Why not go back to the golden ratio? Get away from the dollar and the euro

Long before us

Today, many doubt that the abandonment of the gold standard, which tied together the major world currencies, was a very serious mistake. Its consequences will be felt for a long time, although the current world tycoons are unlikely to risk returning the role of the guarantor of any financial transactions to gold.

Let's look into the not so distant past.

Back in the XNUMXth century, a sailor who got into a difficult situation, who had the right to wear a massive gold earring in his left ear, could, having handed it over to a pawnshop in the nearest port, get home on the first ship that came across for the proceeds.

But now, for three or four grams of gold, you definitely won’t fly and swim, for example, from Rio de Janeiro to St. Petersburg or Sevastopol. However, in dollar terms, as well as other currencies that someone aptly called fiat, the value of gold and other precious metals is only growing.

What caused such a paradox?

Although it is clear that since then, the dollar, like all its competitors, has lost a lot of value. Gold has been a lifesaver in the past, at least for sailors, pirates, bandits and state criminals.

In tsarist Russia, the executioner for a golden ring could pretend to cut off the tongue of a criminal convicted of publicly criticizing the emperor, but in fact he only cut its tip. As a result, of course, the unfortunate liberal went into exile, but at least he did not lose the opportunity to communicate articulately.

For sailors, both civil and military fleet the golden earring in the ear was generally almost a sacred symbol. They say that such a tradition came from Great Britain, but for the first time in the Russian Imperial and other fleets, a sailor's ear was pierced and a gold earring was inserted there at the first crossing of the equator.

Usually on the ship there were earrings in stock, the ship's doctor pierced the ear with a thick needle, previously calcined and alcoholized, then the next conqueror of the equator had to give money for gold to the general treasury of the ship. Sometimes a sailor had to work out an earring for more than one month - then gold was so expensive compared to his salary.

Wrong metal, wrong time

After passing through the Drake Strait, the sailor had the right to insert an even more massive earring into the earlobe. This gave him the right to receive from the owner free of charge three to five mugs of beer in port taverns and put his feet on the table. Those who did not have gold in their ears were expelled from the tavern for such a manner, often with a beating, not to mention the fact that beer was not poured for free.

At the same time, for a long time silver and even incredibly expensive platinum were not quoted in the fleets of all states. Platinum so simply frightened any uninitiated. And only gold served as a sign of the valor of a sailor.

But the most important thing was that the earring could help the sailor at a difficult moment. A pirate caught by the authorities could even pay off the gallows with a particularly weighty golden earring. Well, law-abiding sailors, having a couple of grams of gold in their ears, had a chance in the event of a shipwreck, if, of course, they swam ashore, to get home by selling gold in a pawnshop.

But why is it impossible today to get from one end of the globe to the other for two or three grams of gold?

At the rate of the Central Bank of the Russian Federation, a gram of gold costs less than two thousand rubles, if you rent it in an average Moscow pawnshop - even less.

An air ticket, for example, from Cape Town to Moscow, costs at least 76 thousand rubles. And in terms of fiat money, about which the author promises to write more, the cost of gold is growing.

Buy, I'll give everything, sorry - I'll sell!

It is obvious that the world economy after the rejection of the "gold standard" faced three factors at once.

The first of them is the general impoverishment and decrease in the solvency of the population. The cost of food, services and durable goods is rising faster than the value of specie.

At the same time, no matter how the world ecological community tries to build a green economy instead of oil and gas, oil is still needed by the economy more than gold due to utilitarian needs. An example is the countries of the Arabian Peninsula, which have nothing but oil.

There is not even fresh water, which they extract by sea osmosis. Nevertheless, they have workers from even the largest economies in the world, such as the United States and China, in their oil production and construction. And they don't need any gold. The locals themselves do not particularly want to work, why do they need it if they walk on oil with their feet?

The second factor is related to gold itself, which is being mined all over the world more and more, although so far the demand for it, if it falls, is not much. In addition, the purchasing power of gold is declining as the value of unbacked fiat currencies depreciates. Currently, fiat currencies are no longer pegged to gold, but gold, on the contrary, is pegged to the US dollar.

Yes, because it is in dollars that gold is traded on world commodity markets, and among other things, this is precisely why no one is attracted by the prospect of the return of the “gold standard”. At the same time, the dollar, in fact, is not backed by anything, it is an artificially inflated bubble.

Of course, there are some fluctuations in dynamics, but they are more related to macroeconomic factors in the regions of the world, for example, with crises in the Middle East or New Year celebrations in India and China, which increase the demand for gold jewelry.

And the ruble there too ...

The third and almost the main factor not in favor of gold is that its purchasing value in terms of goods, including vital ones, is actually declining. And the reason for this is the decoupling of many fiat currencies of the world from commodity standards, including from gold.

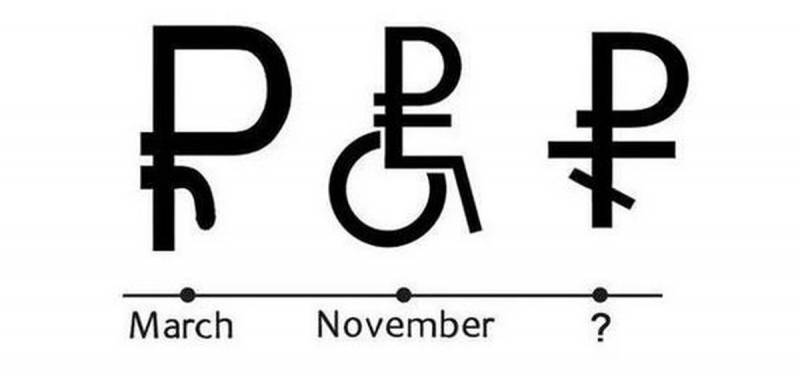

The Russian ruble also does not look the best on the background of its depreciation and rising prices for consumer goods. And this despite the fact that Russia continues, despite the sanctions, to export its raw materials to many countries of the world. Although, of course, everything is clear: the weak ruble is beneficial for the largest exporters.

In the years when sailors paid for their journey home with a few grams of gold, they usually traveled on sailing ships. Naturally, the road was cheaper than even on a modern hydrocarbon-fuelled ship, not to mention an airplane.

So, there is no doubt that the decrease in the purchasing power of the population is evident. And, of course, the same fiat money, which is not backed by anything specific, contributes to this to a large extent.

Therefore, attempts are being made to create cryptocurrencies backed by something more real than the word of honor of the American Fed. For example, oil, as in Venezuela, products, as has already been done in the BRICS countries, or the same gold, as in the BRICS countries, they are only planning to do so far.

Information