“They have their dollars, and we have the mercy of Allah and the unity of the people”

And if everything became quite clear with the Iranian economy after the introduction of the next package of US sanctions last Tuesday, then with the much more stable and successfully developing Turkish situation in recent years, it looks much more complicated. It can be said that Turkey, following Iran’s policy of aggravating relations with the United States and its allies (from among the states of the European Union and from the Arab countries of the Gulf region), is taking long strides towards a serious financial and economic crisis.

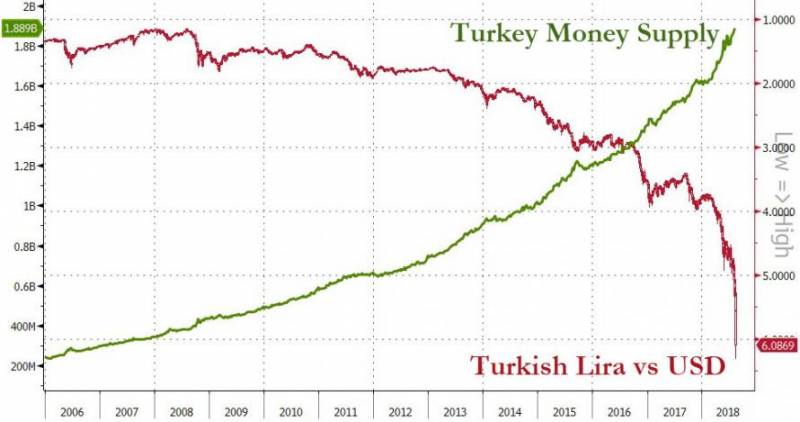

Throughout the world stock exchanges, the assets of Turkish and Iranian companies went off sale last week, which resulted in a drop in the exchange rate of the national currencies of both countries. 10 August, on Friday morning, the rate of the new Turkish lira fell to a historic low, - 6,39 for 1 USD. And this is despite the fact that during the previous trading day the rate of the Turkish lira lost almost 7% of its value, and this, by the way, is the biggest jump in one day of the exchange rate of the national currency of Turkey from 2001.

According to the calculations of analysts of the American financial group Goldman Sachs, with a course above 7 lire per dollar and more, the banking system of the Turkish Republic will be threatened, because it is already seriously suffering from gradually “hanging up” debts of industrial corporations, whose liabilities by 271 billion USD exceed their assets.

If we add to this that only officially in July and the first August decade, the currency of the former Ottoman Empire lost 16% of its value, then we get only the official depreciation of the new Turkish lira against the US dollar for 8 months of the current year by 38%.

At the same time, there appears not only a local issue with the prospects for the Turkish economy rolling towards the abyss, but also a more global problem associated with the extremely high credit links of Turkey and the EU, which has emerged in recent years. Yes, yes, what do you think, where did the European financial resources withdrawn from the Russian market go, and what are the successes of the Turkish economy? It is with the fact that European loans began to be massively extended to Turkish banks and actively invested in Turkish financial assets. Thus, the collapse of the economy of the direct heiress of the Ottoman Empire, unlike the Iranian one, will happen, with a high probability of dragging along to the bottom the leading banks of the European Union.

It should be noted that for a considerable period of the past years of the actually authoritarian rule of R.T. Erdogan’s 15, the Turkish economy enjoyed growth, relatively safely getting out of economic crises, which attracted investors.

However, according to some researchers, the Turkish president, although he won the last election with a large margin, but miscalculated, taking (after an attempt at military rebellion) the course of political confrontation with the West, hoping at the same time to keep the flow of Western investments in his economy.

Especially relations between Ankara and Washington have worsened in recent weeks in connection with the taking into custody of American Christian Protestant pastor Andrew Branson and employee of the American consulate Mehmet Topuz, arrested on charges of involvement in the preparation for the riots and the military coup.

In addition, recently, the interests of Turkey and the United States diverge greatly, if not to become diametrically opposed, in Syria and Iraq, where both countries have their military presence, primarily on the so-called Kurdish issue.

As a result of this, as well as for a number of other reasons, Western investors began to withdraw money from Turkish assets, investing in the high-tech economies of the most developed countries of the world, which caused the instability of the national economy of Turkey and the weakening of its national currency. The logical result: only in 2018, the official inflation reached almost 16%, which is more than three times the stated key rate.

The Minister of Finance of Turkey Beyrat Albayrak, who, probably quite by chance, is R. T. Erdogan's son-in-law, also added fuel to the fire. In his official public statement on Thursday, the head of the Turkish Finance and Economics Ministry, as if adopting the method of speaking from Iranian officials, limited himself to populist postulates, including reliance on Allah, and did not announce any decisive economic measures expected by investors.

All this, combined with the recently introduced US new duties on such important Turkish exports as steel (50%) and aluminum (20%), hit the economy of the former Ottoman Empire, causing the lira to “fly” even to 6,75 for a dollar .

So far, Turkish stock securities have been saved from further decline only by closing exchange sessions, however, financial analysts expect early next week the mass withdrawal of international investors from investments in financial assets of Turkey.

In combination with an extremely low level of control in the field of international capital transfer (unlike, say, Russia, which previously gave the Turkish economy significant preferences) and in the absence of experience in operating gold and currency assets, as well as their relatively small size, the prospects of Turkish enterprises do not look bright. So far, the only thing that R. T. Erdogan could do for the sake of preserving the national currency rate is to urge both the population and professional investors not to buy, but rather to sell their foreign currency and gold, while investing in the Turkish lira ...

Note that Ankara’s financial and economic problems have already hooked Europe: before 5% of its value, the shares of those banks that, according to experts, were most associated with the Turkish economy (for example, BNP Paribas, Uni-Credit and others) lost on Friday . Also, the euro fell against the dollar - to the value of 1,14, which is the lowest level since the summer of 2017.

According to most Western and some Russian experts, three factors can save the flourishing Turkish economy (unlike the Iranian one, which has been stagnating for decades) from a probable collapse.

Firstly, if Recep Tayyip Erdogan can go for it, then this is a sharp foreign policy turn towards the West (which means refusing to supply Russian air defense systems; a policy of reducing confrontation with Greece and other NATO members from among the neighbors of Turkey; an attempt to reach an agreement with the President The United States on the reduction of duties on the import of Turkish metals, the course for a more secular development of society and the state, etc.).

Secondly, Western analysts are proposing a sharp decline in Turkey’s independent geopolitical activity in the Middle East to restore the Turkish economy. This implies a general and significant reduction in military spending; refusal of confrontation with the Kurdish state gradually forming from the territories of Northern Iraq, Eastern Syria and South-Eastern Turkey; a new statement of readiness to support the United States and its allies in a possible war against Iran and so on.

Thirdly, the aforementioned experts recommend that the Erdogan government urgently turn to the International Monetary Fund for financial support in order to stop the depreciation of both the national currency and Turkish securities by means of loans received.

On the one hand, everything seems to be very correct and adequate advice, but we well remember that the road to hell is usually lined with good intentions ...

In connection with what is happening, it remains to add that only one thing can please the Russians: the domestic market of stock assets, and so is, has not been in a particularly good condition since 2014, and therefore some massive speculations (including Turkish securities) and the related hesitation on it is not worth waiting. Yes, of course, the exchange rate of the Russian ruble, as well as the Ukrainian hryvnia and a number of other national currencies, also fell, but this was done more “for the company”, on the basis of stock speculation, since it was not due to serious economic factors.

It should be noted that the share of Russian investments in the Turkish economy for the current period is very insignificant, so the likely “new crisis of the Ottoman Empire” does not affect Russia in the economic sense itself (as opposed to the military-political one) ...

Information