If you do not have gold, gold has you

The real dollar exchange rate is only 6,28 rubles per dollar

As the economic and political problems in the world grow, the idea that when Russia and China buy up all the gold in the world, the American dollar will come full and final Karachun, is gaining increasing popularity. In its favor are two current news. As Peter Hambro (chairman of the board of the Petropavlovsk metallurgical holding) told BloombergTV, in recent years, India and China have been buying up all the real gold on the London Metal Exchange (LME). This is also confirmed by A-Mark, one of the world's largest wholesale dealers in precious metals. Plus, a number of countries have announced plans to return the national gold reserves to their own vaults. In particular, the Netherlands reported this in August: the kingdom intends to transport more than 120 tons to the country, or about 20% of its gold reserves. In general, as follows from the published statistics of the US Federal Reserve, over the past year and a half, the central banks of other countries have already taken 246 tons of ingots belonging to them from the Federal Reserve Bank of New York.

Nevertheless, it must be admitted that the idea of destroying the American dollar through buying gold — with all its visual attractiveness — is in fact quite far from the real situation.

About the connection between gold and tradition

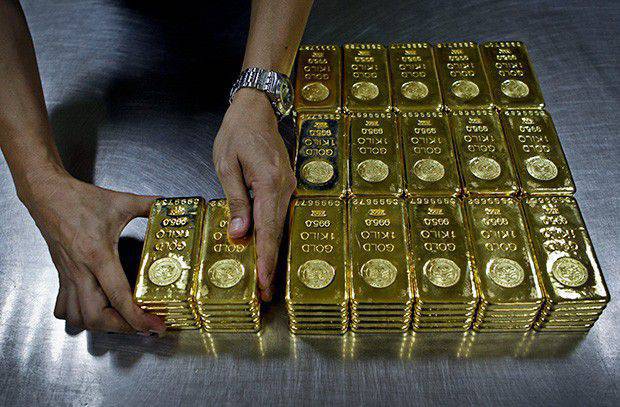

Formally, everything is correct. There are two gold markets at the same time in the world today: physical and paper. Moreover, the second in terms of real weight in tons is more than ten times higher than the first in terms of trading volume. If there are no problems at the auction of various kinds of “gold-backed stock instruments” (for example, derivatives) with supply, then real gold on the trading floors in the world is offered in total 2450 tons per year. Of these, only 10% is converted into bank bars, that is, investment assets, the rest is spent on jewelry and industrial needs, including electronic. It is not surprising that 2450 tons are sold out quickly throughout the entire planet every year, especially in light of the many signs that the ideal financial storm is approaching.

Another question is that this process is indirectly related to the prospect of a dollar falling. More precisely, everything is exactly the opposite. It is not gold that is being bought up to derail the dollar, and fears that in the near future, the dollar crisis will force everyone to look for ways to preserve their capital.

In this sense, there are not so many options available on the planet: for example, real estate, weaponbut the main thing is gold. It has been a recognized value for at least 3 for thousands of years, and there is hardly any reason to expect this tradition to break in the near future.

However, this process is in conflict with the US plans to squeeze world capital from other countries to support the growth of its economy. At least during the time that Washington will need to induce Europe to sign the TTIP agreement, gold prices should not rise, otherwise investors will rush to buy gold instead of US stocks and Treasury debt securities. It is appropriate to recall that 3 / 4 of all world paper gold trading is concentrated on the stock exchange in New York, that is, they are in the zone of direct American official and unofficial pressure. That is why there is such a paradoxical situation, when physical gold is in short supply, but the price officially fixed for it remains low. Moreover, leading players like JP Morgan Chase in their “analytics” predict its further decline.

How much is gold in money

However, the multiplication table does not matter whether you are selling or buying. The excessively aggressive attempt by the United States to bend the world to its own economic needs only exacerbated the imbalance between the size of the American economy and the degree of use of its currency. The share of US GDP does not exceed 20% of the world, while US dollars participate in 80% of all global economic calculations. As Washington loses global leadership, there is a growing fear of the inevitable crisis of the settlement system in the event of a sharp exclusion of the US currency from them. First of all, because the mutual rates of all the rest of the money on the planet to a decisive degree are formed through the dollar.

Another question is that it can not be instantly replaced with gold. The current price of gold metal is rather weakly connected with economic realities. Judge for yourself. In total, about 150,4 thousand tons have been accumulated in the gold world Of these, in the form of coins and settlement bars - 24 thousand tons, and another 30 thousand tons lie in the numbered "golden bricks" in the vaults of the central banks of the countries of the world. At the current price of 1094,9 dollars per troy ounce (31,1 grams), it turns out that a ton of gold today costs about 34 million dollars. Consequently, the total value of the entire gold reserves of the planet does not exceed 5,25 trillion dollars. At the same time, the total money supply, or the total amount of money on the planet, is 71,5 trillion dollars. Of these, by the way, 70,4 trillion belongs to the economies of the largest countries 50.

Actually, this is precisely the reason for the shortage of real gold on the trading floors of the world. If you count in money, then the available money supply is enough to purchase a quantity of gold, in 13,4, times larger than it generally exists in the world. This is if you count all the gold and do not take into account that only one fifth of it is available for investment, that is, the actual effective demand exceeds supply by 67 times.

Towards a dollar-free world

Therefore, no matter what cheating methods the United States resorts to in the gold market, they cannot completely reverse this tendency. Through influence on the pricing process and control over the “paper gold” trading, Washington still manages to keep prices low, but artificiality, which means that this situation is not forever obvious to almost all serious players, and above all to specialists of central banks of the world. That is why the process of returning gold under its control is gaining momentum every year.

Take, for example, the same Germany. On paper, it has one of the largest gold reserves. On 31 December 2012, 3391 was listed on the state balance sheet. However, there are only 1036 tons, or 31% of national gold, directly in the depositories of the Bundesbank in Frankfurt. The rest lies in the Federal Reserve Bank of New York (1536 tons, or 45%), in the Bank of England in London (450 tons, or 13%) and for some reason in the Bank of France in Paris (374 tons, or 11%). In other words, 69% German gold is located anywhere, just not in Germany, therefore it is considered German only on paper. For example, if France fights with Germany, which she does with a laudable consistency at least twice a century, the Parisians are unlikely to be so gallant to return their gold reserves to the Germans. And in peacetime, this is not an easy process: for example, from 84 tons, which the Bundesbank was going to return to the country in 2012, in reality, it turned out all 37. As for the United States, during the 20 years (from the 80 of the twentieth century), the Fed refused to allow German inspectors to store their German (!) Gold stored in their vaults.

It must be admitted that not only Germans face such problems. Austria and the Netherlands cannot return their gold from the USA. Although the process, of course, is underway, albeit with difficulty and delay, but it’s still necessary to return the stocks to the real owners. As a result, American gold reserves fell to 5950 tons, the lowest in 20 years.

Owners are in a hurry to return stocks under personal control precisely because they consider the prospect of de-dollarization of the world economy to be very, very real. In this case, everyone will need some new common denominator to determine the mutual value of national currencies, and they can only be gold. As in view of the traditional universal recognition of its value, and because it is stable and does not deteriorate over time. Moreover, if the world returns to the principles of the gold standard again, it may very well be that under various pretexts the USA will simply refuse to return the gold. And what to do, say, to Berlin? Move your Tanks to Washington or land a Marine Corps in New York? The unreality of such a scenario is obvious, because it is much calmer to prepare for changes in advance, while this can be done in a relatively peaceful way.

New gold standard

About relativity is not said a word for the sake of. The world economy today is a very complex and highly intricate mechanism of billions of direct and reverse links. So far, it is synchronized through a relatively clear system of exchange rates, besides, any country in the world can influence the value of its money, for example, through the launch of a printing press. Now imagine for a moment that the dollar is no more, and no one knows how much, say, a barrel of oil should cost in yuan or rubles. The seller, of course, wrote some number on the price tag, but ... how much will it be in British pounds or Polish zloty?

The current exchange rate of the Russian ruble to the dollar is 67,95 rubles / dollar (securities for 15.09.2015). However, if we take it through gold, then the Russian ruble (the aggregate money supply 15,8 trillion rubles, gold reserves 1246,6 tons) can have a security in 0,000079 a gram of gold. Calculated according to the same scheme, the US dollar (the aggregate money supply 12 trillion dollars, gold reserves 5950 tons) is provided 0,00049 grams of gold. Accordingly, in terms of gold reserves, the ratio of these currencies is only 6,28 rubles. per dollar, which is very different from today's exchange rates.

Similar calculations show that if Berlin introduces a new German mark tomorrow (the aggregate money supply 2,8 trillion dollars, the gold reserve 3391 ton), it will be provided with 0,0012 grams of gold. French franc - 0,0023 gram. British Pound - 0,00013. Thus, instead of 77 Russian rubles for one euro, it would be 15,19 rubles. for German mark or 29,11 rub. for french franc. And instead of 104 rub. for the British pound would give only 1,64 rubles.

It is easy to understand how serious a crisis will arise during the transition period, when the dollar mechanisms will no longer work, and the new gold standard will be only at the start. Here the question is not even in particular particulars like the threat to our import substitution or the scale of oil and gas revenues. Complete, which means painful restructuring will affect absolutely all the economies of the world. Today, the euro against the dollar is 1,12, while under the gold standard, the dollar can be worth the German mark 0,4 or the French franc 0,21. Not to mention the fact that, instead of a common currency, national ones will probably be reintroduced within a single Europe, and then trade between the same France and Germany will take the mark for the franc 1,91.

This will radically change the structure of the entire world economy. For example, it is easy to imagine what will happen to the standard of living in the UK, if it suddenly turns out that European goods will have to be bought not for 1,41 euro per British pound, but, say, for 13,46 pound for one euro. Welcome to the club of the poorest countries in the world!

* * *

The scale of future changes is such that today they can hardly be presented at all, and even more nobody can describe them in tables and graphs. All governments are most afraid of the unknown, and therefore with all their strength they postpone the onset of the crisis, even to the detriment of the interests of their own country. It is clear that the British economy, on 50% dependent on the provision of services, in this case will go bankrupt, and its super-expensive real estate, today often serving as an excellent pledge in financial transactions, to put it mildly, will slow down in price. There is no doubt also the inevitable food crisis in Europe. The profitability of Russian export goods, by the way, will also undergo significant changes not for the better.

Although it should be recognized that any large-scale changes in large complex systems lead not only to losses. The Chinese concept of crisis is designated by a combination of two characters, meaning danger and chance. So the chances in the new conditions to build a more adequate and more efficient economy is for everyone. Another question is that at this stage they are practically not calculated in any way for the future. Therefore, all the leading players prefer to simply stock up with gold, so to speak, just in case. From time immemorial, gold has allowed us to experience global crises of any scale, and traditions because traditions are time tested. When the Khan comes to the dollar, gold is better to have than vice versa.

Information