Half a century without gold. For the anniversary of the abolition of the gold standard

August started in March

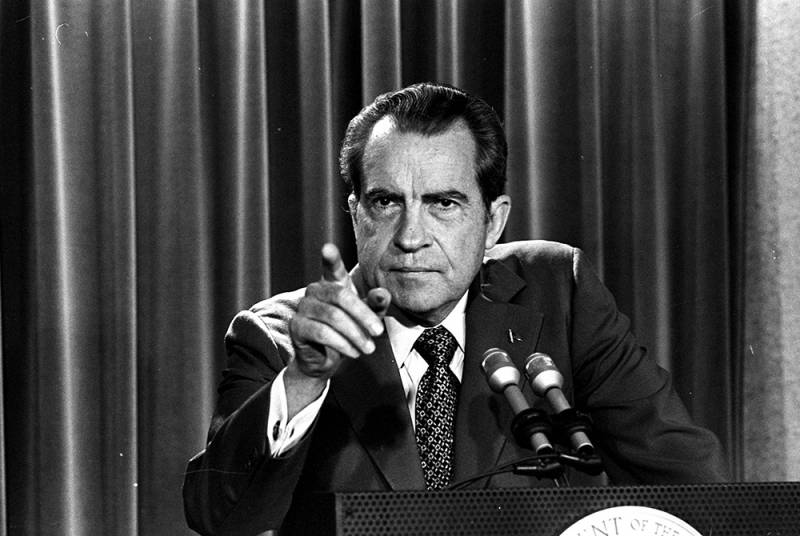

In March 1971, when the first reports appeared about the preparation of the United States to abandon the free exchange of dollars for gold, the era of the gold and foreign exchange standard actually ended. Such plans for the Republican administration of Richard Nixon did not appear out of the blue, because the Bretton Woods system was bursting at the seams.

The reason was well known. After World War II, the United States continuously flooded the world with billions of unsecured dollars. Political adventures such as the Cuban missile crisis and Vietnam, as well as the economic recovery of Western Europe and Japan, soon worked against the dollar.

Even then, there were attempts to return from American vaults a part of the gold deposited under the "gold bonds", the issue of which began in 1934. It was one of the tools that worked well against the Great Depression.

Later, gold from the reserves of countries that became victims of the attack of the Third Reich turned out to be in the United States, and then a significant part of the Nazi gold. For the French President Charles de Gaulle personally, the operation with the return of part of the gold reserve from American vaults was very expensive - not without reason it is believed that this was one of the reasons for his resignation in April 1969.

And 1971 began with the withdrawal from the Bretton Woods system of the Federal Republic of Germany, the authorities of which had previously released the Deutschemark. And then, following de Gaulle's example, they resolutely exchanged five billion dollars for gold at once. And already in March, analysts absolutely accurately predicted that the dollar would be "untied" from gold.

It happened.

Although only on August 15, President Richard Nixon officially announced the suspension of the convertibility of the dollar into gold. And temporary. However, this was a real shock for the whole world - what happened was called

The Americans themselves have once again skimmed the cream, devaluing the billions of dollars that they had generously endowed the world with.

Moreover, the "skimming" could have started earlier. But in just three days in May 1971 (from 3rd to 5th), according to some estimates, at least a billion dollars were sold. Which led to a strong drop in its rate.

But the main thing was the immediate rise in gold prices, an ounce of which, instead of $ 35, began to be quoted at 45 and above. At the same time, the Nixon team postponed the official devaluation of the dollar again until August.

Not all that is gold

Few now remember that the United States moved away from the gold standard much earlier than everyone else. And even before Bretton Woods, when the gold-dollar standard was legalized. Then there were slightly less radical decisions, such as the adoption of the Marshall Plan and the organization of the International Monetary Fund.

The refusal to directly link money to gold, which happened exactly fifty years ago, did not turn thousands of tons of gold, which the countries of the world now have, into reserves of a metal that no one needs. And the point here is not at all that real gold is still an important raw material for both jewelry and a number of other industries.

It seems that it is more important for the world to have some kind of tangible reference point, on which it will be possible to rely, even when everything (or almost everything) will go to the "remote place". The experience of dealing with gold in a short (still) era of a pandemic convincingly shows that the demand for gold will not go anywhere for many years to come.

Historically, gold has become the basis for the standard not only because it was quite expensive. But at the same time it was not hopelessly scarce either. Gold was preserved in almost any conditions. Its reserves were not so difficult to divide. And top up if necessary.

But the main thing is that it was convenient for everyone, everywhere.

And any more or less prepared person could make sure that there was gold in front of him (simply by external signs). And no one anywhere, for many centuries in their right mind, refused to accept gold as payment.

It is not at all just that, and today those states whose economies are growing well (despite the notorious Covid in all its variations) and without any gold are actively replenishing their gold reserves. It is not just that Elon Musk and George Soros do not refuse gold. President (now former) Donald Trump did not refuse him either.

Even global projects (like the long-suffering Nord Stream 2), the Iranian atom and the Silk Road are being implemented not without regard to the first of the metals. China, in general, went to an unprecedented decision, offering the countries of Eurasia along the Silk Road the opportunity to increase the share of gold in the provision of their currencies.

In parallel with this, the PRC announced plans to increase the volume of the state gold investment fund, formed initially for a modest $ 16 billion.

Noble deficit

The growing demand for gold correlates well with the exchange games in oil, when a very small part of the contracts concluded is supported by real goods. Only with gold, this tendency manifests itself even more clearly - simply because there is hundreds of times less of it in circulation. And no more than 0,2 percent of transactions are backed by physical gold.

The acute shortage is not only due to demand from India and China, which continue to buy gold in huge quantities, providing more than 50% of global consumer demand (jewelry, gold bars and coins). According to the estimates of the World Gold Council (WGC), demand in the coming years will at least remain at the same level.

Among the reasons for the deficit is the fact that Russia (one of the largest gold miners in the world) does not sell most of the gold mined now, but stores it in reserves. It's also a matter of speculation, when trading in air (that is, including futures) brings no less profit than a simple sale of bullion.

At the same time, on the New York Stock Exchange Comex, one of the world's largest sites for trading this precious metal, it took a tremendous effort to stem the outflow of gold. Indeed, shortly before the pandemic, its stocks there fell by almost ten times compared to August 2015.

Money, as is well known, is nothing more than a surrogate for trust. Mutual trust: on the part of both the seller and the buyer. For centuries, humanity has believed almost exclusively in gold. And all attempts to replace him with something else ended in either riots or wars.

However, faith in the word of honor of a banker, merchant, and best of all - the head of state, became the basis for the appearance first not of gold, but some other bargaining chips, then paper money. And finally, more recently - electronic currencies.

Don't worry for a dollar

The dollar, as we see, after it was "untied" from gold, depreciated many times. But it has by no means ceased to be the world currency. And seriously consider the bet on gold, made by many, an attempt to really undermine the position of the dollar, can only be naive.

Is it worth repeating that the dollar, as a world currency, has not been dependent on the world gold price environment for a very long time. Even if someone wants (for the sake of experiment) to buy up all the gold in the world, this is unlikely to seriously affect the dollar. Moreover, now, in the era of electronic payments.

Whoever invests in gold invests in something eternal, not aging and not losing demand. At least for the foreseeable future. Liquidity is guaranteed. And changes in price, as a rule, happen much more often in favor of such an asset than to its detriment.

Plus, gold is a good asset diversification tool that is less risk-proof than anything else.

- Alexey Podymov, Anatoly Ivanov, Doctor of Economics, retired professor of PRUE

- madison.com, reddit.com, faradeed.ir

Information