Life on loan

Erich Maria Remarque. "Life Borrowed"

16 May 2011, US Treasury Secretary T. Geithner notified Congress that the country's public debt had reached its maximum statutory level. According to the minister, he has to use "various accounting tricks" as measures to prevent default.

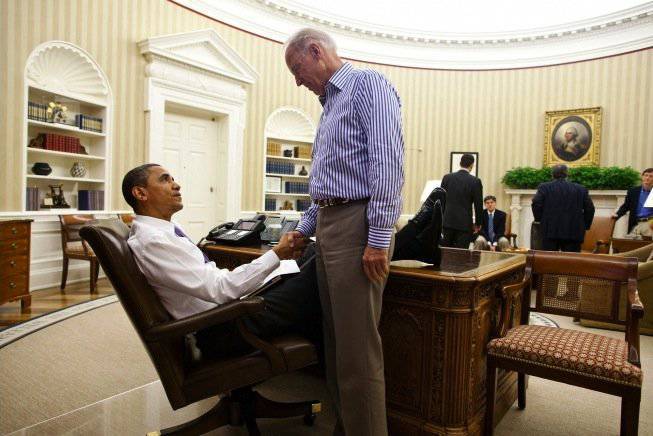

12 July 2011 US President B. Obama said that soon there might not be enough money in the federal treasury for the timely payment of 27 pensions to millions of pensioners if the national debt is not increased.

15 July of the same year, Obama said that if by the morning of July 16 Congress does not increase the national debt limit, the United States can declare a technical default.

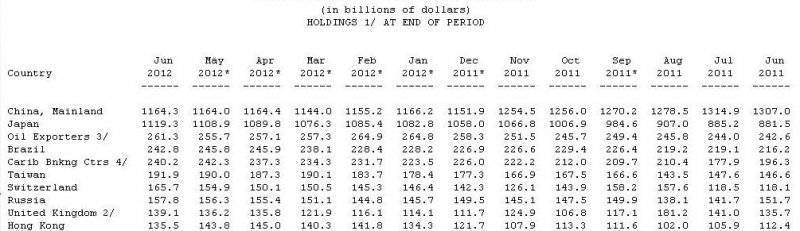

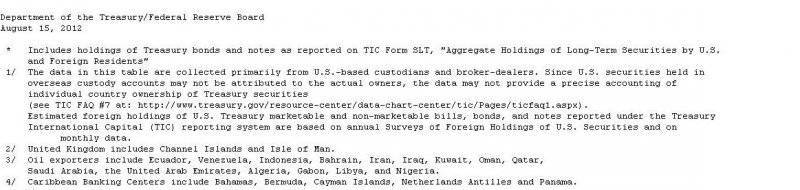

According to statistics from the US Treasury, about a quarter of the government debt ($ 4,6 trillion) is in the hands of foreigners, mainly central banks of other countries.

2 in August 2011 of the year for 12 hours before the possible announcement of default The US Senate voted to increase the national debt by 2,4 trillion dollars - up to 16,7 trillion dollars, thus defaulting was postponed. The national debt amounted to more than 14,3 trillion dollars that day. On the same day, August 2, US President Barack Obama managed to sign the adopted state debt law, preventing a technical default. The same day and the next day new US government bonds were placed for several hundred billion dollars.

On August 4, 2011, the rating agency Standard & Poor's for the first time (since the 1960s) downgraded the US credit rating as a state. This collapsed global stock markets, and the price of gold set a new world record, exceeding $ 1700 an ounce.

The Durst Organization Company in the central region of New York in 1989, the counter of the national debt of the United States was posted on public display. In October 2008 of the year it went off scale because there was no room for a number with more than twelve zeros.

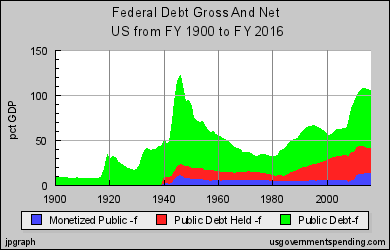

US state debt.

Debts of the US government have a credit rating (AA- according to the Standard & Poor's classification), since they are denominated in their own currency - US dollars and for this reason do not have credit risk (the US Federal Reserve has the exclusive right to issue dollars and can always formally settle with creditors for any debt denominated in its own currency).

The independence of the issuing center from the government is due to the desire to ensure a balance between taxpayers and the government (in the “employer” and “contractor” relations), as well as the banking system historically established in the US, and to prevent the possibility of using the additional cash issue in to cover the budget deficit).

In 1982, a California state district court ruled in the John Lewis v. United States case where it determined that the Federal Reserve Banks that are part of the Fed's structure are not institutions that can be sued by individuals under the law on lawsuits to state organizations and employees (Federal Tort Claims Act). This court ruling relates to the practice of applying the Federal Tort Claims Act to the Federal Reserve Banks and does not make any definitions regarding the status of the Fed in general.

Another Law states that “the term of the charter is set by the maximum allowable law”. It says: "It is a rule of law". the States or Federal Government.)

About a quarter of the national debt ($ 3,6 trillion) is in the hands of foreigners, mainly the central banks of other countries.

The domestic debts of the United States are identical to the domestic savings of the United States and reflect the size of the US economy - the volume of economic interrelations between its subjects.

The total debt of American households is over $ 13 trillion

Strange decision.

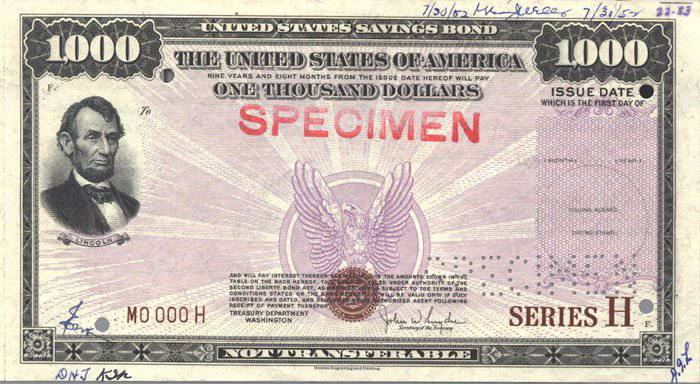

According to CNNMoney, starting next year, the opportunity to buy paper bonds of the US Treasury and other banks in the country will disappear, all of them will be replaced with bonds in electronic form. The transition is scheduled for January 1 2012. Behind the external excuse (about saving on printing more than 70 million dollars) lurks with depressing evidence the course of the state to curtail this popular instrument of public investment:

Savings operations appeared in America just as they did everywhere in the world: from the state’s need to help citizens at a critical moment stories.

It is usually a matter of honor for a state to fulfill its own obligations on debts to citizens. In any case, the American bonds bonds from the first day of existence still enjoy the reputation of an absolutely reliable and profitable instrument of capital investment.

Savings bonds have played a cult role in the history of American material civilization. The selling value of a modest financial instrument has always been half of its face value, which terrible people liked. In fact, for a grandmother buying a beautiful savings bond for 50 dollars for her grandson’s birthday, the deal seemed to be the limit of financial gain on the inscription The United States of America One Hundred Dollars. The magical transformation had to wait for 18 for years, which in terms of conversion gives one of the lowest yields on the market, but this stopped a few people. Bonds were also a universal form of social reward: they were awarded to winners of various student sports competitions, poetry contests, mathematical competitions, scout competitions, etc. The universality of the instrument was also promoted by the democratic line of denominations of savings bonds: denominations of $ 50, $ 75, $ 100, $ 200, $ 500, $ 1 000 and $ 5 000 allowed any member of society to use securities in various situations, regardless of wealth and welfare

From the very beginning, American savings bonds possessed a number of additional characteristics that emphasized and strengthened their elite attractiveness.

- only a US citizen could be a buyer of savings bonds,

- each year it was allowed to purchase savings bonds of each type with no more than 5 thousand dollars (restrictions, of course, gave rise to healthy excitement in the society and a desire to become the coveted owner of securities above the set limits).

- not subject to taxes at the local and state levels. Payment of federal tax is deferred for an infinitely long period (calculated in dozens of years)

- bonds allow you to effectively resist inflation. True, only savings bonds of the I7 type, but they are the ones that are wildly popular.

Savings bonds are in the hands of 55 millions of citizens, that is, every sixth.

Such stunning results overlapped with the decision of the US Treasury with 1 in January 2012 of the year to stop issuing savings bonds in paper form, despite the fact that the paper form of bonds constitutes the lion's share of all their attractiveness! Why does the state do this?

The reason is obvious: the printing of new money cannot continue indefinitely. Sooner or later, this will lead to hyperinflation, and then the indexed national debt will literally pump all state assets into the pockets of the holders of this debt - the prospect is unpleasant.

Whatever it was, the US state, by and large, no matter what interest rate the debt securities they emitted bear. The US is serenely calm, because it is in a unique way that it controls both debt issue and cash cover. But as long as it is possible to issue debts with one hand and collect real money, and with the other you can print new dollars to cover these debts, everything with Uncle Sam will be fine.

The evolution of the US dollar to 1913 year

The reason for singling out 1913 of the year as a turning point in the history of American money was an indisputable fact: according to the US Treasury, the cost of goods and services during the period from 1635 to 1913 remained relatively unchanged, but since the creation of the Fed this cost has increased 25 times. In other words, America showed financial stability for almost 300 years, which - note - was filled with the most dramatic social upheavals.

In the twentieth century, peace reigned in the United States, and the wars that devastated other continents provided the “outpost of democracy” with conditions for unprecedented economic growth. At the same time, however, there was not so much a crushing depreciation of American money, but rather their transformation into an ephemeral, elusive, surreal something that was not tied to anything, was not secured and, moreover, was controlled by no one knows. An unexpected development, isn't it?

Behind the blatant depreciation of money and the forced virtualization of financial relations, there is at least a tragic but rather banal social metamorphosis: this is about the unconditional transfer of power control in the world from manufacturing capital to banking capital. This is where the fun begins.

The chronicle of the American dollar does not begin with the moment when it acquired a new quality (1913 and 1933 years), but from the very beginning - the 17th century, the era of America’s colonial dependence on Britain.

The period from the appearance of the first colonies to the victory in the War of Independence seems to neoliberal historians and economists to be wild freemen. It is terrible to think: in those years more than fifty (!) Various forms of money were in circulation in the United States - in addition to coins of British, Spanish, French and Portuguese minting, certificates (scrips) issued by individual colonies were accepted as payment instruments ( subsequently - states), cities and even large enterprises. The cost of these cash substitutes changed unpredictably, and most importantly, did not correspond to the real value of the underlying collateral (gold and silver), or did not have any collateral at all.

The assessment of financial anarchy that prevailed in the US territories in the 17th-18th centuries reflects the views of the supporters of Alexander Hamilton and introduced by the civilized (in the European sense) banking in the form of First Bank of the United States, the first Central Bank of the United States in 1791 year. The reality, however, is such that colonial certificates (colonial scrips) - paper maternity money, backed up not by gold and silver, but only by the authority of local authorities - did not know inflation throughout the whole of its existence (52), and provided price stability unprecedented before their introduction, or after the ban imposed on the issue by the British Parliament (the so-called Currency Act of the year 1764).

It is characteristic that the elimination of the colonial certificates and the return to the Bank of England, a pound sterling, not only led to the decline of the economic life of the North American colonies, but also became, in fact, the main cause of the War of Independence.

The revolutionary originality of the colonial certificates was manifested not so much in the rejection of the binding to gold and silver, but in the abolition of the very idea of bank lending to the authorities (government) for a percentage - the generally accepted practice in Europe in the 18th century. The absence of a “debt burden” on the self-styled money of the North American colonies allowed local governments to cut taxes and provide loans at low interest rates, which, in turn, led to the flourishing of commodity relations and production.

Benjamin Franklin, who was directly involved in creating the colonial certificates of Pennsylvania, left a sketch of the economic situation, reflecting the ban of the metropolis on issuing self-proclaimed money: “The conditions changed so dramatically that the era of prosperity instantly vanished, and the depression reached such proportions that the streets of colonial cities overflowed unemployed. "

Adam Smith, father of European economics, wrote with unconcealed admiration in the 1776 year of colonial "squeaks": “The government of Pennsylvania invented a new way of crediting, which, not being money with gold or silver, nevertheless, completely duplicated monetary functions. The government provided people with interest and land mortgage paper debt certificates, which passed from hand to hand like bank notes (bank notes) and were considered legal tender in all transactions. This system significantly reduced the annual expenditures of the government, and it is said that Pennsylvanian paper money never depreciated below the value of gold and silver, established in the colonies before their emission. ”

The refusal to bind colonial certificates to gold and silver was due to the objective impossibility of ensuring parity of the money supply and the volume of goods and services: precious metals were stored overseas in Bank of England holdings, which, as you might guess, did not want to increase emissions in proportion to the economic development of the North American colonies . The secret to the success of a home-grown currency was, however, not in their fiat money, but in combining two circumstances — the elimination of the aforementioned “debt burden” and strict control over emissions. As acknowledged by Ben Franklin: “In the colonies we issue our own money. They are called - "colonial certificates". We emit them in the right proportions to the demands of trade and production. ”

Of course, the paper obligations of the North American colonies were far from ideal. There is no doubt that, without a ban of the metropolis, the “right proportions” of the emission would sooner or later be distorted under the influence of unforeseen circumstances, as happened ten years later (in 1775) under the conditions of the outbreak of the War of Independence.

10 May 1775 at a secret meeting of the Second Continental Congress, it was decided to issue "credit notes for an amount not exceeding two million Spanish corrugated dollars." The need for paper money arose to “defend America”, and “12 Colonies Georgia is the thirteenth participant in the Second Continental Congress, which later proclaimed the Declaration of Independence and Articles of the Confederation and Eternal Union (first constitution of the USA), did not participate in the aforementioned meeting. They were obliged to recognize the new issue as legal tender. ” New certificates are called "Continental currency" (Continental currency), or abbreviated - "Continental" (Continentals).

The troubled circumstances of the military confrontation of the metropolis, however, prevented the prosperous development of the scenario: very soon the issue got out of control and showed the saddest defects in paper money. At the end of 1775 of the year, “Continental” was printed for an amount already three times higher than originally planned (six million Spanish dollars), and in 1779, the emission orgy reached its limit: 242 million dollars! Inflation has gained a homemade scale - for 100 "metal" dollars 16 joyfully gave 800 paper.

On top of the troubles, the Continental print protection turned out to be so conditional that the British took advantage of economic sabotage, providing their printing machines with round-the-clock loading of falsification. A typical advertisement of the era of the War of Independence (from the New York Rivington's Gazette): “Travelers traveling to other colonies are supplied with any number of fake Congress debt tickets at the wholesale price of paper. The print quality is so high, and the imitation is so accurate that there is not the slightest risk of failure in sales, especially since our products are almost impossible to distinguish from the real ones. Debt tickets were successfully and repeatedly launched by us in circulation in very large volumes. Interested parties can ask QED at the Coffee House from 11 to 16 every day for the entire month. ”

It is believed, however, that the game “Continental” was worth the time of manufacture: the colonies not only resisted the mighty British Empire for three years, but also emerged victorious from this confrontation. The economic price of victory is 200 of millions of dollars of debt, fully discounted by inflation and illiquidity.

If we assume that the desire for an independent monetary system was in fact one of the main reasons for the confrontation of the United States of America by Britain, then the victory looks much less impressive than the successes of George Washington under Trenton and Princeton. In December 1776 (Trenton) and January 1777 (Princeton) George Washington defeated the troops of the English commander William Gow .. At least, if you take into account not the declarative side of things, but the essential vector of development of the American financial system. Thus, in 1791, at the suggestion of the great anglophil, and concurrently, the first secretary of the US Treasury, Alexander Hamilton, Congress voluntarily surrendered its positions and agreed to the creation of the first American central bank fashioned with touching precision in the image and likeness of Bank of England.

Externally, Hamilton's motivation looked more than commendable: restoring order in the financial life of the young state, ensuring reliable lending essential for the development of industry and commerce, eliminating the inflationary consequences caused by the uncontrolled emission (and British sabotage) of the Continental. To fulfill the tasks set, centralization of finance was proposed under the auspices of a single bank capable of ensuring and protecting the interests of the state and government. Remarkable and convincing.

The sly face of a Satanian woman began to look through only in details describing the mechanisms of functioning and - most importantly - the distribution of property of the Central Bank. Thus, the initial capital of First Bank of the United States, at the suggestion of Alexander Hamilton, should have been 10 million dollars. The government of the United States reserved a royal share - in the amount of two million dollars. One bad luck - the government did not have that kind of money! "It does not matter," the student of British Finance Minister Robert Walpole, sophisticated by European experience, admonished, "he will lend this money to the United States government ... the Central Bank itself!" Of course, for modest interest, otherwise it is not necessary in a civilized society. In addition, the return of the loan immediately is not necessary. It is possible and gradually: for example, over 10 years in equal shares.

The remaining eight million dollars (and in fact - all 10, since the government’s share was also covered by a loan) were made by private individuals to the authorized capital of the first American Central Bank, and Hamilton’s mandatory condition was not only American citizens, but also foreign partners. What for? What do you mean why?! Even if the government of the young state didn’t have 20% of the authorized capital, does anyone really think that the ordinary citizens of the North American States, who were supplied with “Continentalists” for generations ahead, could have gotten eight million dollars? Moreover, the other indispensable condition for Hamilton to form the authorized capital of the American Central Bank was the introduction of at least a quarter of the amount in gold and silver.

Payment of the remaining amount was allowed to produce bonds, liquid certificates, securities and other sane debt obligations. Thus, gold-silver, with which the colonies, as the reader remembers, initially did not have good-neighborly relations.

In short, the hidden background of the demarche to create an American Central Bank can not leave doubts (in the eyes of our contemporaries, of course): the transfer of control over the financial system of the new state to the "old money" of Europe. And at the same time - the desire to "plant" the US government on the debt needle of credit money. Not only did George Washington's office have to pay out its share in the bank's share capital for ten years in a row, it was also supposed to carry out subsequent lending to government activities in full compliance with the British standard: at interest!

In order to not accidentally create the perverse impression that the government’s debt obligations do not affect the privacy of citizens, we hasten to dispel dangerous illusions: the government, having received loan money from the Central Bank, being sane, immediately redistributes the burden of its obligations to the law-abiding population. How? Raising taxes, adding interest on a consumer and business loan, writing out excise stamps - the tools are extensive and time-tested.

Since the debt burden imposed on the government of George Washington by the first American Central Bank, Alexander Hamilton elegantly proposed to ease by introducing a tax on the import of alcohol and increase the excise tax on local production of whiskey. The problem, however, was that the residents of the southern states indulged in sublimation of the American hot drink, and immediately after the President signed the Bank Law (25 on April 1791), the Perennial Whiskey, which became a worthy foundation for the subsequent confrontation of confederates, was launched and unionists.

For the financial benefit of the young nation, Alexander Hamilton requested nothing at all: the private status of the Central Bank and the twenty-year charter (1791-1811) for the right to exclusively ensure the financial interests of the government. As a compensation, a ban on foreign shareholders from participating in the voting and the right of the Secretary of the Treasury to conduct weekly audits of the financial statements of the Central Bank, supported by the right to withdraw government deposits, was proposed.

This last circumstance (control by the government), coupled with the binding of monetary emission to gold and silver reserves, suggests that at least the appearance of independence of the financial system of the United States is visible as it was at the end of the 18th century. Next to the closed and unaccountable private bench of the Federal Reserve, the brainchild of Alexander Hamilton looks like a model of enlightening humanism.

Even under such sparing circumstances, the development vector of the Central Bank, endowed with the status of a private company, emerged in its true form in the near future: already in 1796, the US government ran out of money, and Congress unanimously voted to sell the state's shareholding in the independent Central Bank under the full control of European "old money".

At first it seemed that Alexander Hamilton's cunning affair was firmly rooted in American soil. Despite Congress’s refusal to extend the charter of the first Central Bank in 1811, it was replaced five years later by the Central Bank No. 2 (Second Bank of the United States) with all relying attributes: private management, state lending under interest, emission control. James Madison's Child

The Central Bank’s depositary funds, and only the third appointee, Roger Teini, had the civil courage to eliminate the Philadelphia feeder.

1837-1862 in the United States came a long period of free existence (the so-called Free Banking Era:), during which the country did most beautifully without the Central Bank. The civil war even led to the revival of the tradition of monetary emission, which was not burdened with interest and produced by the state itself without private mediation. In the summer of 1861, President Lincoln appealed to the banking community to provide a soft loan to finance the army and military needs. The banking community responded enthusiastically: 24-36% per annum - and no questions!

The reaction of Lincoln turned out to be admirable to descendants: rejecting private loans, the president conducted through Congress (the 17 Act of July 1861 of the year) the issue of Treasury notes (greenbacks, green backs). Despite the fact that the “green backs” were classic fiat money, completely free from all credit and debt obligations, under the conditions of a patriotic uplift, they coped remarkably well with the function of “legal tender” and allowed unionists to make ends meet in their opposition to the confederates.

In total, from August 1861 of the year to April of 1862, green backs were emitted to the amount of 60 million dollars without any signs of inflation and destabilization of the financial system. The only injured party was “old money” and banking circles interested in interest loans to the federal government.

The idea of independent, debt-free maternity money seems to have liked the Americans, and following the Treasury notes, they immediately launched the issue of Legal Tender Notes, which, unlike the green backs, were untied from the gold and silver standard.

The financial system of the country was streamlined by the “Law on the National Banking System”, which in three editions (the last one took place on 3 in March 1865) set up a system of national banks under the supervision of the Office of the Currency Controller (OCC). From now on, 1 644 of the national bank (October 1866 of the year), although they financed the government against interest, did so in exchange for purchasing government debt obligations (federal bonds). And all this - pay attention! - without the slightest hint of a private central bank.

The independent national monetary policy of the United States lasted for almost fifty years - until the very counter-revolution of the Federal Reserve System (1913).

1913 - 2012

There is something mystical about how easily historical decisions are made in the United States from time to time: the Federal Reserve Act, the Patriot Act, or, say, the Security and Reporting of each Port Act (on the Internet).

This lightness, of course, is illusory, because behind it lies a tremendous job of preparing favorable conditions. “Hour X” always falls on the eve of major holidays, the first days of a new presidential term, or the last hours of the head of state’s stay in office before resigning, hide months, and often years of painstaking “liner” to the right decision.

Usually criticism of conspiracy theories related to the US Federal Reserve (Prof. Edward Flaherty vs. Eustav Mullins and Gary Ka) develops in three directions. The main criticisms are the following:

- The Federal Bank of New York is not under the control of foreign bankers;

- The Federal Bank of New York does not have a key influence on the decisions of the Fed;

- The Fed's profit is not assigned by the shareholders, but is transferred to the US Treasury.

Indeed, according to the Mullins Conspirologist List, the controlling stake in the Federal Bank of New York (63%) is owned by five banks (Citibank, Chase Manhatten, Chemical, National Bank of North America and Bank of New York) and three trusts (Morgan Guaranty Trust , Manufacturers Hanover Trust and Bankers Trust Company), which for the most part are controlled by European financial institutions, primarily the Rothschild House.

The Ka List is even more straightforward: the researcher names the eight major shareholders of the Federal Bank of New York on the forehead and the London-Berlin and Rothschild banks in London, the Lazar Brothers Paris Bank, the Italian banks of Israel Moses Zeyf, the Warburg banks in Amsterdam and Hamburg, and also York Quadrumvirate - Bank of Lehman brothers, Bank of Kuhn and Lyuba, Chase-Manhattan and Goldman-Sachs.

Academic science in the person of Dr. Edward Flaherty categorically refuses to accept the Mullins and Ka lists on the grounds that both researchers are unable to provide reliable sources of information. Because "the Fed is not a public company and it is not subject to the requirements of the Securities and Exchange Commission to disclose the list of shareholders!" - Dr. Flaherty exclaims triumphantly. As a result, information about shareholders has never been made public in print publications of the Fed, its bulletins and reports to Congress.

Dr. Flaherty is not embarrassed by the fact that America’s financial system is in the hands of a private company and the real names of shareholders are kept in the greatest secrecy of the American people.

The conspiracy theorizing that the Federal Bank of New York controls the entire Fed, Edward Flaherty brilliantly dispels a scrupulous analysis of the structure of the organization: it turns out that all 12 federal banks in the System have equal votes, and control over the decision-making of the Fed is sic! - they are implemented not by banks, but by the Board of Governors and the Committee for Open Market Operations (FOMC)!

As for the distribution of profits, here the hints of conspiracy experts are not worth a damn: according to the annual report to Congress for 2006 a year, the Fed transferred US $ 34 billion to the US Treasury from the total 29 profit, and 871 a million dollars paid dividends to shareholders! About how much a priori insider knowledge is about changes in the rate of federal funds (the one that causes the most radical stock market shocks), Flaherty wisely holds back.

If you believe the Flaherty revelations, it turns out that it is not the federal banks that control the Reserve System, but two structures - the Board of Governors and the FOMC.

The Board of Governors and the FOMC market make decisions on all key issues of the Fed's financial policy: they determine the interest rate of federal funds, the amount of bank reserves, the volume of annual issue of money, as well as the volume of trading in government debt obligations carried out by federal banks. The Board of Governors consists of seven members appointed by the President of the United States and approved by the Senate. FOMC, in addition to members of the Board of Governors, includes another president of the Federal Bank of New York (on an ongoing basis) and four presidents of regional federal banks (on rotation).

Since the US president appoints 7 from 12 members of the Board of Governors, you do not need to have the wisdom of Solomon to guess: he is the key figure of the Fed! Accidentally or intentionally, Dr. Edward Flaherty, dispelling the arguments of classical conspiracy theorists, suggested the weak link in the chain of control over the US financial mechanism. It turns out that the “old money” does not even need to fight for the shares of the Federal Bank of New York: it’s enough to control one person!

The extent to which control over the president is more effective than control over a joint stock company is demonstrated by the example of Woodrow Wilson, who, it seems, has been chosen specifically to plow the “Federal Reserve Law” without looking. “I have unwittingly ruined my country” (I unintentionally destroyed my country ”), the Democrat recalled sorrowfully about the main achievement of his life. There is no doubt that “ruined” only looks like the word “unwittingly” in the mouth of the head of state, who, according to his personal admission, New York bankers allowed themselves to appoint only one member (Thomas Jones) of the twelve to the Board of Governors of the Federal Reserve System first convocation. Further events went on increasing:

- 5 on April 1933 of the Year FDR signs "Decree No. 6102" prohibiting citizens and organizations from having gold savings. 5 June 1933 of the year: The President is letting go to Congress, and the Congress accepts the so-called. A joint resolution (48 Stat. 112), stating the refusal of the United States to maintain the gold standard inside the state. 31 January 1934: President Roosevelt reduced the gold content of the dollar from 25,8 grain (20,67 USD per troy ounce) to 15,715 grain (35 USD per troy ounce) on the second day after the adoption of the Gold Reserve Act (Gold Reserve Act). Modestly so - on 41%.

- in the Bretton Forest, the dollar was recognized as the world's reserve currency. It was then that it became clear why the wise EF-DI, by eliminating the gold peg of the dollar within the country, kept it abroad! Without these 35 dollars per ounce, the allies, although battered by fairly military operations, would hardly have agreed to establish a higher instance of monetary justice in the form of Fed debt obligations!

- already at the beginning of 60-x there were serious difficulties with the retention of the gold level of the dollar. In 1961, on the initiative of the US Deputy Treasurer Robert Rus, the London Gold Pool was created, which united the US Federal Reserve and the central banks of Britain, West Germany, France, Switzerland, Italy, Belgium, the Netherlands and Luxembourg in the fight against the gold exchange speculation of independent traders. The dagger in the back stuck General de Gaulle, who, appealing to the agreements of the Bretton Forest, demanded that America pay for French exports not with the Federal Reserve's debt obligations and US Treasury tickets, but with a kind yellow metal. The depletion of US gold reserves led to the elimination of the London Pool in April 1968.

- 15 August 1971, President Richard Nixon thanked the “Great Architect of the Universe” for creating a unique situation and brought to the logical end the case started by Franklin Roosevelt: not exchanging for a palliative depreciation, the future hero of Watergate took a smash and canceled any peg of the American currency to gold in the international market!

The implications of decoupling the dollar from the Great Equalizers are well known:

- The Fed had the opportunity to issue not just its own debt obligations, but obligations, also deprived of any security;

- Gold set off for free swimming, demonstrating an amazing ability to correlate with the American currency, as they say, “how good it will be”: 35 USD per ounce in August 1971 of the year, 195 USD - in December 1974, 300 USD in July 1979- go, 850 USD - in January, 1980;

- US national debt broke out into strategic space

The dollar as a world reserve currency provided the United States with phenomenal political dividends, but domination was given by the extreme tension of the economic biceps. Even “internal segregation” did not save: the citizens of America, as before, could only dream of providing their own money with gold. Of course, sooner or later the colossal collapse of the American currency will take place - all that remains is to break the ephemeral balance between ostentatious well-being and the naive belief in the invincibility of the financial system. The fact that this collapse will not cause any doubt in any sensible person. The only uncertainty - with the timing.

http://www.usgovernmentdebt.us/us_deficit

http://www.usgovernmentspending.com/federal_debt_chart.html

http://en.wikipedia.org/wiki/2012_United_States_federal_budget

http://www.business-magazine.ru/mech_new/experience/pub287877/

http://www.business-magazine.ru/mech_new/experience/pub288322

http://www.publiceye.org/conspire/flaherty/Federal_Reserve.html

Information