The death of capitalism: ahead is the “new slave system”

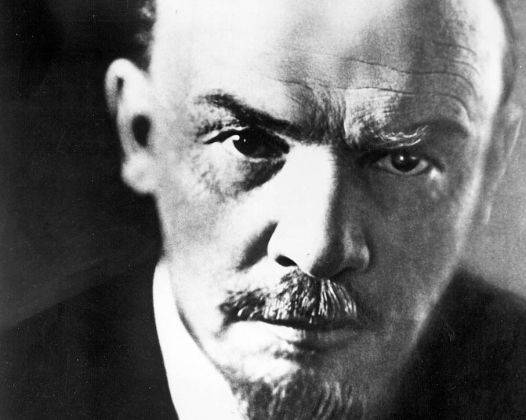

I have already written many times that world capitalism has entered a new and final phase of its development. Almost 100 years ago (in 1916), V. Lenin (Ulyanov) wrote the book Imperialism as the Highest Stage of Capitalism. In it, he stated that at the end of the 19th and the beginning of the 20th centuries capitalism became monopolistic, and that such capitalism was the last stage in the development of this socio-economic formation. The classic hurried somewhat with the imposition of the death penalty on capitalism.

Humanity had to wait another century until, finally, we personally witnessed the death convulsions of capitalism. Outwardly, everything looks prosaic. The world of capital has entered a phase of zero and negative interest rates. And these are not some “temporary difficulties”, but a sustainable new quality of the economy. Capitalism is a model in which the highest, ultimate goal of economic activity is profit. In the form of industrial or commercial income, loan interest. Profit provides capital gains, it becomes, as the classic Marxism said, “self-increasing value”. So the "self-growth" of capital is over. It began to "decrease".

The core of the capitalist model is banks with their lending rates. In the banking sector, you can trace the unique metamorphosis of interest. A modern bank is a depository institution. It attracts money on deposits at a certain percentage and gives loans at interest. After the financial crisis, 2007 − 2009. in the world began to be observed a mass phenomenon to reduce deposit interest. The trend has gone so far that in some countries and in some banks deposit interest (not only real, but also nominal) has gone into the negative zone.

First of all, the central banks began to establish negative interest rates on deposits. The first to do this was the Central Bank of Sweden. He was followed by several European Central Bank. Last June, the European Central Bank (ECB) lowered the deposit rate from 0 to minus 0,10. Such actions of central banks were explained by the fact that the monetary authorities tried to overcome the economic stagnation, force commercial banks to lend to the economy, and not sit out in the “quiet deposit haven”.

After some time, the epidemic of negative interest rates on deposits began to seize private commercial banks. At first it was the banks of Switzerland. In fairness it should be recognized that in the past some of them took money from customers for placing money on deposits. It was a fee for the “service” of confidentiality. A very popular "service", given that money flowed into Switzerland with a very dubious origin. Today, bank secrecy in Switzerland is almost completely eliminated. Therefore, today negative deposit rates do not represent a fee for a delicate “service” of a bank to a client. They are dictated by the economic conditions of the banking business.

It should be emphasized that the Swiss monetary authorities encourage a similar interest rate policy of their banks, since it holds back the flow of free capital into this country from all over Europe. Financial and economic instability in the European Union increases the investment attractiveness of Switzerland (even despite the fact that bank secrecy has been eliminated). But a powerful influx of money into Switzerland sharply increases the Swiss franc, and this creates big problems for the country's economy. In Switzerland, there is a paradoxical situation when banks are protected from the influx of customers with the help of negative interest on deposits.

Yes, this is the Swiss specificity. But in neighboring Germany, a number of banks also announced negative deposit interest rates. How can this be explained? - Negative interest on deposits is a necessary measure, since banks have sharply sunk their income from active operations. Especially on credit. So far, loans have not reached negative interest rates, but positive values in some cases have decreased to 2 − 3%. Money has become almost free. And in some countries, where there is at least a small inflation, real interest rates (nominal rates, adjusted for changes in the purchasing power of money) went into the negative zone.

In this difficult situation, it is unprofitable for banks to engage in their traditional deposit-credit industry. They go to financial markets, shifting the center of gravity of their active operations from loans to investments. But under the "investment" actually lurking banal speculation with all sorts of financial instruments. However, in the financial markets for the speculators come the hard times. In Europe, over the past two or three years, a large number of government debt securities with negative interest have appeared. Speculators, of course, try to play with such "cards", but this game is extremely unusual and does not bring fabulous profits. And losses happen more often.

However, the phenomenon of zero and negative interest rates is still mainly observed in the countries of the “golden billion”. There, the reduction of interest rates on deposits, loans and financial instruments is greatly facilitated by the monetary authorities, who pursue a policy of “quantitative easing”. Simply put, central banks turned on the “printing presses”, continuously throwing huge amounts of money into the economy. There is an "overproduction" of money. And with the "overproduction" of any product, the price for it falls. Money in this sense is no exception.

But on the periphery of world capitalism, central banks are strictly forbidden to engage in "quantitative easing." They were ordered to engage in the exact opposite - “quantitative tightening”. Simply put, the contraction of the money supply. Therefore, on the periphery of world capitalism, interest rates remain (so far) at a high level. For the world of usurers, Wall Street, the City of London, and other banking centers of the country, the periphery of world capitalism is a lifeline. Here they continue to feel like classic money capitalists. However, sooner or later, an epidemic of negative interest will reach the periphery of world capitalism. There are signs that already got.

In 2015, capital began to withdraw from the periphery of world capitalism to the countries of the “golden billion”. First of all in the USA. According to the Institute of International Finance, in the third quarter of 2015, investors sold assets in developing countries for 40 billion dollars and brought them to the “golden billion” zone. This is the worst quarterly indicator of capital outflows from 2008. The sharks of the capitalist business have gnawed fairly third-world countries and are returning to their safe havens. The latest surveys of peripheral companies of world capitalism, as reported by the latest issue of The Economist magazine, show that more than 20% of companies have interest payments higher than their income before taxes.

According to other sources, in many third world countries, the net profits (ie, after-tax profits) of the corporate sector are comparable to the costs of servicing foreign debts. Corporate debt in developing countries has grown fivefold over the past decade and today amounts to $ 18 trillion dollars, or more than 70% of GDP, notes The Economist in the UK. How to explain this phenomenon of net capital outflow from the countries of the periphery of world capitalism? - Apparently, the base in the form of corporate profits to maintain high interest rates in this area is rapidly eroding.

Partly, the phenomenon of the movement of capital into the “golden billion” zone, into quiet harbors with zero or even negative interest rates can be explained by the fact that the era of so-called passionary capitalists has already passed. We are dealing with very strange capitalists who choose security and sacrifice profits. At one time the classics of Marxism, wrote: "Provide 10 percent, and capital to agree to any application, at 20 percent he becomes animated, at 50 percent positive is ready to break his neck at 100 percent, he tramples on all human laws, at 300 percent there is no crime which he would not risk, even under the gallows fear. ” These words do not belong to Marx, but to Thomas Joseph Dannin, the classic only quoted him. But in any case, the spirit of capitalism, these words conveyed very accurately.

Today's capitalism is different. Earlier this year, Jacob Rothschild, president and principal shareholder of the investment fund RIT Capital Partners, has published an annual report on the Foundation's activities in 2014 In it, he admitted that in the coming years, not capital gains will be the main goal of the business, and its preservation. The meaning of his statement is as follows: they say, it is necessary to go through hard times, and then we will return again to our usual and beloved business (capital increase).

I am afraid to disappoint Rothschild: there will be no return to the past. And I recommend to reread "Capital", in which the classic formulates a law - the tendency of the rate of profit to decrease. All the century and a half, the rate of return really went down, today it is already at the level of "plinth". Aggregate capital will not increase, since real GDP growth has already ended. Begin a brutal time of "black redistribution" of capital balances. The majority of capitalists, deprived of their former “passionarity”, will seek refuge anywhere. Even in financial instruments with a negative percentage.

In mid-September, a meeting of the Board of Governors of the US Federal Reserve was held. Everyone was tensely waiting for this meeting, because the crucial question had to be decided: should the Fed raise or not raise the interest rate? In other words: to return to the times of classical capitalism with a lending rate or extend the “interest vacation”? The Federal Reserve decided to extend the “interest vacation”. Fed officials had to choose between "bad" and "very bad." Judging by the decision, they considered “bad” the preservation of the interest rate close to zero. A "very bad" - its increase. For the money will cease to be free, and this may introduce the American economy into a "tailspin" with unpredictable economic, social and political consequences.

The countries of the periphery of world capitalism also breathed a sigh of relief. For even the establishment of accounting rates by the Fed 1-2% level it would be a disaster for them: to the mass flight of capital to the "land of promise", ie, in the financial and banking system of the USA... We know the saying: “Nothing is more permanent than something temporary.” The “quantitative easing” programs in the USA (and later in other Western countries) were launched as “temporary”. However, the West will not be able to abandon them. Recently, the Treasury Department announced that the interest rate on US Treasury securities was set at zero. This is a landmark event, indicating that there will be no return to the previous capitalism.

The classics of Marxism-Leninism said that in the process of capitalist accumulation, the rate of profit (and loan interest as the main form of profit) would inexorably decrease. And this will inevitably lead to the "death" of capitalism. We can agree with that. True, at the same time, we add that the classics did not have enough imagination to imagine that the loan interest could fall below zero. Negative interest rates tell us: capitalism has become a corpse. But at the same time for some reason no one has the courage to fix the fact of death.

Speaking of the antagonistic contradictions of capitalism, the classics made an “iron” conclusion that socialism would replace capitalism. But with this you can not fully agree. There is no “iron” determinism in stories There can be no. The “owners of money” realize that the capitalist model of the economy and society that has existed for several centuries has become obsolete. And "routinely" prepare humanity for the transition to a different model, where they could be masters, but no money, and the whole world as a set of natural resources, the material productive forces and all people on the planet.

Moreover, power over people should be extended to their consciousness. Without an understanding of tectonic processes in global capitalism is difficult to understand many of the current events in the world: the emergence of LIH, war in the Middle East, "migration of peoples" in Europe, the "democratic revolution" in Ukraine, etc. All of these are elements of a gigantic project to transform doomed capitalism into another socio-economic formation, which can be called the “new slave-owning system”. You can resist new slavery only if you understand what the plans of the current "owners of money" are.

Information