SIPRI Top 100: Largest Arms Manufacturers in 2014

General trends

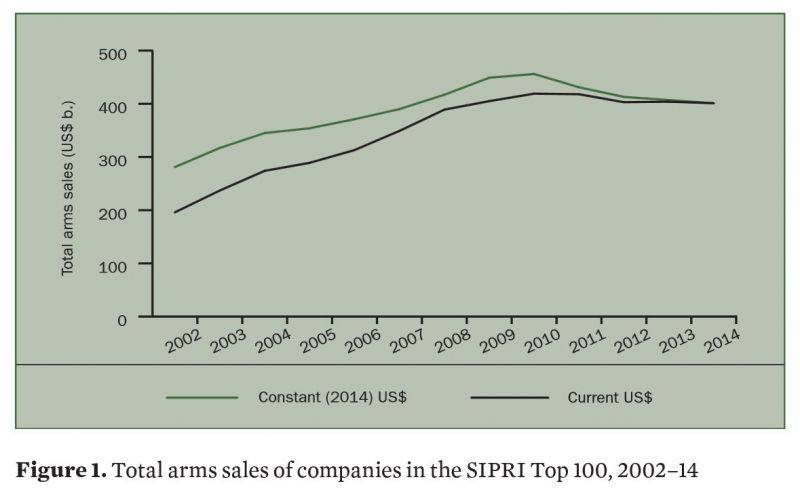

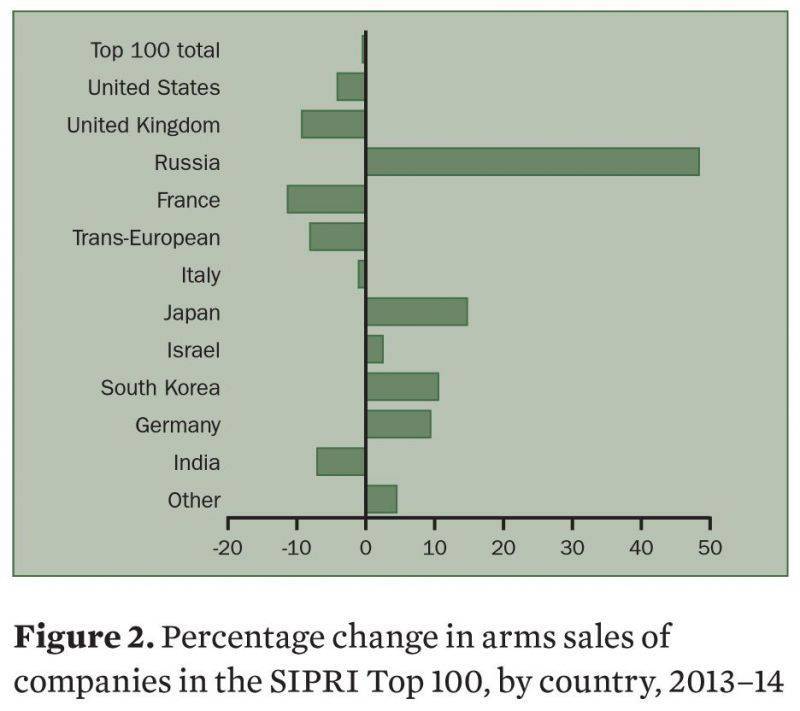

In a press release, traditionally accompanying the publication of the rating, the organization-publisher notes the main market trends observed during the period under review. This time, SIPRI writes that 2014 has once again been marked by a reduction in the global arms market, which is why these trends continue for the fourth year in a row. Compared to 2013, the drop was 1,5%, which makes it moderate. The 2014 cuts of the year hit the companies in North America and Western Europe the most. Organizations from other countries, in turn, increased their revenues and market share.

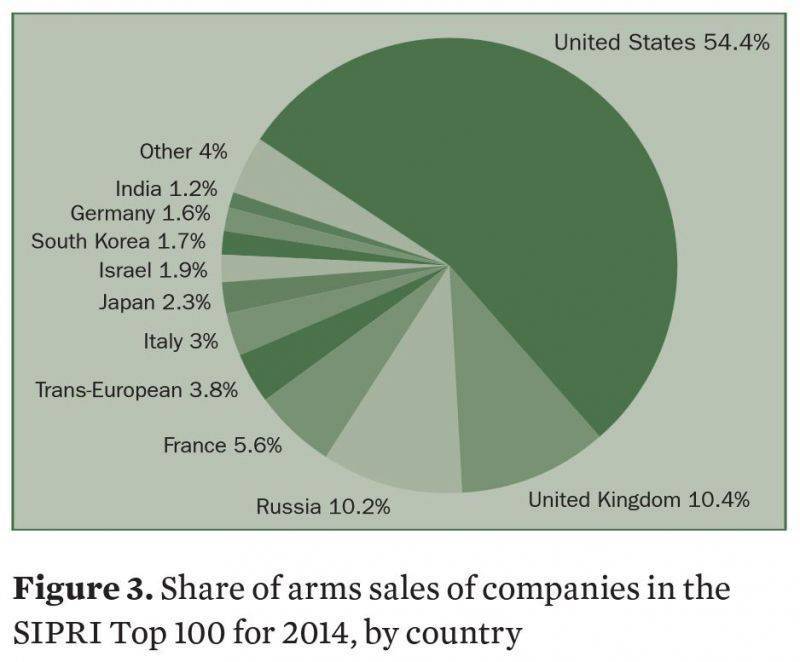

SIPRI notes that companies from the United States, as before, retain their leading position in the ranking. American companies account for 54,4% of the total sales of Top 100 firms. At the same time, US sales last year fell by 4,1%. Similar rates of decline have already been observed several years ago, in 2012-13. Only one company from the USA shows growth. Lockheed Martin increased its performance by 3,9% to 37,5 billion dollars, thanks to which it once again defended its right to the first place. SIPRI analysts believe that this situation in the upper part of the rating will continue. Not so long ago, Lockheed-Martin acquired Sikorsky Aircraft, which would only increase the gap between its pursuers.

In Western Europe, only Germany (9,4%) and Switzerland (11,2%) showed growth. In general, Western European sales fell by 7,4%. The successes of the German and Swiss industry are related to the growth of ThyssenKrupp (29,5%) and Pilatus Aircraft (24,6%) companies.

Despite economic problems, the Russian defense industry continues to show revenue growth. Due to this, in particular, the number of Russian companies in SIPRI Top 100 increased from 9 to 11. The list of Russian companies in the rating was supplemented by the holding company High-Precision Complexes and OJSC RTI. Mintsa Some changes in the list of Russian companies are associated with transformations. Thus, the concern "Constellation" gave way to the United Instrument Making Corporation, organized in 2014 year.

The best growth among Russian enterprises was shown by Uralvagonzavod Corporation, whose revenue on military contracts grew by record 72,5%. The Almaz-Antey Air Defense Concern also works well with 23 percent revenue growth.

It is noted that the growth of revenues of the Russian defense industry is associated with an increase in government spending on defense and the emergence of new orders from third countries. As a result, in 2014, their sales increased by 48,4% compared to 2013. From the point of view of the revenues of its companies participating in the rating, Russia is the undoubted world leader.

Also, in its press release, SIPRI experts touched on the topic of Ukrainian sales. In connection with the well-known events, the indicators of Ukrainian enterprises are falling. The company "Ukroboronprom" lost 50,2% of sales, because of what fell from 58 to 90 place. Another Ukrainian company, Motor Sich, left the rating due to falling sales. The cause of these events are the armed conflict, the loss of the Russian market, and the problems of the national currency.

In 2013, SIPRI introduced the Emerging producers category ("New Producers") into its ratings, the purpose of which is to track the achievements of countries that have not yet won a significant share of the international market. In 2014, Brazil, India, Turkey and South Korea were assigned to this category. For 2014, the defense industry in these countries earned 3,7% of the total revenues of the Top 100 companies, and their total income during this period grew by 5,1%.

Two companies from Turkey are included in the rating: Aselsan and Turkish Aerospace Industry (TAI). Aselsan increased sales by 5,6%, but dropped from 66 to 73. TAI, in turn, showed an increase in 15,1% and for the first time entered the rating, hitting the 89 place. Analysts say that Turkey seeks to reduce dependence on foreign companies, and also leads an aggressive export policy. All these factors contribute to the growth of sales of various companies, primarily Aselsan and TAI, which were able to get into the new rating.

The SIPRI Top 100 rating for 2014 a year includes a dozen and a half Asian companies (excluding Chinese), which show quite good growth. In particular, South Korean organizations increased sales by 10,5%.

market leaders

The international market of weapons and military equipment has long been divided between major players, which is why the upper part of the SIPRI rating rarely undergoes major changes. So, in the first ten only one line has changed. The French company Thales has dropped from 10 space to 12, allowing its immediate "pursuers" to climb the line above. After these changes, the top ten closes the American company L-3 Communications, and the Russian Air Defense Concern Almaz-Antey is now literally on the threshold of the top ten.

The leader of the rating, for several years in a row, is Lockheed Martin from the USA. Despite the general negative trends in the market, she managed to increase sales from 35,49 billion dollars in 2013 to 37,47 billion in 2014. At the same time, military orders accounted for 82% of revenues, while total revenue amounted to 45,6 billion.

The second place is left to Boeing, which, however, does not rely on military contracts. Of 90,762 billion, revenue for military orders accounted for only 31% - 28,3 billion. A year earlier, military sales amounted to 30,7 billion. Despite a noticeable reduction in revenues from the construction of military aircraft, Boeing retains second place in the ranking.

The three leaders are the British company BAE Systems with military sales of 25,73 billion from 27,395 billion dollars in total revenue (94%). Like Boeing, it showed a decline in sales, but the overall market situation did not affect the company's place in the ranking.

The fourth line was taken up again by the Americans from Raytheon, who earned billion dollars on military orders from 21,37. At the same time, military products accounted for 94% of sales totaling 22,826 billion. During 2014, the company's revenues fell: a year earlier, they accounted for 21,95 billion.

The top five closes the American company Northrop Grumman. In 2013-14, its sales of military products fell from 20,2 to 19,66 billion dollars. At the same time, such orders accounted for 82% of total revenues in 23,979 billion dollars.

Also in the top ten, according to SIPRI calculations, the companies included General Dynamics (USA), Airbus Group (Europe), United Technologies Corp. (USA), Finmeccanica (Italy) and L-3 Communications (USA). Their revenues on the supply of military products ranged from 18,6 (General Dynamics) to 9,81 (L-3 Communications) billion. A noticeable gap between different companies, as well as almost simultaneous growth and decline in indicators, leads to the fact that the top ten do not undergo any changes.

Russian companies

In the SIPRI Top 100 ranking for 2014, 11 Russian defense enterprises are present. At the same time, however, the report contains 19 organizations. The fact is that in the rating “out of the total offset” there is data for some plants and enterprises that are part of larger corporations. They are not full participants in the rating, but they are still included in the summary table with the corresponding note, and their location is determined in accordance with the main financial indicators. This time Russia is represented by eight such organizations.

The best results in 2014 year showed Concern Air Defense "Almaz-Antey". Sales of air defense systems and other military products with a total volume of 8,840 billion allowed him to rise one position in comparison with 2013 and take 11 place. Revenue growth for the year amounted to 800 millions. The total revenue of the Concern last year was 9,208 billion dollars, of which military orders accounted for 96%.

From 15 to 14, the United Aircraft Corporation has risen to the line with annual revenues of 6,11 billion dollars (80% of all sales of 7,674 billion). In 2013, aircraft manufacturers delivered products worth a total of 5,53 billion. Like Almaz-Antey, the KLA showed a high growth rate in percentage terms.

Following the KLA is United Shipbuilding Corporation, which managed to climb 17-e from 15. Such an increase contributed to the growth of revenues from military contracts from 5,11 to 5,98 billion. Military ships accounted for 82% of orders, and total revenue for the year amounted to 7,329 billion.

Russian Helicopters Holding has risen by three lines and is now at the 23 site. Last year, he supplied military hardware for 3,89 billion dollars against 3,5 billion in 2013 a year. Military equipment accounted for 90% of orders, while total sales amounted to 4,3 billion.

For the first time in the SIPRI ranking, the United Instrument Making Corporation, formed last year, is present. The production and sale of military products with a total value of 3,64 billion dollars allowed it to start from the 24 site. The total revenue of this corporation last year was 4,019 billion (91% on military orders).

The tactical missile armament corporation, which now occupies the 34 line of rating, has risen to a dozen places. Over the year, its military revenues increased from 2,23 to 2,81 billion dollars (95% of total income in 2,96 billion).

The only Russian organization that failed to maintain or improve its place in the rating is United Engine Corporation, which has shifted from 36 to 38 place. The reason for this fall could be a reduction in sales of 120 million dollars to 2,6 billion. However, engines for military aircraft account for only 61% of total revenue in 4,267 billion dollars.

Another newcomer to the ranking, representing Russia, is the High-Precision Complexes holding, starting from the 39 location. This organization deals only with military products and last year sold products worth 2,35 billion dollars.

Sukhoi is part of the United Aircraft Building Corporation, but is included in the "out of competition" rating. Revenues in 2,24 billion (2,32 billion dollars in 2013 year) would allow it to take the place 45. Interesting information about non-military orders is given: according to SIPRI, Sukhoi last year sold similar products for just 3 million dollars.

Instead of “Sukhoi”, the “Radioelectronic Technologies” Concern is located on the 45 location with sales at the level of 2,24 billion dollars. Rising from 54 locations to 45-e The Concern was helped by sales growth from 1,85 billion 2013 of the year. Military contracts account for 82% of total sales of 2,731 billion.

Swedish analysts do not have complete information about the sales of the Russian corporation Uralvagonzavod, but they nevertheless collected the available data and made conclusions. According to SIPRI estimates, in 2014, the organization sold military products to 1,45 billion dollars - 510 million more than in 2013. This allowed Uralvagonzavod to rise from 80 to 61. Interestingly, military orders accounted for only 44% of all revenues at 3,317 billion dollars.

In the 2013 rating of the year, the Constellation concern was located on the 85 site. In 2014, he joined the United Instrument Making Corporation, which is why he is no longer an independent participant in the rating. However, thanks to the growth in military sales from 910 to 1270 million dollars (89% of total revenue in 1,428 billion), Constellation could take 66 a place.

68 would be a place for Irkut Corporation, which, nevertheless, is part of UAC. This organization last year earned 1,706 billion dollars, of which 73% or 1,24 billion accounted for military equipment. Compared to 2013, the year has seen a drop in performance - during this period, Irkut earned 1,37 billion on military orders.

71 could take place Ufa Engine-Building Production Association (UMPO), which is a division of the United Engine Corporation. Last year, it earned 1170 million dollars - 70 million more than in 2013. Total revenue was 1,272 billion dollars (92% on military orders).

The Sevmash plant, belonging to the United Shipbuilding Corporation, could take the place of 75, earning 1,04 billion last year. The annual growth of military revenues amounted to only 10 million. In total, Sevmash fulfilled orders worth 1,339 billion dollars - 78% fell on military contracts.

The line below could be located the company "MiG", which is part of the KLA. In 2013 and 2014, she earned 950 and 1020 million dollars, respectively. At the same time, all orders concerned only military equipment.

Last year, Zvezdochka, a USC company, earned 990 million dollars on military contracts, which would allow it to take the place of 80.

Admiralty Shipyards fulfilled orders with a total volume of 900 million (40 million more than in 2013). The warships accounted for 95% of revenues totaling 946 million. Such indicators would allow the plant to rely on 87 place.

For the first time in the "Top 100" on the 91 place entered the organization RTI them. Mintsa engaged in the production of electronics. In 2013-14, she improved her revenues from 780 to 840 million dollars (45% of all contracts totaling 1,844 billion). It is noteworthy that in the 2013 year, this organization almost fell into the rating, stopping at the 101 place. Now she rose to a dozen positions and became a full participant in the "competition".

***

According to the Stockholm Peace Research Institute, the main trends in the international market for armaments and military equipment remain unchanged. General market indicators are falling, the share of some countries is growing, and sales of others are declining. At the same time, despite all these trends, a dozen leaders remain almost unchanged, and enterprises of the Russian defense industry mainly show strong growth. A good demonstration of this growth is the increase in the number of Russian enterprises from 9 to 11, as well as the entry of several out-of-competition organizations.

Unfortunately, SIPRI takes too much time to process and rating the weapon manufacturers. The report is published only by the end of the year following the one under consideration. Thus, changes in the market this year, as well as new indicators of domestic and foreign enterprises will be consolidated into a new rating and published only a year later. However, before this, SIPRI will publish several other reports on the state of the world arms market, which means that over the next year, specialists and the interested public will not be left without food for thought.

Press release release report:

http://sipri.org/media/pressreleases/2015/SIPRI-Top-100-December-2015

Full report:

http://books.sipri.org/files/FS/SIPRIFS1512.pdf

Information