The ruble is against everyone. Why it falls and why it should strengthen

Wrong season

Since mid-July, we have been observing the slide of the ruble to the levels to which it fell in the spring, during the days of pandemic panic. And again, both in the ranks of analysts and among the inhabitants, there was talk about the impending default and the fall of the national currency to 100 rubles per euro or dollar.

At the same time, the main reason for the rollback of the ruble is no longer called the coronavirus and not the strict quarantine that drove the economy into a corner. And not even oil prices, which are kept at an acceptable level above $ 40 per barrel. The seasonal factor and the purchase of foreign currency by the population are to blame.

This argument, voiced not only by so-called independent experts, but also by officials of the Ministry of Finance and the Central Bank, is not just dubious. It should be considered dangerous, since it can hide the true reasons for exchange rate fluctuations. About them below, but for now, a few words about the seasonal factor.

Allegations about the massive purchase of foreign currency by Russians traveling on vacation do not stand up to scrutiny. Firstly, the flow of tourists abroad has fallen not only at times, but almost to zero. Unless, of course, you do not take into account the public of a special kind, for which the borders, it seems, did not close even under the most severe quarantine.

By definition, in Crimea and the North Caucasus, dollars and euros are not needed, it is another matter that there are now great difficulties with payments by bank cards. But this has nothing to do with the problems with the ruble exchange rate.

However, there is still a seasonal factor, and it should actually work in favor of the ruble. We are talking about the beginning of a harvesting company, under which large-scale purchases of fuel are going, which, taking into account the growth of exchange rates, may even become cheaper for someone, for example, for large agricultural holdings. If, of course, such buyers need to use foreign currency accounts.

Wrong demand

100 rubles per dollar, more than 100 rubles per euro - such courses no longer seem fantastic to anyone. But, it seems, no one is frightened anymore. Indeed, one should not be particularly afraid of them at all: the exchange rate itself determines little, and we remember this well in the post-default era.

With a normally functioning economy and finance, citizens should be generally indifferent to exchange rates. The same trip abroad is so rare, and often just accidental, that it is better for tourists to simply take the exchange rate for granted.

But this, we repeat, with a normally functioning economy and finance, which, alas, does not exist in Russia, as has not happened since the reforms. Even in the fat XNUMXs, no matter what the TV screens tell us.

Sadly, but the exchange rates in Russia actually dictate prices and quite directly stimulate their growth. Now they have not yet begun to grow, only because the domestic market simply stopped, and the currency turnover was somehow pushed into a corner.

Due to the fallen demand for everything and all the trade is forced not only not to raise prices, but also to try to sell the illiquid assets accumulated during the quarantine. However, this cannot go on for a long time, numerous purchases for foreign currency will have to be done in any case, and if the dollar and euro rates remain overvalued or even grow, the price jump simply cannot be avoided.

Wrong competitors

The ruble, no matter how wooden, oil or surrogate it is called, still has a serious support in the form of Russian oil and gas and the economy as a whole. Even if not the most powerful and not the most advanced. This is its fundamental difference from the dollar. As, however, and from the euro.

The main advantage of these competitors of the ruble is that there are simply many more of them in the world. This is reminiscent of card games or roulette, when a larger amount in the stash gives you a much better chance of winning.

That is why, unlike the Russian Central Bank, the American Fed and the European Central Bank could afford to put into circulation hundreds of anti-crisis billions and even just distribute them. In our country, if something was released into circulation, it went mainly to either the banks or the oligarchs.

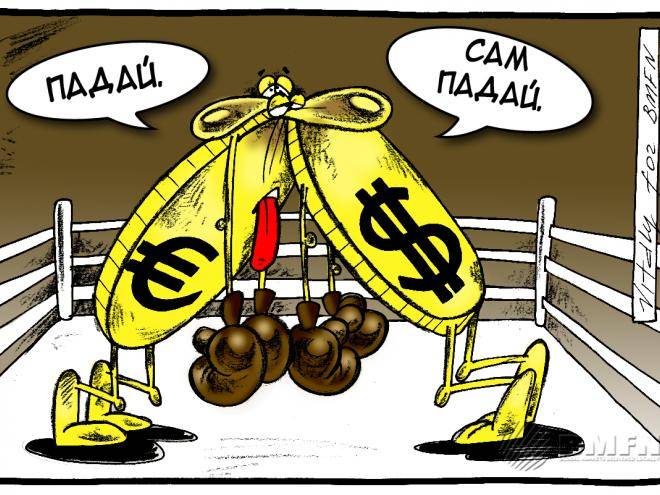

That is why even now the ruble, or rather its exchange rate, was hit not by the seasonal factor, but by currency speculators who decided to simply dump the extra rubles, which ceased to bring super-profits due to the difference in rates.

Nevertheless, the possibilities for outside manipulation of the ruble are severely limited both by the very scale of the Russian market and by the need to buy our oil, gas and a number of other export goods in the future. In such a situation, betting only on the euro and the dollar, forgetting about the ruble, is a serious mistake.

This makes the prospect of the restoration of the positions of our national currency quite realistic. The domination of the dollar has long been called the most dire threat to world trade and finance. However, when US GDP fell nearly 40 percent in the quarter, there was no escape from dollars.

Why? Yes, simply because there are so many dollars circulating around the world that too many factors must work at once for a real fall of the “green”. Nevertheless, it is not as difficult to move it in the limited space of rubles as it seems to many. And Russian financiers, no matter how we criticized them, have done this more than once.

This was the case after the default, when the ruble exchange rate, which fell four to five times in the fall and winter of 1998-99, then rose for seven years. This was also the case after the 2008 and 2014 devaluations. Apparently, it will be so now. Although, according to a number of indications, the Russian financial authorities at this particular moment are simply trying to take advantage of the weakening of the national currency to warm up the economy.

The chances of the ruble for an increase, albeit a delayed one, are undoubtedly connected with the fact that both the dollar and the euro, due to the coronavirus crisis and the multi-billion dollar emission, have clearly entered the overvalued zone. Let it be very conditional for now - in relation to the basket of foreign currencies of the countries of the main trading partners. This index takes into account, among other things, the difference in inflation within the country with each partner.

However, the current account balances in both the United States and the Eurozone cannot be compared with either the Chinese or the Russian, although in the latter case the scale is, of course, not the same. It would seem that if the dollar and euro were cheaper, the USA or Europeans would export more goods.

But the economy fell both there and there, although the EU has now even achieved a foreign trade surplus. But this is unlikely to last long, and the euro has a little less problems than the dollar, which is just a sin not to take advantage of. China, for example, is already using it with might and main, but it is clear that the catastrophically poor US is definitely not profitable for it: such a market is collapsing.

Wrong rates

Now the situation is developing in such a way that the ruble and ruble instruments are no longer particularly attractive either as a strategic asset or as an object of speculation. The difference in rates, very different, and on credit, and on deposits, and on coupons of securities in comparison with foreign or corporate instruments, has become minimal.

At the same time, the risks are almost equal. Confidence in the ruble, which is formed on the basis of trust in the financial authorities, has clearly not increased recently. In addition, one should not ignore the fact that the recent decrease in the key rate of the Central Bank could not but affect the position of the ruble.

Despite the fact that it was minimal, by only 0,25 percentage points (up to 4,25 percent per annum), the psychological effect was very important. Many regarded the July decline as the last one, since the 4 percent mark is already going further, which was designated by the Russian financial authorities several years ago as the so-called inflation target.

The fact that inflation is now hovering at just above 3 percent on an annualized basis, even with the June jump up, makes little difference. Taken together, all this suggests that for many investors, especially outsiders, the time has come to simply fix ruble profits. That they did well at the turn of July and August.

At the same time, the Central Bank failed, and most likely did not want to offer the market any alternative that would help tie up the excess of rubles that had arisen literally out of the blue. But many counted on the issuance of some anti-crisis ruble bonds or other securities with a yield higher than inflation. It is desirable long-term - at least three to four years.

But it did not happen, although, perhaps, only for now. In the event of an aggravation of the situation with exchange rates, this may well be done by the Central Bank together with the Ministry of Finance. In the fight against inflation, our liberal financiers, in an anti-crisis impulse, again used a proven means - the maximum compression of the money supply.

In Russia, alas, low lending rates are not for everyone, but only for the elite. As well as billions of dollars in anti-crisis injections into the banking sector and oligarchic structures. After that, is it any wonder that the rich have once again become richer in the pandemic wave, and this is especially noticeable in Russia!

There is no need to talk about how much poorer the poor have become. However, I still had to say - both the official structures and on the pages of "Military Review" (Trust no one. The truth is in your wallet). But all the same, while harshly criticizing our “fighters against the crisis,” we must not forget that now it is not the summer of 1998 in the yard.

Now the financiers in power have no need to raise rates on government securities at all. Russia owes few people and, by and large, is not going to go into debt, even for the sake of fighting the second wave of COVID-19. As there is no need to collapse the ruble. As they say, let go of the course for a while, and that's enough.

- Alexey Podymov, Anatoly Ivanov, Doctor of Economics

- istockfoto.com

Information