The golden vector of Chinese politics

Professionals who deal with gold issues constantly pay attention to the Chinese factor. At the same time, experts studying modern China increasingly associate various events in the life of the Middle Kingdom with the “golden policy” of this country. What are the essence of China’s “golden policy”, its goals, means, and results achieved?

Professionals who deal with gold issues constantly pay attention to the Chinese factor. At the same time, experts studying modern China increasingly associate various events in the life of the Middle Kingdom with the “golden policy” of this country. What are the essence of China’s “golden policy”, its goals, means, and results achieved? Gold mining: South Africa ceded leadership to China

The most obvious "golden vector" of Chinese policy is manifested in the unprecedentedly high rates of yellow metal mining. Since the turn of the century, China has seen some of the highest rates of gold production in the world (1). If the production volume in 2000 was taken as 100, then in 2011 in China, the gold production index was 214,5; in Russia - 149,7, and in South Africa - only 46,3; in the USA - 65,6; in Canada - 69,7; in Australia - 87,5. In the first decade of the twenty-first century, a radical change in the positions of leading countries took place in world gold production. China was only fourth in 2000 year (after South Africa, USA and Australia), and in 2007 year it managed to move to first place. This became a landmark event in the world of gold: South Africa lost the title of world leader in gold mining, which it has held since 1896, that is, during 111 years.

Over the following years, China has steadily increased its lead over the rest of the world in terms of gold production ... In 2011, China’s share in world gold production was 13,4%. Only South Africa has reached such heights in the past. Back in 2000, the share of South Africa in world production was equal to 16,5%. It is possible that in 2012, China managed to reach the same level (this will finally become known only after the appearance of data on global gold production in the 2012 year). According to data released by the Chinese Association of Gold Producers in February 2013, in 2012, the volume of precious metal mining in the People's Republic of China was 403 t, which confirmed China’s position as the world leader in gold mining. It is noteworthy that in the 1949 year (the year of the creation of the People’s Republic of China) gold production was 4,07 t. That is, for the period 1949-2012. in China, there was a 100-fold increase in yellow metal production.

Consumption and import of gold: in 2012, China breaks out in world leaders

According to the World Gold Council, in 2011, China ranked second in terms of consumption of yellow metal (811 t), coming close to India (933 t). It is noteworthy that the USA took the third place in gold consumption - 194,9 t. That is, the gap between India and China from the USA was multiple. It is noteworthy that in India there is a decrease in consumption (by 7% in 2011, compared with 2010), and in China, on the contrary, growth (by 22% in 2011, compared to 2010). In 2011, China accounted for 26% of global gold demand versus 6% a decade earlier. According to preliminary data, in 2012, China bypassed India and became the country that consumes the most yellow metal in the world.

As we see, domestic consumption of gold in China more than doubled the volume of yellow metal production in the country in 2011. The deficit is covered by imports. For quite a long time, the leader in the import of yellow metal was India, which is not surprising, since this country has traditionally had a high level of gold consumption, and domestic production is very small. In 2011, India reached a record level of imports equal to 967 tons. But in 2012, the usual pattern changed, China moved to the first place for the import of yellow metal, pushing India to the second place. According to Bloomberg experts, mainland China imported tons of gold from Hong Kong to 2012, 834,5, including scrap and gold coins, compared to about 431,2 tons in 2011 (almost doubled in the year).

Many countries both buy and sell gold at the same time. But this story not about China. Legally, the export of gold from China is extremely difficult. And de facto there is none at all (with the exception, perhaps, of a small contraband). The authoritative gold site contains the following conclusion on this issue: “Experts and brokers of precious metals agree on one thing - they have never seen China sell gold on the world market” (2).

Official statistics on China's gold imports - only the top of the iceberg

Official statistics on the influx of yellow metal into China probably underestimate the scale of this phenomenon.

First, the import of gold to China occurs not only through Hong Kong (where it is strictly taken into account by customs statistics), but also through Singapore and Macao. These are mainly “gray” imports, not counted by official statistics of the PRC. Since the total length of the state border of China exceeds 22 thousand km, and the coastline has a length of 14,5 thousand km, it can be assumed that there are other "corridors" of illegal import. Often, such operations are various goods exchange transactions without the use of currency. For example, in the press, visits of Chinese merchants to African countries were repeatedly mentioned, where they exchange Chinese consumer goods for the yellow metal from local residents and entrepreneurs.

Secondly, gold flows into China not only through conventional trading channels, but also within the framework of international credit agreements between Chinese banks and European banks, in which gold is used as collateral. Jim Willie, an American financial analyst, told goldenjackass.com about a scheme for leaching gold from large European banks: “The contracts with Asian banks and investment funds that lent them huge amounts of money are written that the requirements for additional collateral are fulfilled only in the form transfer of physical gold. Due to the fact that Western banks work with a large financial leverage, the consequences of mistakes for them are catastrophic. In just four months (from March to June 2012), 6 thousand tons of physical gold (mainly from Switzerland and Italy) has already flowed to Asia. At the same time, the banks borrowed gold from their own clients (they simply stole it). ”

Thirdly, as experts note, the gold, which comes into the country from mines that belong wholly or partially to Chinese companies, is also behind the official statistics. Naturally, such gold is much cheaper than the one that has to be acquired in ordinary markets.

China's buying up of gold mines abroad

The insufficient amount of geological reserves of the precious metal in China is forcing many of the country's gold mining companies to look for new resources in other countries. It should be borne in mind that the raw material base of domestic production in China is quite close to exhaustion. Back in March, World Gold Council 2010 announced that the existing gold deposits in China will be depleted within six years due to increased production rates. According to the US Geological Survey, which is a very reputable source, in just one 2011 a year the Chinese extracted 20% of their proven gold reserves (3) from the depths of the world.

China has two trump cards that make it easier for it to buy gold mines around the world. First, China already has quite efficient mining technologies. Secondly, he has money. Their main source is extra-budgetary funds of the sovereign fund, managed by the state organization China Investment Corporation (4). Recipients of money - state-owned companies. The largest gold producer in China, the mining company China Gold Group, announced that it intends to participate in foreign transactions to purchase additional gold deposits and cooperate with other companies in the development of gold deposits around the world (5).

Other major gold mining companies in China, Shandong Gold, Zijing Mining and Zhaojin Mining, are actively negotiating the purchase of deposits abroad. Today, China is a partial owner of major international gold mining companies, such as Norton Gold Fields, A1 Minerals, Gold One International, Zara, YTC Resources, Sovereign Gold (6).

Chinese investors are especially active in Australia. Here are examples of several transactions for the acquisition of gold mines in this country (7). Chinese mining company Zijin Mining Group announced in April 2012 that it would buy for $ 299 million Australian gold mining company Norton Gold Fields, which operates at the Paddington mine near Kalgoorlie. The purchase by the Chinese of a stake in the Australian gold mining company Norton Gold Fields is just the beginning, they said that they would continue to buy shares or all of Australian gold miners, thereby increasing the PRC's gold reserves. In 2011, the Chinese already bought the Australian A1 Minerals gold miner based in Laverton, a suburb of Melbourne. This company is now renamed Stone Resources Limited after its parent company in Hong Kong. The Chinese also spent $ 80 million to buy a controlling stake in Australia's Zara gold project in Eritrea. Another Chinese company, the Yunnan Tin Group, which is the largest tin producer in the country and the world, owns 12,3% of the Australian mining company YTC Resources, which is developing the Hera mine near Cobar in New South Wales. Another Australian gold miner, Sovereign Gold, which has begun the development of abandoned mines at the Rocky River-Uralla deposit in northern NSW, has signed a cooperation agreement with the Chinese exploration company Jiangsu Geology & Engineering, which paid $ 4 million to buy 30% of the two sites. ...

There are reports of the purchase of gold assets in other regions of the world. For example, China National Gold Corp bought half of Coeur d'Alene Mines (CDE), a gold mine in Alaska. Chinese Stone Resources Limited bought for 79 a million dollars a share of 17,7% in the South African gold mining company Gold One International. Africa is of particular interest to the Chinese, but many deals on this continent are kept secret.

One of the biggest deals took place in the autumn of 2012, in Venezuela. The government of this country and the Chinese company China International Trust and Investment Corp. signed an agreement to jointly develop one of the largest Latin American gold mines, Las Cristinas. The Las Cristinas deposit is located in the south of Venezuela, in the state of Bolivar. Commenting on the agreement, Venezuelan President Hugo Chavez noted that it is a question of mining not only gold, but also copper, since the deposit is rich in both of these metals. At the same time, the gold share, according to preliminary estimates, is 17 million ounces. Prior to this, a Canadian company was engaged in the development of gold at the field, the Venezuelan government decided to replace Canadians with Chinese (8).

We emphasize that China is buying up shares in gold mining companies from different countries in order to guarantee in the future gold supplies at low prices.

Official reserves of gold: "Chinese mathematics"

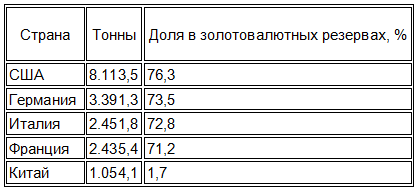

The data on the official reserves (reserve) of gold - a metal that is on the balance sheet of the country's monetary authorities - central banks and treasuries (ministries of finance) are as follows. According to official sources, in China these reserves are equal to 1054 tons. The Chinese authorities claim that all this gold is on the balance sheet of the country's central bank (People’s Bank of China). This figure does not change from 2009, when the Central Bank immediately increased its gold reserves by 75%, but few experts believe that official reserves in China today are really 1054 tons and that the country ranks fifth in the world in this indicator.

Official reserves of gold for January 2013 of the year (according to the IMF)

It is known that all gold mining in China goes to state reserves. Recall that in recent years, domestic production in China was (t): 2009 g. - 324; 2010 g. - 351; 2011 g. - 369; 2012 g. - 403. It turns out that after the 2009 of the year, when the official gold reserves in 1054 tons were recorded, 1.447 tons of the yellow metal went to the state reserves. Consequently, at the beginning of 2013, the state gold reserves in China could be: 1054 t + 1.447 t = 2.501 t. This means that China was not in fifth place on this indicator, as follows from official data, but on the third - after USA and Germany.

It is known that all gold mining in China goes to state reserves. Recall that in recent years, domestic production in China was (t): 2009 g. - 324; 2010 g. - 351; 2011 g. - 369; 2012 g. - 403. It turns out that after the 2009 of the year, when the official gold reserves in 1054 tons were recorded, 1.447 tons of the yellow metal went to the state reserves. Consequently, at the beginning of 2013, the state gold reserves in China could be: 1054 t + 1.447 t = 2.501 t. This means that China was not in fifth place on this indicator, as follows from official data, but on the third - after USA and Germany. But that's not all. Some experts believe that Chinese gold reserves are even greater. Take, for example, the assessments of Insley Matt, editor-in-chief of the Daily Resource Hunter, which appeared in the media in February of 2013 (9). He takes into account that China’s official reserves are replenished not only from domestic mining, but also from imports. And it goes to a volume equal to 3.927 tons. It turns out that China overtakes even Germany in official gold reserves and is in second place in the world after the United States.

Moreover, Insley Matt believes that secret supplies of gold from Africa and South America, which are not reflected in the customs statistics of China, should also be taken into account. As a result, it goes to the value, roundly equal to 7.000 tons of gold. That is, if you take these calculations on faith, China came close enough to the level of the United States, whose official reserves of the yellow metal slightly exceed 8.000 tons.

If in absolute volumes even the official figures of China’s gold reserves look impressive, then in relative figures the Celestial Empire lags behind many countries of the world. The share of the yellow metal in official foreign exchange reserves - 1,7%. Even if we agree with the estimate of Insley Matt (7 thousand tons), then this percentage will be only 11,3%. Chinese leaders have repeatedly stated that it is necessary to change the structure of the country's international reserves in favor of the yellow metal.

In order for, say, January 2013 of China to have 50% in gold (relative to the current volume of foreign exchange reserves), the metal reserve would have to be not 1054 t, but almost 30 times, i.e. about 30 thousand tons of gold. And this volume is approximately equal to the official gold reserves of all countries of the world. The amount of foreign currency held today in the official reserves of the People’s Bank of China is roughly equivalent to 3 trillions of US dollars. With the current prices for the yellow metal, this amount of currency is enough to buy about 70 thousand tons of gold. The market can not offer so much. The world supply of the precious metal (both “primary” - extracted from the subsoil, and “secondary” - coming in the form of scrap and from previously accumulated reserves) rarely exceeds 4 - 4,5 thousand tons of metal per year. One-time purchases on the world market of batches of gold from 100 t and above immediately lead to a significant increase in gold prices. A rise in gold prices at the same time will lead to an even greater depreciation of the US dollar. The Chinese leadership, without feeding any warm feelings towards the United States, is nevertheless not interested in a sharp drop in the American currency, which would devalue the giant currency reserves of the PRC, denominated in dollars. Therefore, Beijing is implementing its ambitious plans for the accumulation of gold very carefully, so as not to upset the balance in the currency and yellow metal markets.

However, the leadership of China does not set the task of converting 100% of its foreign exchange reserves into gold. The goals were announced “in the long run” to reach the level of reserves equal to approximately 10 000 tons (10). However, taking into account the above, it can be assumed that the target in 10 KT is not so distant.

Golden Mobilization: a version that cannot be ruled out

Of course, not all gold comes into the storerooms of the People’s Bank of China today. In China, domestic gold consumption is growing rapidly. Both for industrial purposes (first of all, the jewelry industry) and investment purposes - in the form of purchases by the population of jewelry, coins and ingots. According to the World Gold Council, in 2011, gold consumption in China was 777,8 t, and in 2012, 776,1 t. Citizens accumulate an increasing amount of yellow metal every year. How many - no one knows. True, there are expert assessments. According to one of them, in the hands of the population of the Middle Kingdom - 6 thousand tons of gold. For comparison: in India - 18 thousand tons, in Germany - 7 thousand tons (11). But we must bear in mind that until recently there was a “cultural revolution” in the country when private ownership of gold was prohibited. Today, the state encourages all types of gold consumption, so the gap between India and China on the accumulated gold will be reduced.

But this is not the main thing. Many experts draw attention to the fact that the command of the accumulated gold can be handed over to the Chinese treasury after the calls of the state to accumulate gold tomorrow. For example, in the event of a sharp deterioration in the economic situation of a country or the start of a war. Such confiscations happened. It is enough to recall the “gold confiscation” in the United States immediately after F. Roosevelt came to power in 1933, when, in a month, law-abiding Americans handed over several thousand tons of precious metal to the state. In China, such a "golden mobilization" is much easier to hold. If such confiscation were carried out at the present time, the state’s gold reserve would no longer be 7 thousand tons (the Insley Matt estimate), but 13 thousand tons.

Why does China need so much gold?

It remains to answer the most important question: for what purpose is China so diligently accumulating gold? In the end, all the answers can be reduced to two main options.

1 option. China needs gold as a strategic resource in case of a sharp exacerbation of the international economic and political situation - external or internal. For example, if the world as a result of a global currency collapse turns out to be without the usual reserve currencies like the US dollar or the euro, gold will turn into “extraordinary money”.

A situation of gold covering some extraordinary expenses within the country is possible. By the way, in 2011, Japan, in order to compensate for the effects of the tsunami and the accident at the Fukushima nuclear power plant, was forced to sell gold from its stock of 20 trillion. yen.

Gold may also be required in case of war - and not necessarily war against China. This may be a war against a major and important trade partner of the PRC. An example is Iran. Neighboring Turkey pays for the Iranian hydrocarbons it receives from the yellow metal, because the usual US banking settlements have blocked. China also bypassing international sanctions receives some hydrocarbons from Iran. It is possible that today China is paying for these gold supplies.

2 option. China needs gold to strengthen its national currency and turn the yuan into an international reserve currency. They even talk about the fact that the yuan can become "golden."

Some analysts and experts (including Chinese) believe that China pursues two goals simultaneously. For example, Sun Zhaoksu, president of China National Gold Group, said in the central party newspaper Zheminy Zhibao: “Increasing the gold reserve should be one of China’s key strategies, regardless of whether this is required for the economic security of the state or to accelerate the internationalization of the yuan” (12). A few more details on the second version.

About gold and Chinese yuan

Some authors argue that when a critical mass of the gold reserves of the People’s Bank of China is reached, the monetary authorities of the People's Republic of China will declare that the yuan becomes “gold”. That is, the monetary authorities of the country will undertake the obligation to exchange cash, and perhaps non-cash, yuan for a yellow metal. And this will automatically make the yuan the main currency in the world, the rest will adapt to it. Something reminiscent of the gold exchange standard when countries accumulate currency that is convertible into yellow metal. Until 1970's last century in the world there was a gold standard as a kind of gold exchange. Now, according to some authors, a gold-anus standard may arise. The version is beautiful, but unlikely. At least from a formal legal point of view. According to the first amendment of the IMF under Article IV of the agreement, ratified in 1978, the participating countries do not have the right to peg their currencies to gold. Even if it were not for this amendment, China, having assumed the obligation to exchange the yuan for gold, would quickly lose its gold reserves, no matter how big it is.

However, indirectly, China uses its gold policy to raise the international authority of the yuan. Recall the axiom of the financial world: confidence in a currency issued by a central bank with a growing stock of gold (even if gold is not converted into a currency) is always on the rise. And that's not it. The Shanghai Gold Exchange has been operating in China since 2002. The People’s Bank of China controls the situation on this exchange not only as a regulator, but also as a participant - not directly, but through Chinese state banks that have received licenses for operations with the yellow metal (13) from the Central Bank. For ten years, this marketplace "unwound" by the Chinese authorities. Foreign participants were admitted to it. But at the same time, the authorities announced: gold trading will be conducted for the yuan. Obviously, this increases the demand for the yuan from non-residents (14).

Today, China is concluding bilateral agreements with a number of countries on the mutual use of national currencies. For example, with Japan, Russia, other BRICS countries. Experts expect that over time, the exchange rates of national currencies under such agreements will not be determined by the currency exchange, but by the gold parities of these currencies. Amendments to the Charter of the IMF such gold parities abolished, but nothing prevents countries on a bilateral basis to restore them. And the next step in the development of such bilateral relations is the use of the yellow metal as a means of equalizing bilateral settlements. Gold hastily returned to international currency relations. Here is how Russian expert V. Pavlenko comments on the conclusion of the agreement between China and Japan on the mutual use of yuan and yen in the past (2012): “China and Japan with June 1 went out of mutual dollar calculations and will now be calculated strictly in yuan and yen. This tale, however, for naive simpletons. The yuan and the yen are brought to a common denominator only through an equivalent (EMC is a single measure of value). Previously, this equivalent was the dollar (it is controlled by the Rockefellers). And now? Since it does not say what it is, it means that the role of the EMC goes to gold. And this gold equivalent (standard), from the price of which mutual Chinese-Japanese calculations will make a start, will already be controlled by the Rothschilds ”(15).

Let us add: today gold is EMC, and tomorrow it becomes a means of international payments. Obviously, the credibility of China as a country with a large gold reserves, as a partner in international economic relations will be high. Accordingly, there will be a high confidence in the Chinese yuan.

There is another aspect of the “gold-yuan” problem that is little covered in the media. The latest global financial crisis has highlighted the problem of extreme bank instability. The Basel Committee on Banking Supervision has developed a third generation of capital adequacy standards for banks (Basel-3). For the first time, these standards stipulate that gold becomes a full-fledged financial asset, which, when calculating equity, is quoted as the most reliable treasury securities or cash (legal means of payment). The Basel-3 rules should have been implemented since January 1 2013. In fact, this means the return of gold to the world of money. Banks of the USA and countries of Western Europe (with the exception of Switzerland) were not ready to adopt new rules, their introduction there is delayed indefinitely. At the same time, several countries took the start on Basel-3, among them - China. Experts believe that Chinese banks, having gold, will be able to easily fit into the new standards (16). This will sharply increase their attractiveness and competitiveness against the background of the banks of the “golden billion” zone. It is obvious that strengthening the competitive position of China’s banking sector with gold and Basel-3 will inevitably increase the prestige of the yuan, its gradual transformation into an international currency.

Conclusion

And the last. China’s Rothschild financial group is playing up to its gold policy, which is casually mentioned in the quotation from V. Pavlenko's work “Gold versus oil, pound versus dollar, Rothschild versus Rockefellers”. It is well known that this grouping traditionally controls the world market for the yellow metal. The Rothschilds have their own views on China, their plans include warming up the “golden ambitions” of Beijing, assistance in the implementation of Chinese projects in the field of gold. In short, China, with its golden potential, is interested in the Rothschilds now as a temporary ally to defeat their eternal rival - the Rockefeller group. The Chinese currency, reinforced by gold reserves, plays only the role of a battering ram for the collapse of the US dollar and support for the transition period. The ultimate goal of the Rothschilds is to establish a supranational currency (17) in the world.

However, a substantial reservation is required. China can not be considered only the object of backstage games of world financial clans. Not all Western capital plans for China are being implemented. In particular, until now the Rothschilds have failed to create a “fifth column” in the Chinese economy in the form of an extensive network of their banks. So the number of branches of the largest Commercial and Industrial Bank in China (state Chinese bank) is 16232 units, while the number of units of the largest foreign bank HSBC, part of the Rothschild empire, is slightly more than 100. It is noteworthy that today the share of foreign banks accounts for less than 2% of all assets of China’s banking system (18). Does not show the Chinese leadership and obvious willingness to make the yuan a gold currency.

A recent Chinese media outlook with the significant title “China Announces the Beginning of a New Era” contains the following conclusion from an anonymous author: “China is fully prepared for the hyperinflationary scenario. China refuses to implement the English plan for a strong world yuan in order to speed up the funeral of the dollar. China predicts the greatest difficulties in Europe. China has fully protected its financial system with multi-ton gold reserves. China refuses to play the role of a world commodity donor, except in cases of complete counter-provision of export deliveries with real goods ”(19). Well, if this conclusion reflects the real state of affairs in the Middle Kingdom, it indicates that China does not want to be a bargaining card in the hands of the Rothschilds.

China demonstrates the desire and ability to be an influential and active subject of international financial and economic relations ...

(1) The following are the gold mining figures according to the World Gold Council.

(2) “Experts: China never sells its gold” //gold.ru (6 November 2012).

(3) www.usgs.gov

(4) Manages capital of about 400 billion euros, the Chinese sovereign fund is one of the largest in the world.

(5) "The Chinese will continue to buy deposits abroad" // Gold.ru (November 8 2012)

(6) Tatiana Pismennaya. China lowers the dollar // Ugmk.info 31.08.12

(7) According to the article "China buys shares of gold mines around the world" // Gold.ru (12.04.2012).

(8) Until 2008, the Canadian company Crystallex International Corp. owned a license to develop gold mines during 16 years. However, in May 2008, the Ministry of Environment and Natural Resources of Venezuela ceased its operation. Canadians estimate the damage caused to them at 3,8 billion dollars and are going to recover this amount through the International Court of Arbitration (http://www.km.ru/economics/2012/09/22/ugo-chaves/692900-kitaiskie-starateli-prishli-na -zolotye-priiski-venesuely)

(9) Insley Matt. So how much gold does China really have? // Goldenfront.ru (12.02.2012)

(10) In 2008, a special expert group was assembled in China, which recommended increasing Chinese gold reserves to 6 000 tons in the next 3-5 years and, possibly, to 10 000 tons in 8-10 years.

(11) Olesya Pugacheva. Gold and investment. // Zolotonews.ru (16.07.2012).

(12) Tatiana PismennnaI. China will lower the dollar // ugmk.info (31.08 / 2012)

(13) In China, in 2012, 20 banks received the right to participate in the purchase and sale of gold on the Shanghai Gold Exchange, where a special platform for interbank gold transactions was created for this. Among them are: Industrial and Commercial Bank of China Ltd, China Construction Bank Corp., Bank of China Ltd, Bank of Communications Ltd, HSBC Bank (China) Co. Ltd and Standard Chartered Bank (China) Ltd. (http://gold.ru/articles/news/kitaj-zapustil-torgovlju-zolotom-mezhdu-bankami.html).

(14) In addition to the Shanghai Gold Exchange, Chinese authorities have been working to create the Pan-Asian Gold Exchange (PAGE) in Kunming, China. However, the launch of this exchange in 2012 for the Chinese authorities was not very successful: the only shareholder of a foreign listing (in the USA) suddenly and secretly increased its stake from 10% to 25%, thereby obtaining a blocking stake. This is clearly not included in the plans of the Chinese leadership. At the same time, it was announced that trading on this exchange would be conducted not for dollars, but for yuan.

(15) V. Pavlenko. Gold versus oil, pound versus dollar, Rothschilds versus Rockefellers // akademiagp.ru (19.06.2012).

(16) In Europe, according to media reports, at least some central banks plan to sell or lease gold to commercial banks to strengthen their positions. It is known that in 2011, the Bank of Italy has already sold gold to its banks in order to prepare them for work in the Basel-3 environment.

(17) Attention should be paid to the statements of the well-known financial speculator George Soros, who calls for a radical reform of the global financial system by creating a supranational monetary unit similar to “special drawing rights” (SDRs). The issuance of SDRs was started by the International Monetary Fund in 1969, but was later suspended. Today, the volume of this supranational currency is very small. We must remember that Soros acts as an agent and mouthpiece of the Rothschild clan.

(18) (E.N. Chebanenko. Evolution of attracting foreign capital into the Chinese banking system // “Problems of the modern economy”, No.1 (41), 2012).

(19) “China announces the beginning of a new era” // Telegraph website, 21.02.2013.

Information