Experiments costing sovereignty

The inflation targeting policy adopted by the Central Bank of the Russian Federation has completely failed: instead of suppressing inflation, we have a surge in rising prices and inflation expectations, unacceptable ruble swings swayed by speculators and disastrous for the real sector reduction in the money supply in the economy

The surprising combination of the self-confidence of the representatives of the monetary authorities of 1 with the failed results of their policies is alarming for the country's economy. If economics is the science of the rules of housekeeping, then the constant leakage of money, minds and resources from this very economy cannot be considered normal. This leakage has been going on for a quarter of a century, contrary to the aspirations of economists invested with authority, frozen in anticipation of the influx of both. While they are talking about improving the “business climate”, the cumulative capital outflow exceeded one and a half trillion dollars, more than a million educated minds left abroad, and resources, raw materials and materials were pumped out in energy equivalent to no less than fifty billion tons per unit of standard fuel.

In the same quarter of a century, the Chinese, who at the same time began the transition to a market economy, began to live an order of magnitude better, five times ahead of us in terms of production and three times in the number of scientists. Yes, and other countries did not stand still, mastering the production of a new technological order, raising the level of education of the population, increasing investment in the modernization and development of infrastructure. Therefore, in terms of the level of development of the economy and human potential, we consistently descended to underdeveloped countries. In the fat 2000, this slide has stopped, but in recent years, against the backdrop of the revival of the economies of other countries, it has begun again.

Why, having the highest level of national wealth per capita in the world, did we go down to the underdeveloped countries in terms of the level of income derived from it? And we continue to fall, while the world economy comes to life on the eve of a new long wave of economic growth?

The reasons for the ruin of our economy must be sought in the peculiarities of its management. If half of the production capacity is idle in the country, workers work at half strength, knowledge of scientists and engineers are not claimed, this indicates unsatisfactory management system efficiency.

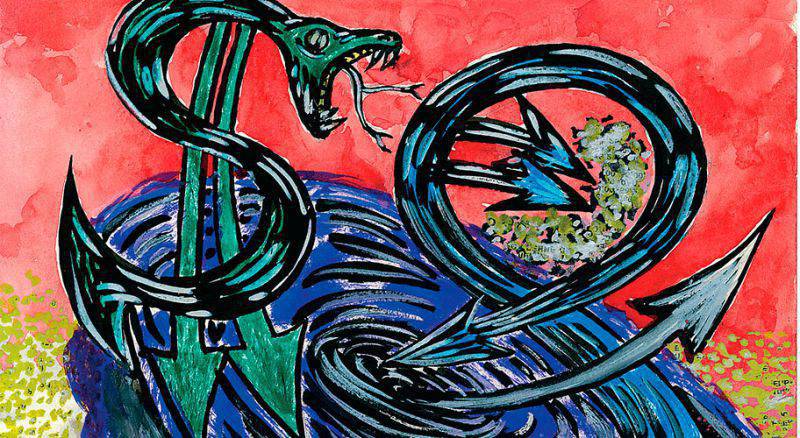

Speculative funnel

According to the results of 2014, currency speculators, profiting from the devaluation of the ruble, and now continuing to profit from its revaluation, became the leader in making profit. Throughout the past year, the profitability of currency speculation against the ruble was tens of percent per annum, and after lowering the exchange rate of the ruble to free float, it went off scale on other days in a hundred. At the same time, the profitability of the manufacturing industry dropped to 5%, the solvency of enterprises in the real sector significantly decreased. The terms of their lending gradually deteriorated as the Bank of Russia increased its key rate. After it was raised to 17%, credit for the majority of enterprises in the real sector became unavailable, and the liquidity remaining in the economy rushed to the foreign exchange market. Its subsequent collapse was the logical result of both manipulating it and the policy pursued by the monetary authorities.

This year, the policy of stimulating currency speculation continued. In order to reduce the demand for currency on the stock exchange, the Bank of Russia has launched a refinancing mechanism in foreign currency for repo transactions. Thus, he created a new channel for the enrichment of speculators, now on the appreciation of the ruble. Taking foreign currency loans under 2%, banks convert them into rubles, buy OFZs under 10%, and then sell them and convert them into currency again at the already increased ruble rate. Taking into account its growth by one third, it is easy to calculate that the profitability of these monetary and financial speculations was the same 30 – 40%, and for 1 insiders - an order of magnitude more than last year at a smooth decline in the ruble exchange rate.

The duration of the upward trend of the ruble is limited by risk assessments - lower oil prices, the introduction of new sanctions, toughening of the distribution policy of currency SWAPs of the Central Bank, etc. After 26 in May, the trend changed. Now they are speculating on the trend of the fall of the ruble, waiting for tougher sanctions. So far, on a smooth and relatively easy to predict, it is possible to get all the same 30 – 40% per annum without much risk and labor. Not surprisingly, with such a caring attitude of the monetary authorities to the speculative sector, money continued to flow into the monetary and financial market, leaving the real sector.

In the first quarter alone, the volume of loans issued by banks to manufacturing enterprises fell by almost half a trillion rubles. Accordingly, the financial situation of enterprises continued to deteriorate. According to the Rosstat operational data, in January 2015, the net operating loss of Russian organizations amounted to 152,5 billion rubles. The share of unprofitable enterprises on average in the Russian economy reached 36,1%. At the same time, the largest share of unprofitable production is fixed in the processing industries (39,9%). In real terms, net profit in manufacturing fell in the first quarter to 2001 values of the year.

In the second quarter, manufacturing companies made their choice. Without waiting for the credit support for import substitution, they simply raised prices following the rise in prices for imports. This allowed them to dramatically increase profitability while reducing production. Thus, they increased the inflationary wave and contributed to the recession. The economy was in a stagflational trap.

Manufacturing industries have not been able to take advantage of the increased competitiveness of their products due to the devaluation of the ruble due to a super-rigid, stifling monetary policy. Despite all the appeals of the country's leadership to the widespread import substitution and the use of raising the price competitiveness of domestic products after the devaluation of the ruble to expand its production, this was not possible due to lack of credit. Worse, the portfolio of ruble loans issued to the real sector decreased by 2015 billion rubles in the first quarter of 410, while the share of overdue debts on ruble loans to the real sector grew by more than a year ago on 1 in May of the current year compared to the beginning of 2014. 60% (including 27% since the beginning of 2015 of the year) has reached almost 7% of this segment of the loan portfolio. It is not surprising if the real sector, especially engineering, for at least the first quarter of this year, had access to credit resources at rates of about 20% per annum in rubles, which is almost twice as high as the Bank of Russia’s inflation on the annual horizon.

In essence, the activities of the Bank of Russia have been reduced to financing currency speculation. Of the 8 trillion rubles given by the Central Bank to refinance commercial banks last year, three quarters were in the foreign exchange market. The same thing happens today with foreign currency loans, the amount of which has already exceeded 30 billion dollars.

Attempts by the Central Bank to influence the financial market by raising interest rates are not successful. And they cannot have it, because the profitability of speculations on swinging the currency market many times exceeds the key rate. At the same time, speculators manipulating the market take almost no risk, easily calculating the uncomplicated policy of the monetary authorities. They shook the currency corridor last year without any particular risk, knowing in advance the algorithm of the Bank of Russia’s actions, and this year they are converting foreign currency repo loans into OFZs without risk.

Due to the policy of the monetary authorities, the currency market became the main generator of business activity in the Russian economy. The volume of trading on the MICEX last year amounted to about 4 trillion dollars, which is twice as much as the country's GDP and its foreign trade turnover is 10 times. The speculative funnel generated by the policy of the Bank of Russia absorbs more and more money being sucked out of banks and from the real sector.

False dogmas

Surprisingly, the monetary authorities and the analysts serving them are not able to calculate the elementary consequences of their 1 decisions. Three years ago, the author of these lines in his “Dissenting Opinion” about the project “Basic Directions of the Unified State Monetary Policy for 2013 – 2015” concerning the planned transition to free floating of the ruble exchange rate wrote: “The inflation targeting announced by the Bank of Russia as the main objective of monetary policy, it can not be achieved without control over the cross-border movement of capital, the amplitude of fluctuations of which can in current conditions reach values comparable to the volume of foreign exchange reserves. Under the influence of these fluctuations, changes in the exchange rate of the ruble, which the Central Bank allowed to float freely, can be quite significant to undermine macroeconomic stability. Similarly, the destabilizing effect may have a transition to a floating refinancing rate announced by the Bank of Russia. ”

Alas, this dramatic forecast came true in accuracy, which, however, did not shake the faith of the monetary authorities in the correctness of their dogmatic policy.

Despite all the warnings, they persevere in their previous course of overvalued interest rates and free float of the ruble. The first component of their policy was motivated by a strange opinion about the "overheating" of the Russian economy, in fact, working no more than two-thirds of its potential. The rationale for this view was the reasoning about the supposedly achieved equilibrium level of unemployment, which were completely inadequate to the true situation in the labor market. Contrary to polls of enterprises and official statistics, testifying to significant hidden unemployment and underutilization of production capacity by 40%, Bank of Russia analysts believed that output could be increased by no more than 1,5% and made a conclusion about the inflation risk of monetary easing.

Even more strange is the fanatical conviction of the monetary authorities that they can cope with inflation and ruble exchange rate fluctuations by manipulating interest rates. During the years of market reforms, thousands of studies have been published, the results of which indicate the absence of a statistically significant relationship between the dynamics of interest rates and the money supply on the one hand, and the inflation rate on the other. At the same time, there is a well-traced hard relationship between the first two indicators and the dynamics of production and investment. Always and everywhere, a reduction in the money supply and an increase in the rate of interest is accompanied by a drop in production and investment.

Raising interest rates to reduce inflation and appreciation of the national currency is a standard IMF recommendation. It is based on mathematical models of market equilibrium, which do not correspond to economic reality, but illustrate very simple and externally convincing judgments. Monetarists are confident that the increase in interest rates increases the attractiveness of bank deposits, reduces demand and leads to lower prices, and binds free money and reduces their supply in the foreign exchange market, which leads to an increase in the national currency. This superficial judgment does not take into account, however, that an increase in interest rates entails an increase in costs for borrowers, which they shift to the cost of production, and this leads to an increase in prices and devaluation of the national currency. A reduction in demand leads to a decrease in production and an increase in costs, the result of which is not a decrease, but an increase in prices. Conversely, a decrease in interest rates and an increase in the money supply can be transformed into an expansion of production and investment and, accordingly, into lower prices and costs.

Monetarists do not want to understand the obvious things - nonlinearity and disequilibrium processes of economic dynamics. In our case - due to the demonetization of the economy. The expansion of the money supply has so far been accompanied not by an increase, but by a decrease in inflation due to the absorption of money by the real sector of the economy starving for under-lending. Although this does not mean that tomorrow the increase in credit will not cause a new wave of currency speculation and the next collapse of the ruble exchange rate with the subsequent acceleration of the inflation wave. But one can definitely predict that the continuation of the demonetization of the economy, which began last year, will most likely worsen the decline in production and investment.

It's all about cash flow management. As the experience of China shows, the annual increase in the money supply can reach 50% and be accompanied by deflation if control is exercised over the targeted use of loans and so that money does not overflow to the consumer and foreign exchange market. And vice versa, Russia's experience clearly demonstrates the possibility of galloping inflation in the contraction of the money supply. If cash flows are stationary, their expansion will not cause inflation, as long as the increase in money is associated with the expansion of production, investment and savings. And if they become turbulent, galloping inflation can also occur with a decreasing money supply and rising interest rates.

Import substitution is delayed

A typical example of the absurdity of the “symbol of faith” of the monetary authorities is the above-mentioned transition to targeting inflation with a floating exchange rate of the ruble. With absolute certainty, the monetary authorities continue to state that inflation targeting involves the transfer of the ruble exchange rate to free float. Although for any systemically minded person this dogma would seem at least strange. In the initial courses of management theory, students are taught that the selective ability of the control system should be no lower than the diversity of the control object. But, apparently, our monetary authorities are not familiar with the theory of management and even more so with the system approach. Therefore, having announced inflation targeting, they refused to control the factor that determines the price dynamics for a good half of consumer goods, namely, the exchange rate. Any engineer of this kind would approach it would be insane - it's like trying to heat a room without windows in the windows in the winter, not realizing that the temperature in it will depend not on the power of the heating equipment, but on the temperature and wind outside the window.

Under someone else's tune

Let us try to understand the logic of the actions of our monetary authorities. They postulate without discussion the abandonment of control over the cross-border movement of money on the capital account. Then, in the conditions of free market pricing for the management of macroeconomic parameters, the monetary authorities are left with control over the exchange rate of the ruble and monetary policy instruments: the discount rate and other conditions for providing / absorbing liquidity, statutory reserve requirements, capital adequacy, formation of reserves for loans and securities, volumes open market operations with government bonds and currency interventions, which together form the monetary base. On this account in the scientific literature is considered a proven trilemma that, in the absence of a gold standard, it is impossible to simultaneously keep open the capital market, the fixed exchange rate of the national currency and pursue an autonomous monetary policy. Apparently, based on this logic, the monetary authorities choose an autonomous monetary policy, preferring to manipulate the interest rate and sacrificing exchange rate management. Thus, by “targeting inflation”, monetary authorities understand not inflation targeting, as it seems by literal translation of this word into Russian, and nothing more than a technical device, which reduces the entire monetary policy to the manipulation of the key rate when financial sector.

This trilemma was formulated by Obstfeld, Shambauh and Taylor based on an empirical study of monetary policy conducted by national banks in the period between the First and Second World Wars (IMF Staff Papers, Vol. 51, 2004). However, much has changed since then. A global financial market emerged with a world reserve currency, in which the dollar emitted by the US Federal Reserve System is used mainly under the obligations of the American government. Given the fact that the volume of these obligations is growing exponentially and has gone far beyond the stability of the American fiscal system, the trilemma should be supplemented with a new initial condition on the increasing emission of global capital in the form of unsecured obligations of the American state. For accuracy, one should add unsecured obligations of the EU countries (Greece, Great Britain, etc.), with which the emission of the euro and the pound is growing, as well as of Japan, with the parallel emission of the euro. The emission of these quasi-reserve currencies following the dollar grows exponentially, which led to an increase in the mass of these currencies on the global financial market three to five times after the global financial crisis began in 2008.

Thus, in contrast to the interwar period, the modern capital market is characterized by the pattern of its increasing inflation (swelling) due to the unsecured emission of world reserve currencies. It follows from this that the countries that keep the capital market open receive the threat of importing inflation caused by the inflow of infinitely increasing unsecured capital in the form of issuing these currencies. This means the emergence on the world financial market of a monopoly, which has enormous possibilities of manipulating it, including by establishing control over the national segments of the world financial system open to free movement of capital. Unlike the global commodity market, subject to competition laws and regulated by WTO rules, the global financial market is not seriously regulated, and the IMF rules protect this deregulation in the interests of institutional financial speculators (investment super banks) enjoying unlimited access to issuers of world currencies.

From the foregoing, it is necessary to clarify the trilemma: if the national bank does not have a monopoly on the issue of the world reserve currency and keeps a cross-border movement of capital open, it cannot control either the rate or interest rates. Happy owners of access to the issue of world currencies at the right time can conduct a speculative attack of any capacity, knocking over the course, and also provide the borrowers with a sufficiently large loan volume relative to the capacity of the national economy at an acceptable interest rate. In relation to Russia, they demonstrated this many times.

Thus, in order to manage the state of the national monetary system, it is necessary to control the cross-border movement of money in capital transactions. Otherwise, the development of our economy will be determined from abroad, and this will not be management in the sense of reducing the entropy (randomness of changes) of the object of management, but, on the contrary, increasing chaos. At the same time, it is not possible to talk about a certain single subject of management, since, in addition to transnational corporations (TNCs) and foreign banks, the Russian financial market will be manipulated by “its own” oligarchic offshore business groups. Actually, this is the political consequences of the transition to the policy of "targeting" inflation.

If politically, the so-called targeting means nothing more than the transfer of control over the state of the national monetary and financial system to external forces (primarily the US Federal Reserve, as well as the Bank of England, the European Central Bank and the Bank of Japan), then economically this is done in the interests of foreign financial speculators ( TNCs and foreign banks, oligarchic offshore business groups, whose beneficiaries have long been international investors and even “citizens of the world”). Russian business entities are forced to adapt to the “controlled” from the outside chaotic movement of the currency and financial market by minimizing their investment activity and translating savings into a “hard” currency. The same is done by the population: dollarization of the economy and the loss of its own internal sources of financing investments is a natural payment for targeting inflation.

If the state loses control over the exchange rate of its currency, this means that it surrenders the manipulation of currency speculators to it. And if the Central Bank also credits them, and the financial regulator transfers the currency exchange to their management, then there are currency swings, the currency and financial market enters into a state of turbulence, there is a disorganization of all foreign economic activity and a breakdown of reproduction of enterprises dependent on it. This is exactly what happened in the Russian economy as a result of the inflation targeting policy.

After the decision to switch to the free float of the ruble was due to its collapse, the leaders of the monetary authorities switched to everyday arguments, citing the instruction of the leadership not to burn reserves in vain. Indeed, the Bank of Russia’s senseless policy on fighting inflation by raising interest rates resulted in the outcome of Russian borrowers abroad and the transition to external sources of credit, the total amount of which far exceeded the volume of foreign exchange reserves. However, the installation “not to burn in vain” does not imply the refusal of currency interventions at all. After all, the purpose of accumulating foreign exchange reserves lies precisely in ensuring the stability of the basic conditions of foreign economic activity, primarily the exchange rate of the national currency. And the main enemy of this stability is currency speculators, profiting from the fluctuations of the ruble exchange rate due to the losses of other economic entities, the population and the state. If, indeed, the ruble exchange rate was to be devalued based on objective factors of the trade balance: the fall in prices for oil and other commodity exports, Western sanctions and capital outflow, then this should have been done simultaneously with the stabilization of the exchange rate at a new level, thus not allowing speculative wave. For example, they would lower the rate one and a half times and fix it for a month to allow trade to adapt to the new course. At the same time, give loans to manufacturing enterprises to increase import substitution. Then there would be no speculative wave and production that would increase price competitiveness would go uphill. And a two-fold depreciation of the course, smoothly turning into a slump, followed by a one-and-a-half increase, is a sure way to ditch production and investment not only by the excessive uncertainty of the exchange rate, but also by the unprofitability of production activity against the background of super profitability of currency speculations.

As it is easy to calculate, after the ruble exchange rate fell by half and inflation jumped to 16%, interest rates increased, the costs of enterprises increased by 20 – 30% depending on the share of imported components. After the ruble appreciation by a third, there was a corresponding decrease in their price competitiveness in relation to imports. She returned to the level from which the devaluation of the ruble began a year ago. Thus, the potential for devaluation, the need for which the President spoke at a recent meeting with Delovaya Rossiya, turned out to be largely exhausted. Only in comparison with the previous year, money was a quarter less, loans became twice as expensive and many times less available.

Information