Bank of Russia: rates do not change while crossing

Stable, how where?

For more than six months we have not thought about the key rate of the Central Bank, but not because it has remained unchanged all this time. Now I had to remember, ignoring the confident, even self-confident reports of the Bank of Russia.

About them a little later, now about the notorious financial stability, about deposits, loans, and only then about inflation. Judging by the latest statements by domestic liberal financiers in power, there is no longer any confidence that there is almost complete order on all these fronts.

With the current percentages - we recall that the rate has frozen at around 7,5 since last autumn, there is nothing to be proud of. At such a percentage, if you do not take into account authorized banks, no one gives anything to anyone.

At the exit from these authorized, you know who, banks, you will not find less than 20 percent per annum. Yes, even with insurance, guarantees and, as a rule, with poorly veiled kickbacks.

At the same time, one can only dream of decent deposit rates, when the money seems to work in a different direction. Isn't this the reason for the complete absence of those who really want to lend to the state, well, if only under duress.

The financing of the defense order, which is now in demand more than ever, was not disrupted in 2022 only because defense lending had to be abandoned almost completely. Direct public funding is now almost everywhere, and we are still surprised by the budget deficit.

On inflation later

Why then, it is understandable, the topic is so slippery that, in the case of a serious discussion, it requires real, and not propagandistic arguments. And also because we all feel it ourselves, realizing that once again certain global tasks are being solved almost exclusively at the expense of the population.

All the benefit from inflation, and there is, and this is a fact that liberal economists do not dispute, goes to those who have time to spare. Whoever raised prices or tariffs first wins. It was at one time, being a vice-premier, that the privatizer Chubais, of bad memory, made good use of it.

Let's not forget, in the end, a country with such games came to default. And after all, this red-haired subject is not even from the "Chicago" boys, although he used the recipes of that very school simply brilliantly. Some of the "Chicago" now severely criticize the Central Bank for its game of stability, and rightly so.

As a result, we really get the stability of a rich country with a poor population and a business that is all in debt, like in silks. Payments to the participants of the SVO, as well as in the most terrible cases - to their relatives, by our standards - are large, although not very much, they do not change the essence of the matter, alas ...

As for the critics of the Central Bank and the Ministry of Finance, keep in mind that critics have been repeatedly accused of wanting to sit in the chairs of the heads of these structures. Although what, in fact, is bad in such ambitions of professionals?

About the features of the national reservation

Nevertheless, the current financial and economic scarecrows are released in a completely different direction - to the budget. What a horror, it turns out that it is already in short supply in Russia, and very scarce at that! However, there are no hints to cover this deficit at the expense of the reserves of the Central Bank and the Ministry of Finance, which have been accumulating over the years, as there were, and are not.

The reader will not find such an appeal in our country either, because that very real “rainy day” has not yet come. And whether it will come at all, there are big doubts. Another thing is that it would be better to put the reserves into circulation within the country.

Readers, of course, will ask how? Quite simply - by sending them under strict control to the same insurance and pension funds, of course, state ones. And from there to draw funds for the implementation of the most important infrastructure and social projects - at normal, not central bank interest.

The “Chicago boys” already mentioned above, most of whom today, as they say, are at the helm, in response to such proposals, they will immediately shout that this way we will simply “meanly go through the reserves.” It doesn’t convince: we ate, or rather, we missed the very stolen 300 billion dollars / euros back in the spring of 2022.

And what happened before, you just need to remember. So, before that, the Central Bank and the Ministry of Finance allowed their reserves to regularly lose weight on the American minimum interest. And after all, by the way, in the same States, reserve funds invested in damned treasuries work exactly like that - through pension and insurance structures.

Yes, the United States has repeatedly received financial bubbles and "hellish crises." But fed by federal money, insurance and pension funds have been and remain almost the main investors in the American economy.

Not our values

Let us return to the statements of our most central bank in the world, the very one that did not even move when our hard-earned 300 billion was taken from under its nose. Not rubles, but convertible euros and dollars invested, forgive me for repeating myself, not in Russian, but in Western values.

Moreover, they are no longer paper, but electronic, where everything is decided, in fact, with one click of a computer somewhere in the corridors of the Fed. One might think that the notorious “investments in the most reliable and liquid” assets, the validity of which we have been convinced for decades in the main credit institution of the country, are justified today.

So, from the Central Bank we are assured that "inflationary expectations of the population and business have decreased." However, they still “remain at an elevated level”, although much higher? In the direction of default, now we just lacked it.

But further in the materials of the Central Bank of the Russian Federation we read something completely optimistic:

The style of press representatives of the Bank of Russia has changed beyond recognition, as if we have returned to the times of the leadership of Viktor Gerashchenko and Tatyana Paramonova. With people now again at least talk like a human being. And even about the stabilization of inflation and the increased level of inflationary expectations of the population, everything is more or less clear.

It is a pity that it is not easy to confirm what has been said with real deeds - but the fact that a lot has worked in the country, albeit for the sake of the NWO, is already not bad. Another thing is that with the old key rate, one should not even dream of some kind of restoration of consumer demand, the very same - effective, according to Keynes. And without it, the whole calculation is only on the growth of savings. And God forbid - currency.

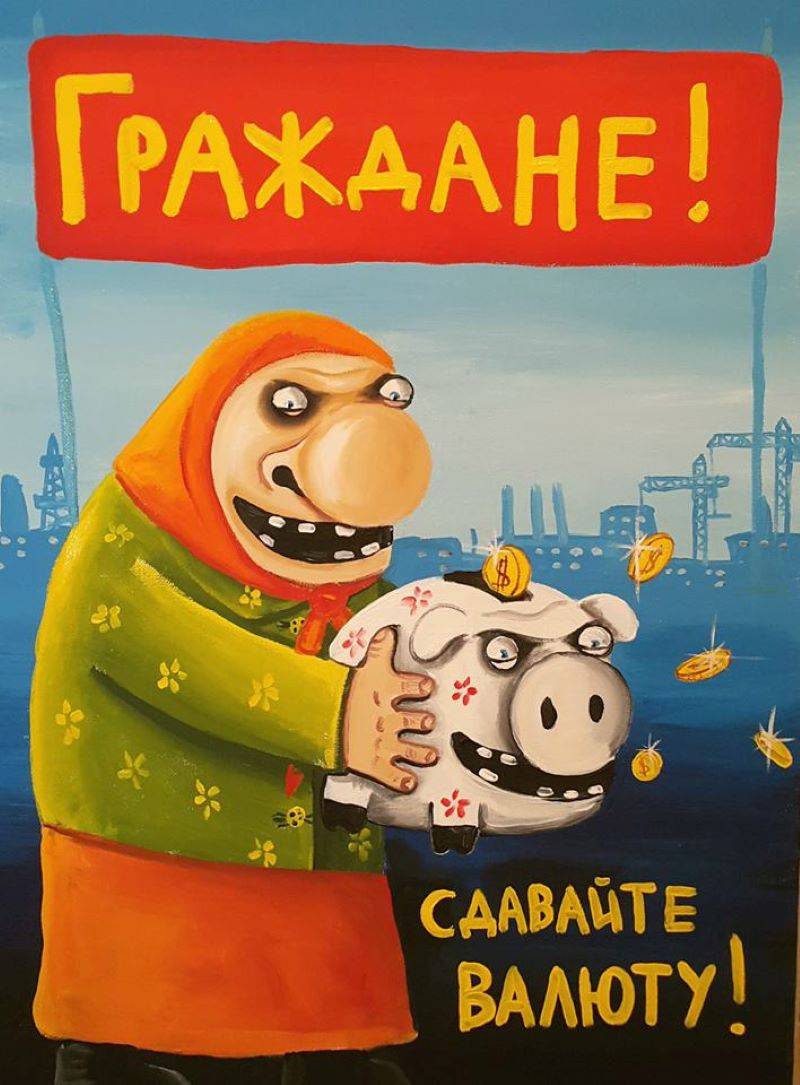

The dollar and the euro again pulled up, but if the treasury is, as a rule, profitable - everything is cheaper inside the country, then the population does not stimulate in any way to invest in something native. Again, it will rush into the exchangers and throw off the last remnants of extra rubles. For dollars and euros.

Well, in a sense, one can even envy the Bank of Russia and its permanent leadership. You definitely won’t have to answer for the sins of adversaries, you can fight inflation with almost no effort, and the time to soften the regulation has not yet come. And, as you can see, it won't be anytime soon.

Information