The time has come. Gathering stones - farewell to offshore companies

Last time we talked aboutWhen it's time to collect stones), that the time has long come to deal with the privatization carried out in the 90s. Now - about offshore companies, and why it's time to simply abandon them. But first, let's figure it out

Why are offshore companies needed at all?

In the 90s, the best and most profitable enterprises went to private traders for a penny ... A striking example: Roman Abramovich privatized Sibneft for $100 million, and after some time sold it for $13 billion! And is it really so important that no Sibneft exists anymore - it has gone under Rosneft. And thanks for that...

As the Ecclesiastes said:

And the time to return capital to Russia from offshore came yesterday. In fact, there have been such attempts. But…

Different countries offer the registration of offshore companies. Why? The answer is clear: in order to bring additional income to your country from international business turnover.

And why do owners of companies register them offshore? It's just that the owners of factories, newspapers, steamships are looking for a more flexible country in terms of doing business and tax regulation. Registration of an offshore company and its maintenance are cheap. But taxes in the country where the enterprise is located are not paid!

Multinational corporations such as Google, Apple, Starbucks, Microsoft and many others are constantly creating offshore companies to optimally manage their business and use them as part of the corporate structure. Registering an offshore company means that you open a company in another jurisdiction, while simultaneously managing all its operations and business from any city in the world.

That is why they are called “offshore”, that is, outside the territory, “out of the coast” (from English: off shore). An example of an offshore company can be a company registered, for example, in the Seychelles, but which operates in other countries, and is managed from Russia, Georgia or Kazakhstan.

The offshore owner is not recommended to conduct economic activities in the Seychelles, so as not to become an object of local taxation. Jurisdictions with similar business tax conditions, such as the Seychelles, Belize, Marshall Islands, British Virgin Islands, Cayman, Anguilla, Panama and Bermuda, offer huge tax incentives to international companies.

An offshore company has the main characteristic - zero or minimal taxation in the jurisdiction of registration. Another plus is the high level of confidentiality of owners and key people. But, unfortunately for offshore billionaires, recently many countries have begun to fight offshore.

After all, the government of which state will voluntarily refuse to receive taxes from enterprises that operate in this state? And so many classic offshore jurisdictions began to participate in the automatic exchange of tax information with other countries of the world.

Thus, the level of confidentiality of key persons and beneficiaries has greatly decreased. But still, offshore bosses from Russia are in no hurry to leave their heavenly corners. Not so American. Why?

FATCA Law

We are talking about the US federal law governing the taxation of foreign accounts (Foreign Account Tax Compliance Act - FATCA). It was adopted to identify the assets of US taxpayers (they are US citizens, resident aliens, and some non-resident aliens) outside the US.

It belongs to a generation of American laws that can be called extraterritorial. Their action extends to a number of other countries, and sometimes to the whole world. These laws help Washington build the Pax Americana. The law we are talking about required all banks to enter into a special agreement with the Internal Revenue Service (IRS) and transfer information about their customers who are required to pay taxes in the United States.

Banks and financial institutions that have agreed to cooperate with the IRS must be entered in a special register and receive an identification number. In other words, Washington's fight against tax evaders is just an excuse to pass the law. The main goal of FATCA is to build a global financial system, individual "cells" of which would be subordinate to Washington!

At first, our Foreign Ministry described the law as an attempt by Washington to impose its dictates on other countries of the world. Officials even stated that if Russia began to comply with the FATCA conditions, this would be in conflict with Russian law. Since FATCA is contrary to Russian regulations on bank secrecy and the Civil Code of the Russian Federation.

But later, Russian Finance Minister Anton Siluanov unexpectedly announced that Russia was preparing a bilateral agreement with the United States on FATCA. At the same time, the bilateral agreement with Washington was not a guarantee against possible sanctions.

And in the summer of 2014, the State Duma passed a law on the transfer of US tax information under FATCA. And almost immediately, Sberbank of Russia announced that it had registered with the US Internal Revenue Service (IRS) in the status of a financial institution that complies with the requirements of this American law. Other banks have also rushed to register in the US.

As you understand, we are a sovereign state, and we decided to comply with the law of the United States of our own free will! Do you think it's good that all our banks began to comply with American legislation, or not? By the way, if someone would not want to fulfill this ending, then the United States would have every right to apply sanctions, withholding 30% of the amount of transactions involving American counterparties.

Economist Valentin Katasonov pointed out:

Katasonov made this statement almost 10 years ago, back in 2013. But how he looked into the water!

Sergey Lineenko, head of Gazprombank's international complex, said during his speech at the 15th annual conference "International Tax Planning 2022: Towards Other Shores".

In 2022, some Russian banks ceased to be listed on the FFI List and lost their GIIN identification number, which allows the IRS to write off a 30% tax on them. This is what an agreement with the United States looks like in practice!

Is there a Russian analogue of FATCA?

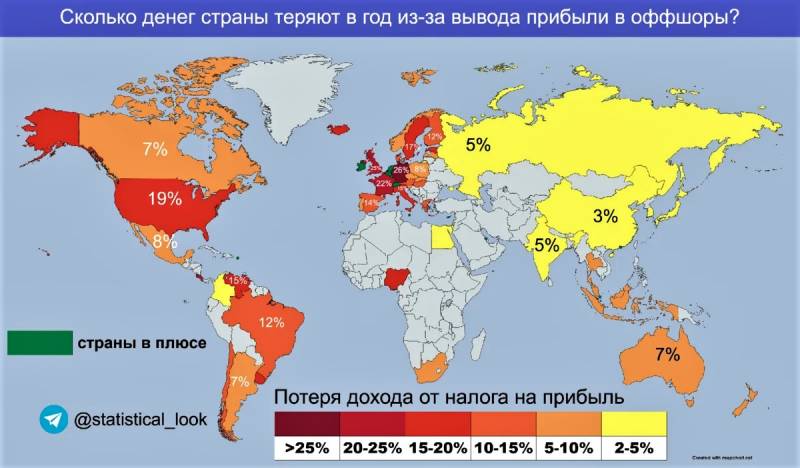

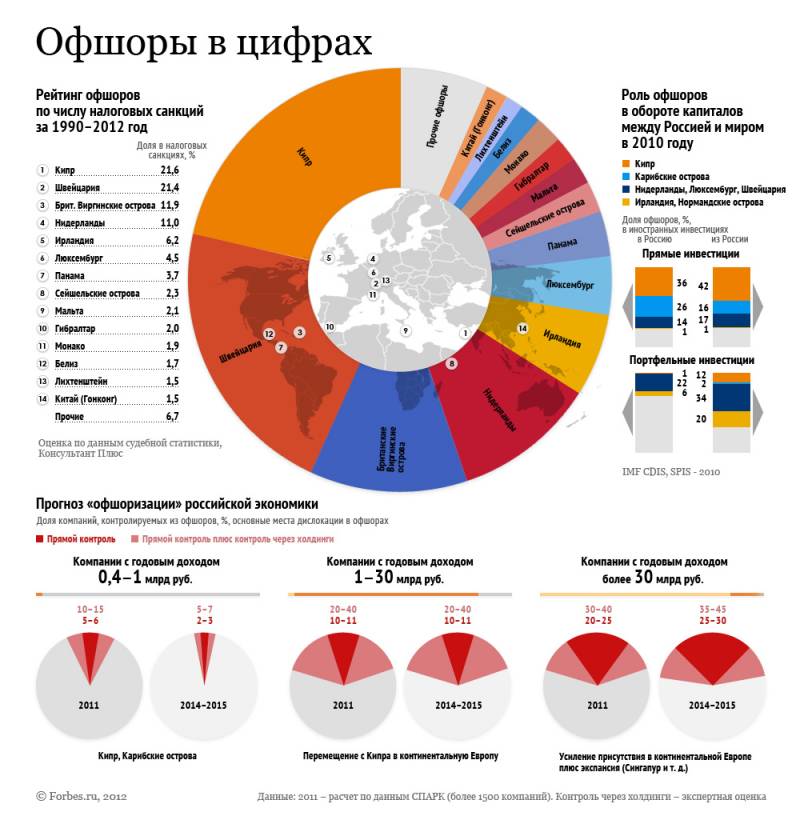

Alas, there is no such thing. And not yet expected. But, according to the Federation Council, over the past 20 years, more than 800 billion dollars have been withdrawn from Russia, and

At the same time, laws were passed in Russia that were supposed to help return capital from offshore companies home. The Government of the Russian Federation even developed a number of legal acts aimed at preventing the withdrawal of funds from Russian jurisdiction. And the plan itself was drawn up after the President spoke about deoffshorization in his Address to the Federal Assembly.

And so, on January 1, 2015, the Federal Law “On Taxation of Profits of Controlled Foreign Companies and Income of Foreign Organizations” came into force. All Russian taxpayers were required to disclose their direct or indirect participation in foreign organizations to the tax authorities.

However, if Russian taxpayers held offshore companies through a trust or nominal value, then such an obligation did not apply to them. But already in December 2015, Deputy Prime Minister of the Russian Federation Igor Shuvalov admitted the failure of the capital amnesty. In many ways, the failure occurred because billionaire businessmen began to become non-residents of Russia.

The fate of a non-resident

It turned out to be easy to escape from taxes: for this you just need to stop being a tax resident. And given that, thanks to such a step, a citizen immediately removes all his foreign assets from the attention of the Russian tax authorities, which was the goal of deoffshorization, we can say frankly: the popularity of the method is great.

It is very easy to become a non-resident: a tax non-resident of the Russian Federation is a person who has been in Russia for less than 183 calendar days within 12 consecutive months (clause 2 of article 207 of the Tax Code of the Russian Federation). Since the current legislation of the Russian Federation does not define a list of documents on the basis of which it is necessary to determine the period of stay of a citizen on the territory of Russia, the period of a person’s stay in the Russian Federation is established on the basis of the marks on his entry (exit) made by the Russian border service in the passport.

Egorov Puginsky Afanasiev & Partners conducted a study by talking to bank representatives, consultants and beneficiaries of controlled foreign companies. According to them, 40% of CFC beneficiaries renounced the status of a Russian tax resident, another 9% transferred their property to non-resident relatives.

And after all, these are mostly the richest people with serious foreign assets. For example, billionaire Alisher Usmanov ceased to be a tax resident back in 2015, since he lived in Switzerland, Monaco, Germany, Italy and other countries for almost the entire year. In December 2015, the former head of Uralkali Dmitry Rybolovlev (Monaco) and Elena Baturina (Great Britain) confirmed their non-resident status to Forbes.

The previously mentioned law on deoffshorization implied reporting on Controlled Foreign Companies or CFCs, as well as a declaration of assets both in Russia and abroad as part of an “amnesty”. However, in both cases, the requirement to pay taxes on assets applied to residents.

Having ceased to be a resident of Russia, citizens are required to pay only from Russian companies and other sources of income, but not from foreign ones. True, instead of 13%, the rate rises to 30%, but, apparently, in most cases this is not so scary - the owners of capital and assets still choose this path. So it's better for them. And further. From January 1, 2019, non-residents of the Russian Federation may not pay personal income tax when selling property owned for more than a minimum period of ownership (three years or five years).

Native expanses - Russian offshores

In 2018, it was decided to create offshore zones on the territory of Russia itself or special administrative regions - SAR with a preferential business tax regime. The ATS was created on the territory of Primorsky Krai on Russky Island and in the Kaliningrad Region on Oktyabrsky Island.

But at first, only an international company could be a member of the SAR, that is, a foreign company that changed its country of registration from another state to Russia. Already in 2019, aluminum producer En+, previously controlled by entrepreneur Oleg Deripaska, completed the registration procedure in a special administrative region on Oktyabrsky Island in the Kaliningrad Region.

This was stated in the notice of the company, published on the website of the London Stock Exchange. At the end of 2020, 37 participants were registered in the Kaliningrad SAR. At the end of March 2022, amendments were made to the Russian legislation on ATS. The main thing is that Russian holdings were allowed to become residents of the SAR and receive the status of an international holding company (IHC).

In addition, the term for exclusion of a company from a foreign jurisdiction has been increased to two years, and some requirements for documents submitted for registration have also been liberalized. And already at the end of April, four international companies that are part of the Kortros development group changed jurisdiction from Cyprus to Kaliningrad: it is known for projects for the construction of residential complexes in eight regions of the Russian Federation.

In 2021, Uralchem, billionaire Dmitry Mazepin, also re-registered in Oktyabrsky SAR. And just the other day I came from Kaliningrad news that the 86th resident was registered in the Kaliningrad offshore. According to the regional Development Corporation, the investments of SAR participants on the territory of Oktyabrsky Island in the Russian economy amounted to more than 55,4 billion rubles.

Vladimir Potanin's company Interros was registered in the SAR on Russky Island in 2021. The company Interros Capital LLC was registered on December 10, Interfax reported with reference to the Unified State Register of Legal Entities. Interros Capital Ltd, prior to registration in the SAR, had a "registration" in Cyprus and was called Bonico Holdings Co. Ltd.

She owns 30,17% of the shares of Norilsk Nickel. Interros is also a major producer of platinum and copper, a developer and manufacturer of pharmaceuticals and vaccines Petrovax Pharm, and owns the Rosa Khutor ski resort.

Personal funds and new laws

From March 1, 2022, citizens, including foreigners, have the opportunity to create personal funds and trusts for the purpose of managing property while still living in the SAR on the Russky Islands in the Primorsky Territory and Oktyabrsky Islands in the Kaliningrad Region.

Such amendments to the law "On International Companies and International Funds" were included in the draft law, which simplifies the procedure for re-registration of foreign companies in the SAR.

- explained the head of the ministry Maxim Reshetnikov.

According to him, the fund may consist of Russian and foreign property worth at least 5 billion rubles. Such funds will have particularities in terms of bankruptcy, applicable law and dispute resolution in arbitration.

A law was also passed banning public procurement from offshore companies.

Sergey Fakhretdinov, member of the Presidium of the General Council of Delovaya Rossiya, explained.

However, as is often the case, there are many gaps in the law. For example, the law does not establish a restriction on the participation in public procurement of Russian companies whose beneficiaries are registered offshore. Also, the problem of exporting assets abroad in the form of dividends from the development of state orders has not been resolved. What do you think, did it happen by chance or not?

Failure or not?

As you can see, the Government drew up a whole deoffshorization plan almost 10 years ago. And the laws were different. And what about in the end? Well, let's just say it's not all bad. And companies are slowly returning to their home harbor. And from January 1, 2023, new rules will be introduced that are designed to push the process of deoffshorization.

From 2023, 57 territories will be considered offshore zones, which is 15 jurisdictions more than the current list. The list includes Cyprus, Ireland, Singapore, Hong Kong, Switzerland, Montenegro, as well as two US states.

In addition, if now companies that are half or more directly or indirectly owned by offshore companies cannot apply for subsidies from the state, then from January 1, 2023, the threshold will be halved to 25%.

That is, there is progress. And foreign offshore companies remain offshore companies, but already ours. Maybe deoffshorization did not fail?

But here's a State Duma deputy, an economist, who instead of United Russia, as one might expect, ended up in the Fair, Mikhail Delyagin is more determined. He believes that deoffshorization is going too sluggishly, that there is nothing to stand on ceremony with offshore companies. In November of this year, he stated:

Honestly, I think that Delyagin is right. Especially now, when the SVO is underway, I consider those businessmen who have registered their company in offshore companies and do not pay taxes in Russia to be traitors to Russia. Why bother with such figures?

Information