Central Bank has remained in deep minus

But about the fact that the losses of the main credit institution, if absolutely necessary, can be repaid at the expense of reserves or are simply written off in general, journalists either do not know or do not want to remember. Although by itself the "unprofitable" practice of the main credit institution of the country still can not help but confuse.

Bad example contagious

In the first days of May, the Bank of Russia reported in its annual report that in the 2018 year they suffered losses in the amount of 434,6 billion rubles. The report of the Central Bank of the Russian Federation has already been posted on the regulator's website. Of course, the report also contains data on income and expenses. And if in the plus at the Central Bank of the Russian Federation 588 billion rubles, which actually is a record, then in the minus it is already more than a trillion - 1022,6 billion.

Actually, the expenses of the Central Bank of the Russian Federation amounted to only 877 billion rubles, and almost 150 billion more to the losses increased due to funds allocated to support the rehabilitated banks from the Fund for the Consolidation of the Banking Sector. The specifics of reporting by the Central Bank of the Russian Federation do not imply that such expenses are directly recorded in the expenditure line, with which some discrepancies in the data are associated.

In addition to funds spent on refurbishing troubled banks, the losses of the Central Bank of the Russian Federation are also related to two factors: you had to pay considerable interest on bonds listed as public in which banks invested, and also to transfer to the state budget dividends of Sberbank, the majority of which is the Bank of Russia.

Bankers love to cry the blues. To complain about the difficulties in working with the funds of shareholders and holders of funds, the shortage of customers who are ready to take loans at insane interest. And, of course, the lack of sources of resources - certainly cheap and necessarily long. But these are all commercial banks, most of which, however, usually report quite well on profits.

The main bank of the country certainly does not have to work with profit. However, the propensity of the Russian Central Bank to set records for losses may well become a contagious example for its wards from private credit institutions. Moreover, in Russia, the largest of them are almost all - with solid state participation. And the losses of the Central Bank, which remains the main shareholder of Sberbank (for the majority of Russians is practically a monopolist), are somehow reflected in their activities.

Where does the loss come from? From sanctions, certainly!

It is still difficult to say whether 2018 turned out to be a more difficult year for the Russian economy than 2017. After all, the main additional portion of anti-Russian sanctions was addressed to the banking sector headed by the Central Bank of the Russian Federation. And judging by the statements of the Central Bank of the Russian Federation, then - of course, although its losses were even slightly higher (435,3 billion rubles). Mainly due to the very significant expenses that the Central Bank had due to the need to radically reorganize the structure of its assets.

Recall that a year ago, the Central Bank reported on expenditures in the amount of 758 billion rubles. At the same time, the revenues of the Bank of Russia were one and a half times lower than the current ones - total 391 billion rubles, and even there was a noticeable decrease in expenditures of the year 2016, which amounted to 430 billion rubles. As you can see, a year ago, the losses of the Bank of Russia were not only the difference in incomes and expenses - there were the same expenses for reorganization, although not as large-scale as they are now.

The Bank of Russia, which practically completed a multi-year cleansing of the banking sector in 2018, required very serious funds for reorganization. At the same time, the Central Bank of the Russian Federation imposed a ban on certain banking operations for credit organizations for 17 banks and applied penalties to credit organizations. However, in 288, a year more complicated than 2018, the Central Bank managed to increase revenues from its operating activities by 2017 percent - to 16 billion rubles.

In fact, excessive media attention to the operational indicators of the Bank of Russia is hardly reasonable: after all, the data contained in the reports of the Central Bank on these items cannot be compared with the assets of the regulator. But they are a kind of base of financial stability of the state. And it was here, despite all the losses, that in 2018 there was a very significant increase. The sum of assets of the Central Bank of the Russian Federation has grown to 39,4 trillion rubles against 30,8 trillion rubles following the results of 2017.

It is known that 135,5 billion rubles. The Central Bank received last year as dividends from Sberbank, which, by law, transferred to the federal budget. The Bank of Russia received income from participation in the capital of other credit and other organizations, and their amount only slightly exceeds the income from Sberbank - 137,7 billion rubles. It is significant that a year ago the amount of such income was equal to the total 70,9 billion rubles.

Stanislavsky would say: "I do not believe!"

With particular pleasure, which is noticeable even in the style of the relevant articles of the Central Bank report, the regulator reports on how things are going with those it regulates. So, the report notes that the profitability of the banking sector as a whole on the basis of the 2018 year increased. Of the 484 banks remaining to 1 in January 2019 in Russia, 382 credit institutions showed a profit, and its total volume amounted to 1,9 trillion rubles. At the same time, losses in the total amount of 575 billion rubles were received by 100 credit institutions.

Financial losses of the Bank of Russia, according to independent experts, including those from leading audit companies, are indirectly related to the reorganization of its assets. In 2018, the Central Bank of the Russian Federation was more actively involved in the transfer of part of the assets from the United States to China, increasing its share in yuan and the euro.

Currently, only 9,7% of assets of the Central Bank of the Russian Federation remain in the United States, while previously the share reached 30%. At the same time, the Chinese contribution to the assets of the Russian Central Bank has grown sharply: from 2,6% to 14,1%. The CBR also increased its investments in Japan - from 1,5% to 7,5% and in Finland - from 0,9% to 1,8%. In addition to the United States, a decline in the share of Central Bank assets was noted in the UK and Canada: from 7,2% to 6,6% and from 2,8% to 2,3%, respectively.

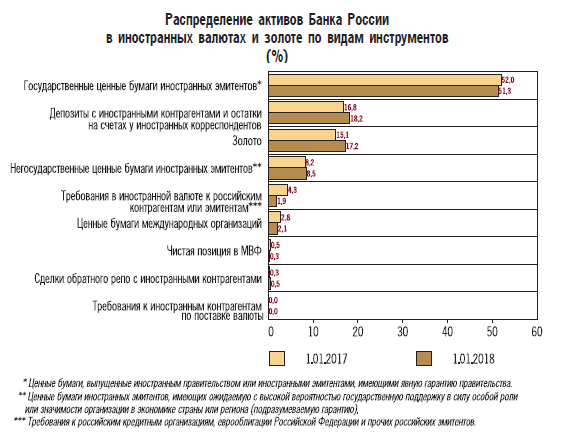

In addition to changes in the geography of placement, our Central Bank went to a direct reduction in the share of its assets in dollars - from 45,8% to 22,7%, that is, more than double. At the same time, the share in RMB increased more than five times - from 2,8% to 14,2%. Also in 2018, assets of the Central Bank of the Russian Federation, denominated in euro, grew from 21,7% to 31,7%, and in gold - from 17,2% to 18,1%.

The most significant reduction in investments of the Central Bank of the Russian Federation was noted in US bonds, which, of course, is directly related to targeted US sanctions. Earlier, Russia held 96 billion dollars in US bonds, but today the amount of such investments fell to 15 billion. So far, no significant increase in investments in securities denominated in yuan has been noted, although the Bank of Russia noted even in the summary of the annual report that the yuan is a reliable currency, secured not only by tangible assets (obviously, gold is meant), but also high-quality goods with a low cost.

And yet, the change of the vector, which is so typical today in working with Bank of Russia assets, does not eliminate the need to keep a very substantial part of the assets and reserves in dollar instruments. This is necessary already due to the fact that the dollar remains the most common financial instrument in the world, and a demonstrative rejection of operations with it is not only impossible, but simply unprofitable.

Not by chance, by the way, the Russian Ministry of Finance plans to conduct more active purchases of foreign currency, primarily US dollars, from 14 May to 6 in June 2019. 300,5 billion rubles are allocated for this purpose, which is 18% higher than the April-May level of 2018 in April. According to the department’s estimates, the daily volume of foreign currency purchases can be at least 16,7 billion in equivalent.

Information