times) price.

During the Great Depression, a huge number of US citizens were deprived not only of their savings, lost in the stock market, but also of their property, which turned out to be a kind of expropriation. At the same time, large corporations and landowners further strengthened their position in the economy.

In the stock market, there is always a redistribution of savings from less informed, passive investors to the most informed players. During a period of normal economic growth, when incoming money flows exceed outgoing ones, they also benefit.

But in the preliminary and initial phase of the crisis, when incoming flows dry up, there is a flow (or long-term freezing) of the savings of investors trying to play for an increase in favor of the “bears”. That is why, with any serious problems in the financial markets, investors panic and sell securities.

Finale

The Great Depression showed one of the main secrets of economic management, the importance of its main force - money. As Mayer Rothschild said (1809):

No money - no economy. And it is this secret that the current globalist elite uses to weaken today’s Russia by controlling the key object of our economy – the Bank of Russia.

Researchers of the causes of the Great Depression cited many reasons - errors in the monetary policy of the Federal Reserve (M. Friedman), the collapse of the stock market (J. K. Galbraith), the gold standard (B. Bernanke), the policy of the Bank of England (M. Rothbard). But the original cause of the Depression of the 30s was the impossibility of maintaining for any length of time the rate of investment that was caused by the boom of the 20s, as L. Mises warned about.

The world depression of those years meant that K. Marx was right in predicting the collapse of the capitalist system. Many looked with hope at the USSR, but it had its shortcomings. The depression affected the main capitalist countries, but at the same time, Soviet Russia, pursuing industrialization, showed miracles of economic growth, when the average rate in the 30s was 15,74% (Development of the Russian economy over 100 years, 1900–2000, V.M. Simchera, 2007).

A new era was dawning, capitalism needed a reboot. And the great English economist J.M. Keynes voiced these recipes. But that was later.

Продолжение следует ...

Used materials:

From global imbalances to the “Great Depression” (1914–1939), Z. S. Moshchensky, London Xlibris 2014, p. 34,

Keynes J. Treatise on monetary reform. – M.: Economic Thought, 1925, pp. 93, 95.

Galin Vasily “Political economy of war”, Moscow, Algorithm, 2007, p. 343.

Timoshina T. M., “Economic history of foreign countries”, Justitsinform, Moscow, 2003, p. 387.

Information